A weekly recap of the largest crypto events and narratives, with an extra dose of insight.

Here’s what we have for you:

-

FTX selling

-

DWF labs pump and dumps

-

Prisma new debt caps

-

Premia Blue

-

BananaGunBot fiasco

FTX may start selling its assets. Creditors have been waiting a long time to be made whole, and unfortunately for us, creditors are paid back in US dollars instead of crypto assets. That means that $1.2B in SOL, $560M in BTC, and $192M in ETH will slowly have to be liquidated. Don’t worry, it won’t be a complete firesale. There will be limits of $50M for the first week and $100M for subsequent weeks. However, the courts can raise the limit to $200M.

In other news, CoinEx was drained of $54M in an apparent hack. They’ve decided to donate the funds to North Korea’s new nuclear submarine, as North Korea’s Lazarus Group continues on its crypto rampage, stealing a total of $270M in the last 102 days. At this point, I’m considering learning how to code and immigrating to North Korea cause they’re probably going to become the largest crypto holders in the world at this rate.

The SEC is reviewing various ETF applications and the Grayscale application, which they kinda have to, so I’m not really sure why this is news. On the CeFi front, Coinbase is planning on integrating the Lightning network as the popular CEX continues to expand, while other exchanges such as Binance haven’t been faring so well with their US CEO leaving along with a third of its workforce. I suspect such moves will continue as the CEX industry continues to consolidate as trading volume dries up and regulatory enforcement ramps up.

-RektRadar

DWF Labs Pump & Dump

DWF is the most sus market maker I have seen in a long time. I don’t know about you, but does the graph above look like organic price action in the middle of a bear? Definitely not. That is the most obviously manipulated graph I have seen in a long time.

Here’s the shocker. This isn’t the only time they have done this. The same sequence of events occurred for PERP, as the token price rapidly increased from $0.42 to $1.29 in a matter of five days.

Similarly, DWF recently put up a governance proposal for SPELL by requesting for a $1.8M token loan of SPELL and a $1M purchase of SPELL at a 15% discount. Since then, SPELL rapidly pumped 30%, albeit retracing some of that move.

DWF’s CEO also tweeted that “two coins can generate a lot of funding rate right now. Just check the ticker if you want.” Is this the most suspicious thing ever from a market maker? Yes. Does the token price always go up? Also yes. If you want to look past the obvious market manipulation, I’m sorry, market making, occurring here, then it would be wise to pay very close attention to what DWF Labs invests in next.

