DeFi liquidity incentives are one of the hardest things to get right. In a graveyard of countless DEXs, only a few survive. Sticky liquidity is essential for DEXs, and their growth is driven by deep markets that support large trading volumes and thus return generous amounts of fees to liquidity providers.

Failure to achieve that flywheel effect often means death of the DEX, but there is a DEX out there stands out from the competition and succeeding above all else. Say hello to Velodrome.

In this article, we’ll dive into:

- Velodrome, an insane concoction of DEXs

- Success so far and what that looks like

- Velodrome V2, a radical upgrade to the protocol

- Aerodrome, we go multichain

Frankenstein Or Master Mix

If you have been playing around in DeFi, you’ve probably heard of Uniswap. What about the (3,3) model pioneered by Andre Cronje with Solidly? Or even Curve and Convex? Imagine all of these combined into the best DEX with the thickest liquidity and most rewarding incentives the world has ever seen. That’s Velodrome.

Velodrome is an innovative AMM that is currently deployed on Optimism and serves as the central liquidity hub for a large number of Optimism projects including OP like:

- Lyra

- Synthetix

- Frax

- Lido

- Rocket Pool

- And More

Here are some stats on why they are an absolute giant:

- Cumulative trading volume of $6.8B

- $3.8M in swap fees generated

- Almost $150M in TVL.

If you want a well-designed flywheel, Velodrome has just that. With a clever combination of bribes, liquidity provision, and incentives, it has become the dominant player on Optimism. 100% of protocol incentives and fees go to veVELO voters. Here’s how the flywheel works:

- veVELO voters direct VELO emissions to LPs

- LPs are incentivized to provide liquidity for protocols

- Which results in protocols emitting further incentives for veVELO voters

Which results in Velodrome having deep liquidity which means low slippage for traders, and more fees for veVELO voters. All of that occurs in a virtuous self-optimising liquidity flywheel.

