A weekly recap of the largest crypto events and narratives, with an extra dose of insight.

Here’s what we have for you:

-

Mixin hack

-

Frax partnership

-

Arbitrum protocols beg for ARB

-

Celestia airdrop

-

Vesta finance dissolves

GM friends. Hope everyone is enjoying the last few days of summer. Because after summer comes the deep dark winters. But hopefully, crypto’s winter ends soon cause I’m getting pretty bored of VCs talking about infrastructure the whole day.

Mixin network, some blockchain that nobody had heard of, got hacked for $200M. Its website states that the network is used to secure digital assets and messages, with an open-source cryptocurrency wallet with Signal messaging. At its peak, the network had more than half a billion in TVL, which makes one wonder what people were even doing there. I ask myself the same question about Tron every day. But speaking of Tron, started by Justin Sun, Huobi exchange also experienced a hack worth $8M early in the week.

Microstrategy continues its BTC buying spree, with $147M more of BTC purchased. Microstrategy stockholders either hate or love Michael Saylor, as he continues to dilute shareholders to buy BTC. In the slightly more tradfi side of things, Coinbase also got approval to offer perpetual futures to non-US customers.

Frax has launched its partnership with FinresPBC to bring RWAs and treasuries onchain. Sure, this may not seem sexy, but MakerDAO (MKR) has been up significantly in recent weeks on its RWA income, so given Frax’s massive balance sheet, the token may see some upside too.

-RektRadar

Arbitrum Season, Part 2

I know, I know, I talked about Arbitrum last week. Don’t worry, my memory isn’t that bad. As mentioned, 50M ARB will be distributed up till Jan 31st, 2024. In one week, 105 protocols have applied for the short term liquidity incentives. I honestly didn’t even know there were 105 protocols on Arbitrum.

Coming at the top of the list are major perps protocols, including GMX, MUX, Gains, and Vertex. The largest request came from GMX, with a whopping 14M ARB request, or 28% of the total ARB available. I don’t know about you, but I don’t feel like GMX deserves 28% of the total grants available, given their lackluster growth and speed of innovation in the past year.

Governance token holders will have one week to vote on all of these proposals, which is also another problem for me. How will token holders find the time to review and vote on 105 proposals? That’s simply impossible to do unless you have five hours of free time a day.

Whatever the case, there will be alpha in following the ongoing votes closely. There’s a handy spreadsheet out there with all the proposals, the grant size, what they will be using the tokens for, and the duration. You could use this spreadsheet vote, or you could also use this spreadsheet to view the amount of ARB requested, compare it to the protocol token’s market cap, and if it’s a significant amount, it could be worth a long.

The Arbitrum Odyssey, an initial initiative when Arbitrum first launched to get users to interact with the general ecosystem, is relaunching. As part of the new campaign, there will be a seven week campaign with Galxe where users will have to interact with 13 ecosystem projects such as GMX, Treausre DAO, Premia, Handle Finance, and more. Users will have the opportunity to collect custom badges along their journey. Do take note that there will be no airdrop or reward of any kind for this event.

In other news, the Arbitrum DAO has recently passed a governance vote to distribute up to 50M in ARB as part of a short-term incentive program. The goals of the incentives are to support network growth, experiment with incentive grants, find new models for grants, and more. Expect to see a flurry of protocols apply for this grant in the coming week.

Celestia Genesis Drop

-

Celestia, one of the most hyped modular blockchain projects, has announced its airdrop details. Celestia is a modular consensus and data availability layer for blockchain developers.

-

60M TIA, or 6% of the token supply will be airdropped to developers, early builders of the modular ecosystem, and likely all of you, 576,653 onchain users. Check if you’re eligible here.

Notional V3 Goes Live

-

Notional V3 has launched on Arbitrum. It allows users to access leveraged yield strategies to maximise yield, lend/borrow through fixed or variable rates, and has a greatly improved UX.

-

If you can find a way to get a beta access NFT, Notional is running a special yield contest that will distribute 30,000 $NOTE, 3 special NFTs, and 100,000 L2DAO tokens.