Prisma New Debt Caps

-

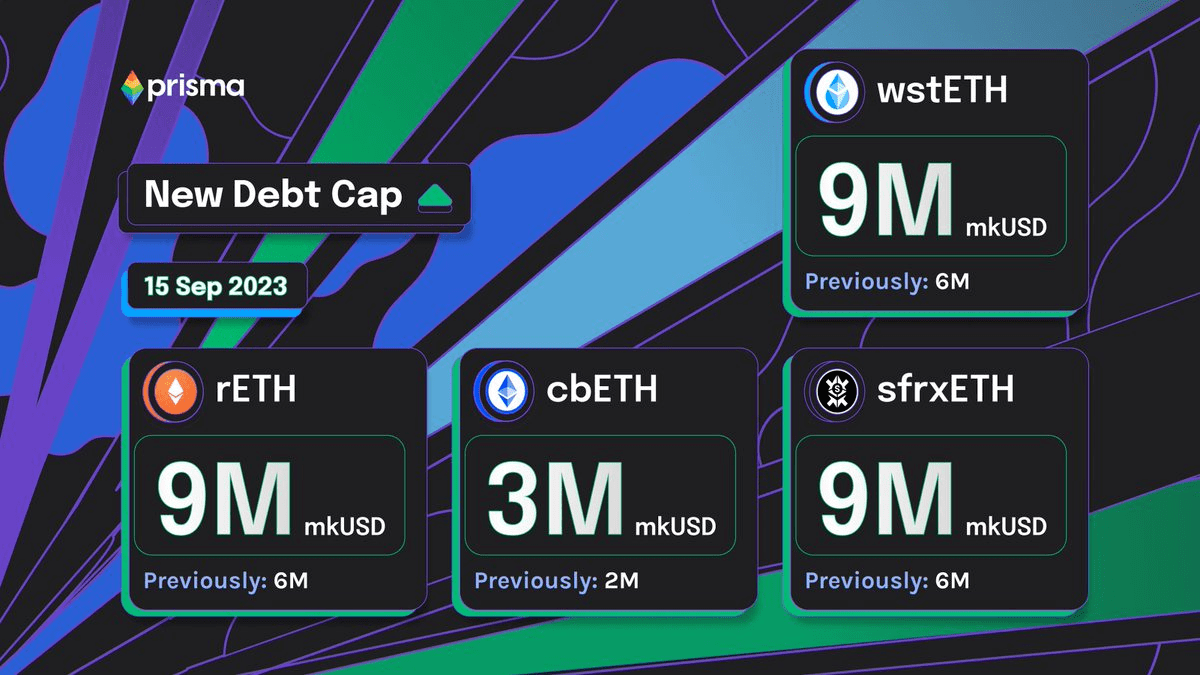

After launch, Prisma, a LST-backed stablecoin, quickly reached its debt caps. Previously, mkUSD debt limits were 6M mkUSD for all types of collateral other than cbETH, which had a 2M mkUSD debt limit.

-

Today, Prisma will have a new debt limit of 9M mkUSD for each pool, with the cbETH pool increasing its limit to 3M mkUSD. I expect all of these debt caps to quickly fill up every time they are raised, much like EigenLayer.

Premia Blue Goes Live

-

Devs keep on devving. Earlier this week, one of the most innovative DeFi options protocols, Premia, released a radical suite of upgrades to the protocol, termed Premia Blue.

-

From permissionless pool creation to UniV3 style concentrated liquidity, strategy vaults to OTC quote networks, and completely revamped tokenomics along with a new margin framework, options traders should be rejoicing for this one.

Distributed Validator Technology go brrr

-

Obol is a go. It has launched its first set of Mainnet distributed validators as part of its Alpha phase, in partnership with various large staking infrastructure providers and many liquid staking protocols.

-

For those unfamiliar, distributed validator technology allows a validator to shard his validator to multiple unique individuals or nodes, vastly increasing the decentralisation of the Ethereum network.

-

dydx chain is expected to go live late September, could be a good event trade.

-

APE is unlocking 11% of its circulating supply on September 16th.

-

FXS is launching its staked FRAX program, similar to sDAI. It’s targeting a minimum yield of 5%.

-

$UNIBOT is turning on its revenue sharing program on September 15th. This will allow eligible token holders to receive 2% of all trading fees.

-

Synthetix will be relaunching its incentive program for trading Synthetix perps.