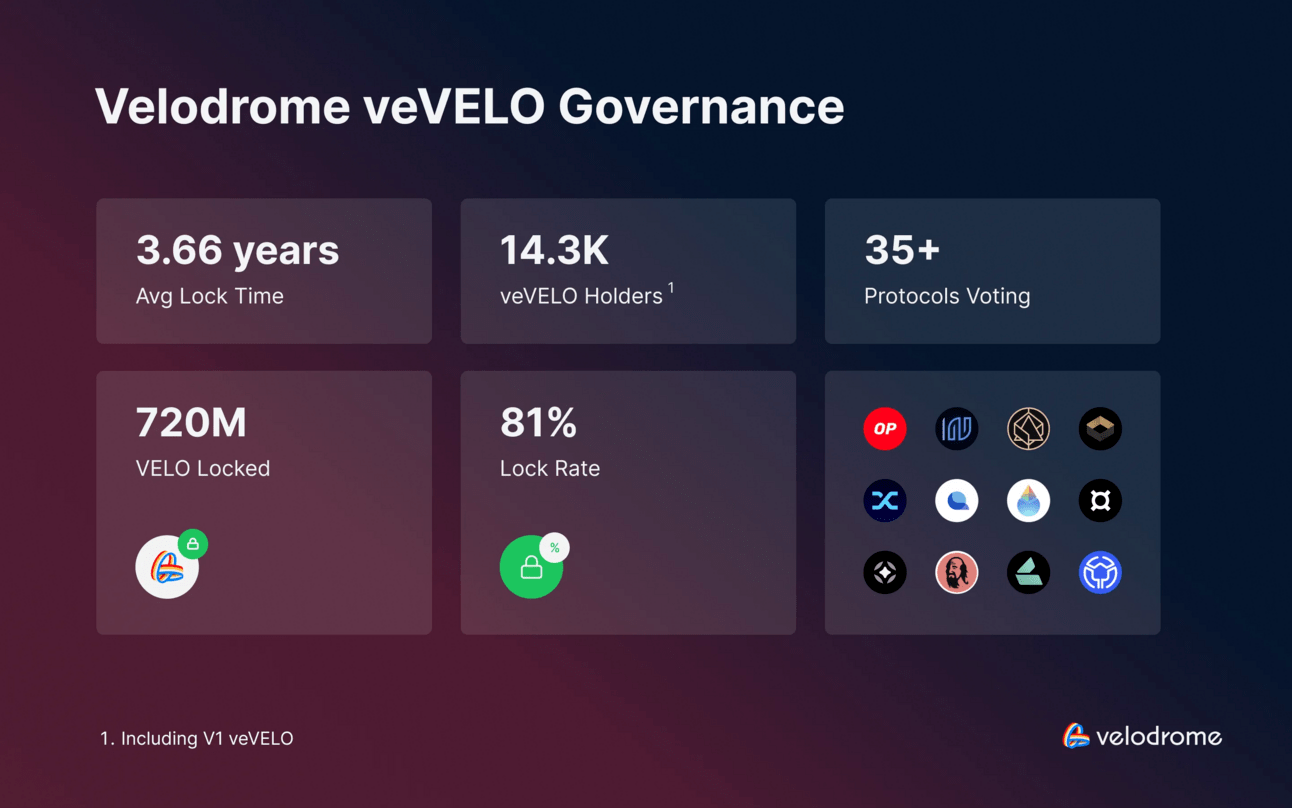

One common argument against the ve DEX model is that individuals who lock their tokens get diluted as tokens get emitted to incentivise liquidity. Fret not, Velodrome introduces anti-dilution rebase for voters, which means you don’t get diluted as tokens are minted. Like Curve, VELO holders can vote-escrow their tokens for up to four years and receive a veVELO NFT in exchange. With veVELO, one can vote for which pools receive VELO emissions. External protocols can “bribe” for liquidity.

See what I mean when I say Velodrome combines the best of Uniswap, Curve, Convex, and Solidly?

Numbers Don’t Lie

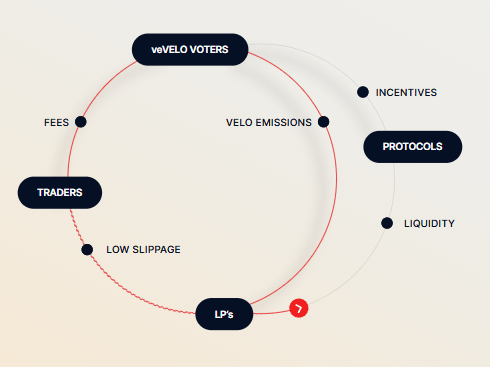

Since the protocol’s inception, TVL has remained relatively sticky, which is exactly the point of token incentives! Ideally, you want liquidity to stay. You want consistent deep liquidity as a result of the incentive mechanisms.

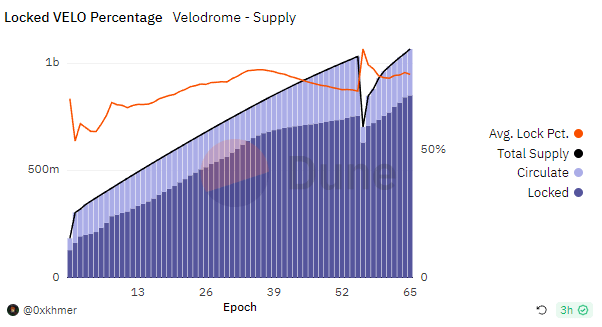

The chart below highlights the success of VELO’s vote escrow model. VELO’s locked percentage has never dipped below 54%, and these days, is closer to 80%. In comparison, I’m sure we can all agree that Curve, one of the DeFi blue chips, likely has one of the most successful implementations of ve tokenomics today. Yet VELO’s locked rate dwarves Curve’s 40% locked rate.

Velodrome V2

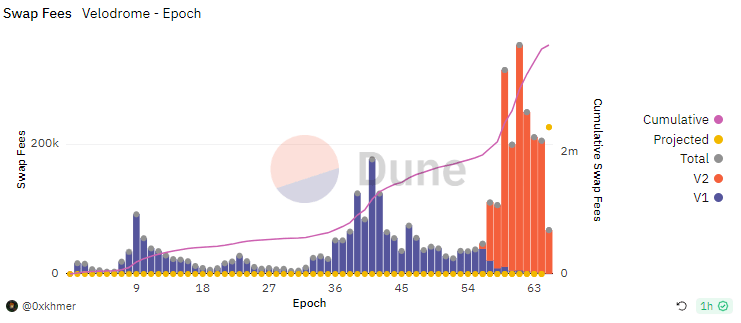

In Velodrome V1, swap fees were capped at 0.05%. With the V2 upgrade, this cap was removed, and swap fees are set at 0.05% for stable pools and 0.30% for volatile pools as a default. Both protocols and veVELO holders can request for changes to the fees. Despite the slight downtrend in volume, this has had a major impact on profitability, as swap fees have skyrocketed since Velodrome V2 went live.