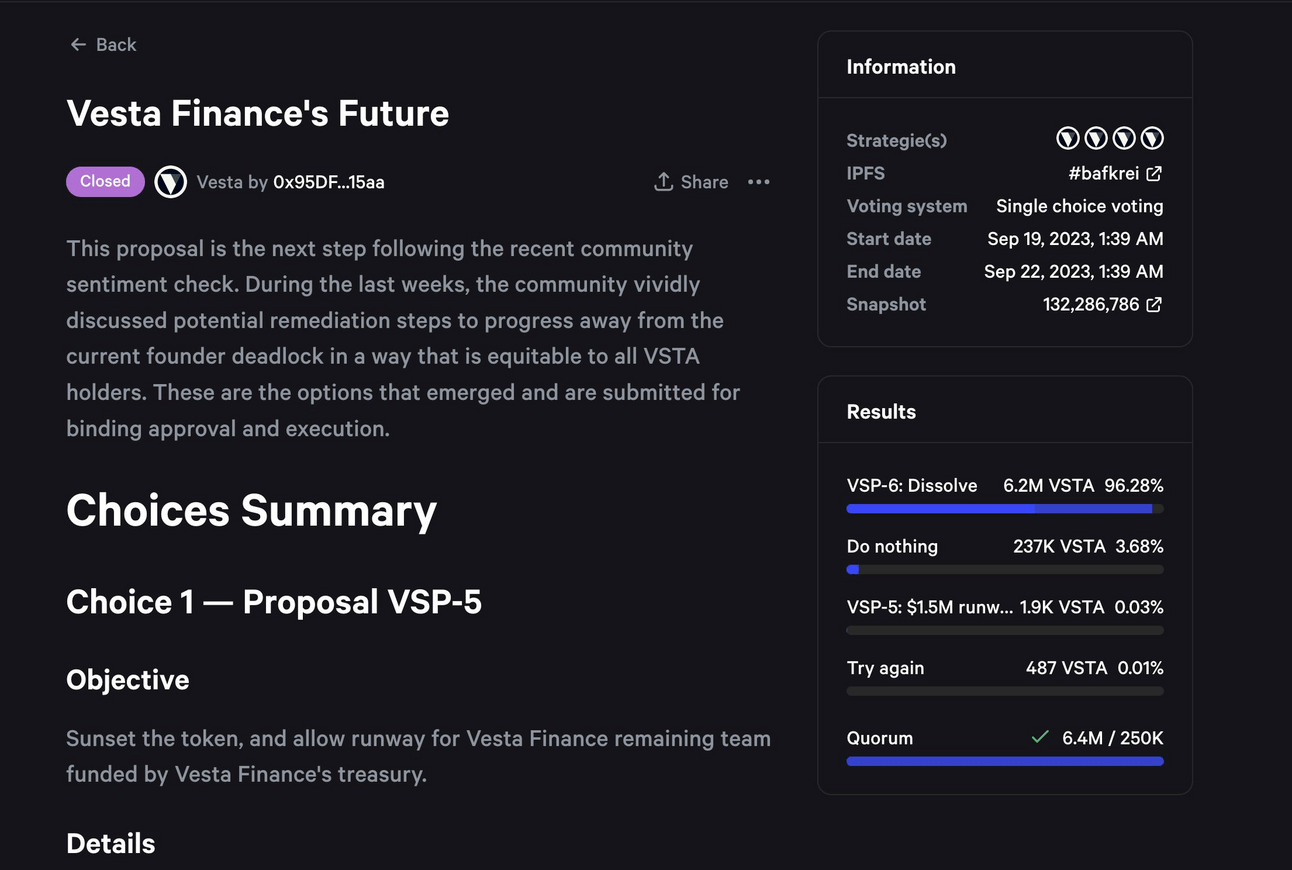

Vesta Finance Dissolves

-

Vesta Finance, what was once a famed stablecoin protocol on Arbitrum, has voted to dissolve. Governance passed the vote to fully unwind and dissolve the entire protocol.

-

Token holders may exchange their tokens for a pro-rata share of the Vesta treasury, which is currently valued at $0.526 per token. The token currently trades at $0.44, making for a cool 20% arbitrage. However, one needs to take into account that this requires the devs to actually execute the dissolution.

