A weekly recap of the largest crypto events and narratives, with an extra dose of insight.

Here’s what we have for you:

-

ETH futures ETF

-

Su Zhu in jail

-

Google Cloud Polygon PoS validator

-

dYdX incentives

-

gTrade upgrade

-

Forex, but on the blockchain

Remember PYUSD, PayPal’s big stablecoin? Today, it has $45M in outstanding supply, with roughly $3.7M minted in the last thirty days. A few days ago, PayPal announced that PYUSD will now be available on Venmo, one of the most used financial payment apps in the U.S. This may not seem like big news, but to me, it is vital that the next generation of users don’t even know that they are interacting with blockchain technology. The more that is abstracted away, the better.

Nansen had a third-party security breach where 6.8% of users had some form of information leaked. Some users had their login email and password leaked, and a small subset of these users had their blockchain addresses leaked too. Not great. This is an obvious use case of crypto, to use ZK technology so that your personal information never has to be stored on a centralised database, and can be retrieved without revealing the underlying information.

I’m not sure if we have any K-pop fans here, but without exposing myself as an avid K-pop watcher (no one asked but m

Asset manager Valkyrie got approval to add ETH futures contracts to its existing Bitcoin futures ETF. We are now one step closer to a spot BTC and ETH ETF. The existing Valkyrie Bitcoin ETF will now offer both Bitcoin and Ethereum exposure in a two-for-one investment vehicle. However, the SEC has decided to prematurely delay the Bitcoin ETF decisions for BlackRock, Invesco, and Bitwise, likely ahead of an anticipated government shutdown that is no longer happening.

On a similar note, VanEck announced its upcoming Ethereum futures ETF, EFUT. The fund will invest in standardised, cash-settled ETH futures traded on commodity exchanges such as the CME. In a pretty gigachad move, VanEck has promised to donate 10% of the $EFUT ETF profits to the Protocol Guild, a collective of 152 Ethereum core protocol contributors, for the next 10 years.

Lastly, as legal processes such as the FTX debtor process play out, there have been some milestones. September 29 was the last day when creditors could submit their claims for FTX, and hopefully that results in some progress in the legal process. In a win for us who lost everything, 3AC co-founder Su Zhu was arrested at Singapore’s Changi Airport and will be imprisoned for 4 months. I’m sure we all hope it’s a bit longer. Up next, Kyle? Hedge fund founders who rug together should be jailed together.

-RektRadar

favourite group right now is G-Idle), South Korea’s Dreamus has debuted NFT tickets for K-pop concerts. Once again, this probably seems gimmicky to you, but these NFTs are integrated directly into SK Planet’s loyalty app, OK Cashbag. Once again, crypto users should not realise they are using crypto.

-RektRadar

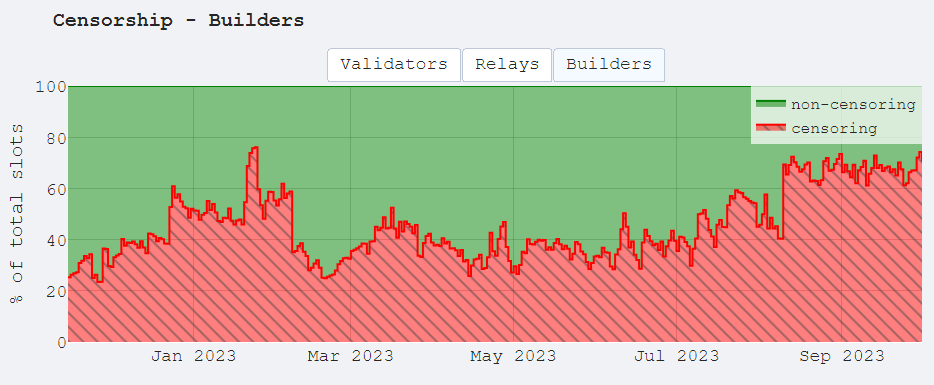

Censorship, the hotly debated topic, and perhaps one of the most important when it comes to our permissionless public blockchains. For us to achieve financial freedom and equal access to economic opportunity, nothing should really be censored. I definitely get the argument that we don’t want North Korea to continue to launder money through the blockchain though, so I’m at least partially sympathetic to some degree of censorship for malicious actors.

In the past month, censorship on Ethereum has grown rapidly. 5 of the 6 largest block builders comply with the OFAC sanctions, likely meaning that there are transactions that interact with the Tornado Cash contracts or interact with assets that have passed through Tornado Cash contracts. This is problematic because the builder market is fairly centralised. In fact, the top 6 builders make up 88% of the builder market for MEV boost. And because only one block is selected per slot, this essentially means that there is a lot of censoring happening. Technically, it also means that to the end user, transaction inclusion likely takes much much longer if you are submitting a censorship-worthy transaction as so many builders are censoring.

Google Cloud runs a Polygon PoS validator

-

Hot on the heels of becoming the default oracle for LayerZero, this time Google Cloud has become one of the validators for Polygon’s PoS chain. They join 100+ other validators that are securing the network.

-

Is it possible that we see more and more big tech alignment, as more blockchain networks and crypto protocols attempt to get Google Cloud to join their ranks? I wouldn’t be too surprised. And for now, this seems ok, as long as a network’s validator set doesn’t exclusively become Google, Facebook, and Microsoft.

Perimeter Protocol. USDC and RWAs

-

Last week, Circle launched a new smart contract codebase called Perimeter Protocol. The goal of the codebase is to encourage tokenised credit markets, one of the key segments of RWAs.

-

Alongside this launch, the company has also released Circle Research, a new division dedicated to open-source development. Tokenisation of assets still remains one of the strongest value propositions of crypto, amidst a tradfi system that is wildly outdated and inefficient.

Gains Network

-

gTrade V6.4.1 is live on mainnet. The upgrade includes part of a community proposal that was published in July as part of a tokenomics revamp.

-

The new upgrade will increase staker revenue capture by ~60-80%, with revenue capture share increasing from 33% to 60+%. Existing dev fund revenue will also be 100% redirected to $GNS staking.

Forex, but on the blockchain

The Bank for International Settlements along with the central banks of France, Singapore, and Switzerland have been hot at the forefront of digital innovation. Specifically, they have been testing out central bank digital currencies (CBDCs) and associated settlement and trading on the blockchain.

They recently concluded a joint test on September 28. The project saw cross-border trading and settlement of a hypothetical euro, Singapore dollar, and Swiss franc.

The coolest part of this experiment? They used a Curve V2 fork to facilitate the trading and settlement. This is one way existing protocols can define a new generation of financial trading in ways that the existing system can’t.

Do we need CBDCs on the blockchain? The answer could be yes. Forex still has a two-day settlement timeframe. This means that upon executing a trade, it still takes two entire days to actually settle the currencies being exchanged. Imagine waiting for two days for your transaction to go through. How ancient is that?

Blockchains provide near-instant settlement, full transparency, and perhaps sometimes better liquidity through passive liquidity solutions. Keep an eye for tradfi institutions that are using existing DeFi mechanisms, and then pay close attention if these mechanisms have been taken from a protocol with a token, as it could result in significant value accrual.