What’s better than generalised liquidity incentives? Granular liquidity incentives. Velodrome V2 pools now have concentrated liquidity, but more importantly, veVELO voters can now direct emissions to LP positions in a specific active range. Similar to how Uniswap V3 unlocked a vast amount of liquidity from V2, Velodrome V2 will unlock an incredible amount of incentives for great liquidity providers who are providing liquidity in active price ranges.

veVELO holders will have a tough choice weekly when voting on VELO emissions, especially considering that there are 35+ protocols to vote on and 120+ token pairs that are attracting liquidity. In addition, more than 65 tokens have been claimed as rewards, and as one can imagine, trying to compound all of those can become tedious.

Don’t worry. With the advent of V2, Velodrome is actively working on the Velodrome relay. With this relay, veVELO holders will be able to delegate their NFTs to other holders. In addition, users will be able to automatically distribute their votes, or to maintain active votes in pools on a week on week basis while compounding rewards.

Rise Of Aerodrome

With the success on Optimism, The Velodrome team is expanding the protocol and going multichain. The Base and Velodrome teams are partnering up to launch a new DEX, Aerodrome, using Velodrome’s V2 code.

Aerodrome has its own token, AERO, with its distinct launch plan. Of the initial supply of 500M AERO, 90%, or 450M of it will be locked as veAERO. A staggering 40% of the AERO supply will be airdropped to veVELO holders as veAERO. Talk about a payday for VELO supporters. Two for the price of one! Similar to VELO, veAERO holders will receive 100% of trading fees and incentives.

To drive the growth of Base ecosystem, 25% of Aerodrome’s initial voting power will be reserved for ecosystem goods. This will be prioritized for protocols that are critical to Base’s success and help them incentivise deep liquidity to kickstart network effects.

The list of launch partners from day one is nothing but impressive, to say the least. It includes many heavy hitters like:

- Tarot Finance

- Yearn

- Deus

- Thales

- UniDex

- QiDAO

- Liquity

- Beefy Finance

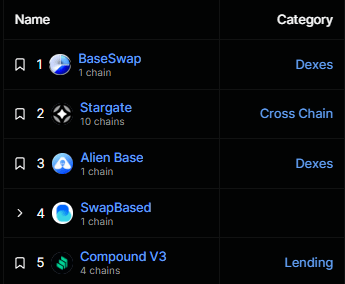

Here are the top five protocols on Base by TVL pre-launch. Recognise any of the DEXs? No? Exactly. None have established themslves as the dominant player on Base. Normally, for a new chain, you’d expect to see a large DEX like Uniswap on Ethereum or Velodrome on Optimism to top the list. But the playing field is still wide open on Base.

Since launching on Base on August 29th, Aerodrome quickly:

- Garnered more than $200M in TVL at one point

- Processed more than $60M in trading volume

- Generated $258K in fees

Here’s another fun thought experiment. Velodrome has fully established itself as a brand name on Optimism, and with the expansion onto Base through Aerodrome, it’s fair to say that they are choosing to align fairly heavily with the OP ecosystem for now. In recent months, we’ve seen network after network launch as a OP stack rollup, including opBNB, Base, and multiple other rollapps. What if Velodrome can establish itself as the brand name of choice for the Optimism ecosystem and new OP stack rollups? Or could that already be the case 😉

Victory For Velo

There has been ZERO innovation in DEX incentives since the last bull market. After countless failed experiments in the depths of the bear, it seems like this is where the real innovation is happening, and Velodrome is happily leading the charge on DEX incentives.

- Combining the best liquidity incentive design

- Engaging with their passionate community

- Continuously improving the core AMM experience

Velodrome is steaming ahead of other competitor DEXs with liquidity incentives. Aerodrome has a chance to establish itself as the premier DEX on Base, and is a fantastic bet on the Base + OP stack narrative. We believe that liquidity and more specifically protocol owned liquidity, will be the focus of protocols next bull. Velodrome is set to be the best DEX and mechanism that facilitates that liquidity deployment.