-

dYdX is slated to go live in October and allow users to trade in November. Watch the token.

-

Collect your Celestia airdrop here.

-

Go check out all the friend.tech forks such as post.tech

-

Banana revenue share claim is live, potentially being a catalyst for the token

-

Being a degen on friend.tech? Try out Unibot’s new friend.tech sniper.

Unibot’s advanced bundle feature is live, try it out for better snipes

Unibot’s new Advanced Bundle Feature is now live, paving the way for our ultimate sniper experience.

We’re strategically optimizing token swaps for Unibot users, ensuring you always get the best market prices.

Snipers, keep an eye open for upcoming announcements. 🎯🦄 pic.twitter.com/cIMksJU92z

— Unibot (@TeamUnibot) September 25, 2023

Banana revenue share claim goes live. We love revenue shares.

<blockquote class=”twitter-tweet tw-align-center”><p lang=”en” dir=”ltr”>REVENUE SHARE CLAIM<br><br>You can now claim your part of revenue share on our dApp: <a href=”https://t.co/HlGuSgUfGS”>https://t.co/HlGuSgUfGS</a><br><br>- You can only claim every 24 hours and a minimum of 0.1E<br>- ETH claim is straightforward<br>- Opting for <a href=”https://twitter.com/search?q=%24BANANA&src=ctag&ref_src=twsrc%5Etfw”>$BANANA</a> does not incur a 4% buy tax<br>- 50E of <a href=”https://twitter.com/search?q=%24BANANA&src=ctag&ref_src=twsrc%5Etfw”>$BANANA</a> has been bought back… <a href=”https://t.co/pdooNTPALQ”>pic.twitter.com/pdooNTPALQ</a></p>— Banana Gun 🍌🔫 (@BananaGunBot) <a href=”https://twitter.com/BananaGunBot/status/1706181859736957219?ref_src=twsrc%5Etfw”>September 25, 2023</a></blockquote> <script async src=”https://platform.twitter.com/widgets.js” charset=”utf-8″></script>

Share your Banana referral link for some extra rewards

REFERRAL LINKS

Very good news! Everyone can generate a referral link now and accrue rewards based on your referrals! We also updated our dashboard to include referral rewards.

From now on:

🍌 Everyone can generate a ref link to earn ETH

🍌 You can claim your referral rewards…— Banana Gun 🍌🔫 (@BananaGunBot) September 27, 2023

veYFI is going live on October 19, buy the pre-launch, sell the launch

W̶e̶n̶?̶ 👀

veYFI launches Oct 19, 00:00:00 UTC.

Gauge voting begins a week prior; snapshot on Oct 12, 00:00:00 UTC. Lock veYFI by then to vote.

Note: oYFI is now dYFI (discount YFI) for easier pronunciation. pic.twitter.com/UTlzqeSVER

— yearn (@yearnfi) September 27, 2023

Aori public beta is live with a potential airdrop

The Aori public beta is officially live with a kickoff announcement from the @BanklessHQ podcast!

Beta for Order on Aori is officially live: https://t.co/RcXx5ij4cI

Let’s breakdown how to test Order for yourself, our vision for [order], and where you can share feedback ⬇️ https://t.co/3wXda33f9e pic.twitter.com/NLQuuuMnKV

— aori ⑁ (@aori_io) September 26, 2023

Potential Raft Finance token?

The Aori public beta is officially live with a kickoff announcement from the @BanklessHQ podcast!

Beta for Order on Aori is officially live: https://t.co/RcXx5ij4cI

Let’s breakdown how to test Order for yourself, our vision for [order], and where you can share feedback ⬇️ https://t.co/3wXda33f9e pic.twitter.com/NLQuuuMnKV

— aori ⑁ (@aori_io) September 26, 2023

oETH goes live on Pendle, try out the yield trading and see if you can find any yield opportunities

OETH by @OriginProtocol is now on Pendle, offering 27.38% APY for liquidity providers, one of the highest available for ETH LSDs.

Balanced exposure of LSDs, higher-than-average yield… OETH by itself is already an ETH lover’s dream and you can do much more on Pendle now 🧵 pic.twitter.com/NCITMP9jCa

— Pendle (@pendle_fi) September 26, 2023