There Is Always Risk

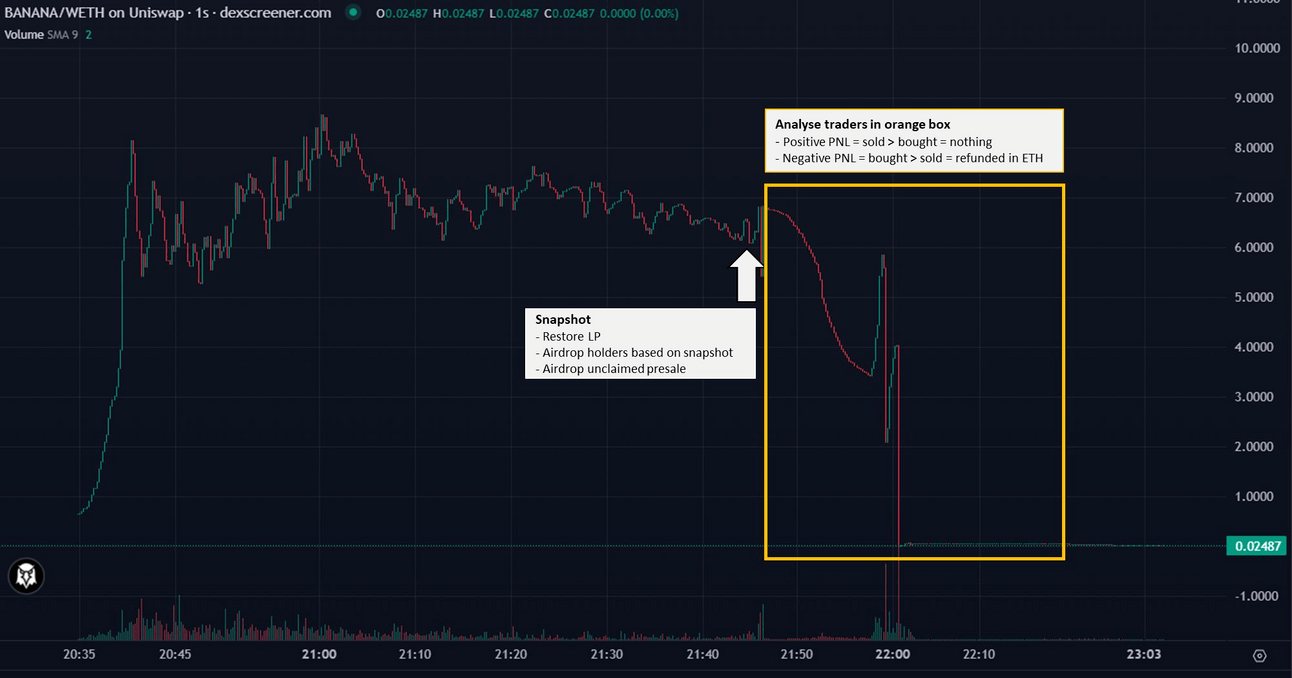

BananaGunBot was one of the most hyped token launches in a while. In a classic crypto mess, the team first launched a fake token to trick token snipers (idk if this is even legal), and then subsequently launched the real token.

However, despite two audits, the token contract had a critical vulnerability in that the sales tax of 4% did not work as intended. Instead of going to the project itself, the 4% of tokens remained inside the user’s wallet. If only taxes could be like that too. I get taxed on paper, but the money remains in my bank account. How nice would that be.

Despite that, the token still managed to pull off an impressive rally, quickly rallying from the launch price of $0.65 to almost $9, and then plummeting to $0.02 a few hours later as the vulnerability was discovered and made public. What a classic crypto chart.

Despite the huge snafu, the team did the right thing by refunding 740 ETH to various wallets that did not manage to sell in time. However, it’s important to note that there is always a risk of something like this occurring in crypto. And that not all teams will always do the same thing as Banana and refund users who lost funds. Nothing is truly ever safe, even if it’s the most hyped telegram trading bot in history. And so take caution in that, and never all in something. When the bull market starts, I would always have a % of your portfolio that acts as a limit for a single position. 10% is a safe bet.

Some friend.tech analysis

@friendtech is giving me early 2021 NFT bull market vibes. Is this all a sham? Or is this the start of something big?

After diving in deep into the Friend Tech ecosystem over the past 2 weeks, here are some findings.

A quick 🧵 pic.twitter.com/oS3VY45EzQ

— yh.eth🦇🔊 | Delphi (@yh_0x) September 13, 2023

Thena’s public beta is now live

♐️ ALPHA’s public beta is now LIVE ♐️

The future of onchain perpetuals is here. The days of liquidity constraints are over.

Trade $BTC, $ETH, $BNB, and over 150 other assets on @BNBCHAIN with up to 60x leverage 📈

✨ ZERO funding rates for a limited time ✨

Open interest is… pic.twitter.com/vuqtsSRBPg

— THENA (@ThenaFi_) September 11, 2023

opBNB mainnet goes live

Today, we’re launching the opBNB mainnet!

Our Layer 2 solution is now fully released to the public, allowing for lightning-fast transactions and super-low fees! ⚡

Let’s dive deeper into the incredible benefits this brings to BSC 🧵[1/6]https://t.co/vRK7Pbyk4b pic.twitter.com/hqxt3ChsR4

— BNB Chain (@BNBCHAIN) September 13, 2023

yETH is coming soon

Mark’s excited. We’re excited. yETH s̶o̶o̶n̶ imminently. pic.twitter.com/GlR0SF4sQy

— yearn (@yearnfi) September 12, 2023

A perps DEX powered by Starkware launches its token

Introducing $ZKX Token 🔥

The support from our community has played a significant role in shaping ZKX 🤝

In line w/ this, we’re thrilled to share the details on the community launch of the ZKX token before our 1st locked Airdrop.

More here 👉 https://t.co/ehgLSlMdXv

1/14 🧵 pic.twitter.com/FbJRB6m1yE

— ZKX (@zkxprotocol) September 13, 2023

Synapse launches its interchain network

The wait is over. The Interchain future is here.

Testnet live today!

Synapse Interchain Network: the first Optimistic Proof of Stake Interchain Network

Synapse Chain: An L2 built on the Syn OP stack. Apps deployed have access to all interchain state

Let’s go Synterchain 🧵 https://t.co/c0Pdh62KeC pic.twitter.com/qLDhHRP40V

— Synapse Labs (@SynapseProtocol) September 11, 2023