A weekly recap of the largest crypto events and narratives, with an extra dose of insight.

Here’s what we have for you:

-

CFTC goes after DeFi

-

RWA coalition

-

Socket raises from Coinbase Ventures

-

Grab (Southeast Asia superapp) dives into web3

-

Visa <> Solana

I’m not sure about you, but it feels like we whipsaw between we’re so back and it’s over every single day. Especially when it comes to legal news. We’ve been bull posting for some time about spot ETF applications, Grayscale court victories, and Uniswap winning a class action lawsuit. But it looks like the CFTC doesn’t want to keep the happy news coming.

Last week, CFTC announced three settlements with DeFi protocols, Opyn, Deridex, and 0x. One of them is a DEX while the two others are DeFi derivatives/perps protocols.

Here’s where it gets really messed up. The charge against 0x’s DEX aggregator was due to the fact that they allowed the trading of third-party tokens that provided leverage, such as leveraged ETH and BTC. Apparently, that is a nono. But this seems relatively unfair considering that they’re a DEX aggregator, and anyone can trade or list any token on every DEX.

For the other two, they were charged by the CFTC for allowing people to trade derivatives, including perps. And this was even after Opyn had attempted to block US users. For the CFTC, that wasn’t enough. Turns out, the CFTC wanted them to implement a KYC program.

You can see how this is potentially really really bad for many DeFi protocols. If geo-blocking all US users isn’t enough, will all DeFi protocols really have to implement a KYC program? How much DeFi activity will that kill off? Are perps not allowed anymore? Where will I go to degen.

Hopefully, this doesn’t kill DeFi’s momentum and the amount of innovation we are seeing in the space. If the people want to gamble, let them gamble. Long live free markets. However don’t go to the CFTC and SEC crying if you lose all your money. There are always two sides to the coin.

-RektRadar

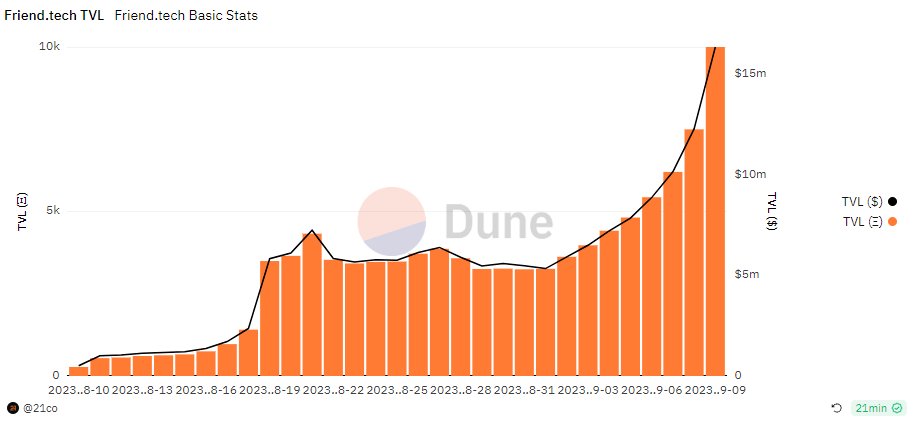

Is friend.tech so back? After plateauing for more than two weeks, TVL is suddenly shooting up again. TVL has been stuck at the ~$6M mark for the past two weeks, yet for the past eight days, we’ve seen consistent daily TVL growth.

Many popular apps follow this trend. They start off by going viral, gaining a large amount of casual users who are in it due to FOMO. Once that dies off, growth and activity plateaus as users get whittled out. Over time, a core set of power users continue to use the app, and momentum eventually picks up again.

Despite the influx of OnlyFans creators that made it seem like the platform was going to become a barren wasteland, devs have been shipping. Users can now receive personalised recommendations based on the keys their friends hold, one can now sign up with a credit card, and one can now see who is talking in a new posts list.

All of these small features contribute to a viral feedback loop. It’s the type of thing that makes you constantly refresh your Twitter timeline or Instagram feed. Finally, someone who understands consumer app thinking. It’s about time.

RWA Coalition

-

RWAs. They’re nerdy and not as cool as your telegram trading bot, but they’ll be the largest growth driver for DeFi in the next 10 years. I guarantee it.

-

Coinbase, Aave, Circle, Centrifuge and a few other players recently formed the Tokenized Asset Coalition. Their goal? To onboard institutions into the tokenised asset space.

Socket Goes Big

-

Socket, builder of the popular bridge aggregator, Bungee, has received a $5M strategic investment from Coinbase Ventures and Framework Ventures. It’s pretty rare for Coinbase Ventures to lead an investment so this is pretty big.

-

The bridging feature within Coinbase wallet is currently powered by Socket, and I wouldn’t be too surprised to see Socket’s technology (which is great by the way) be adopted more widely. Their user experience is top notch.

Grab Goes Web3

-

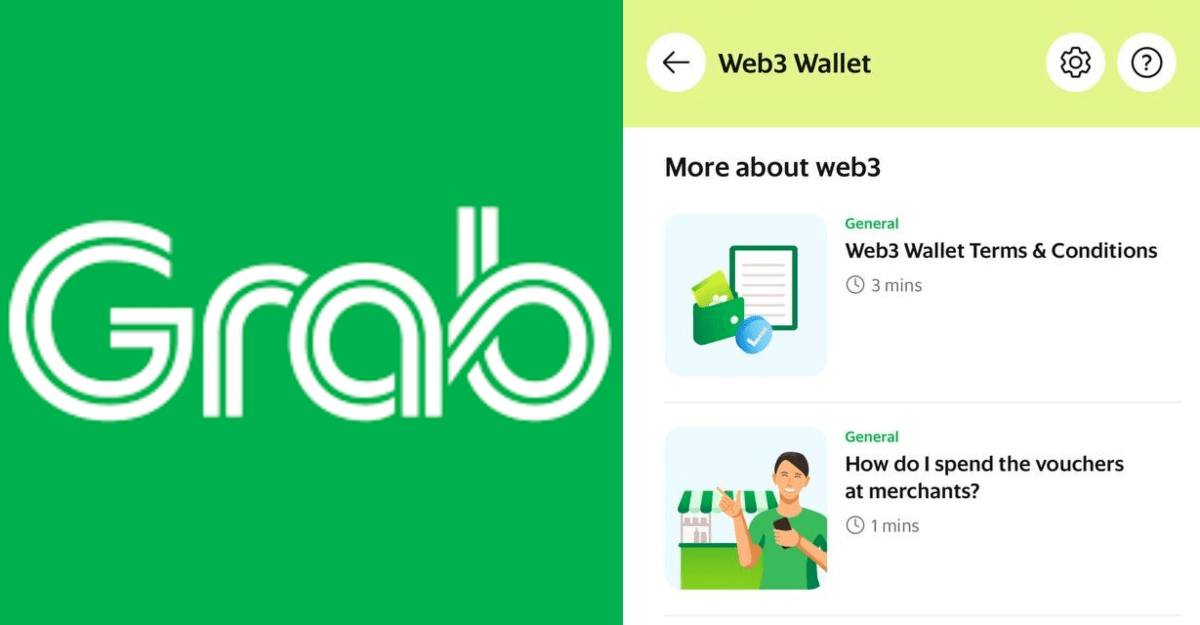

Grab, a ride hailing super-app in Southeast Asia, has launched its web3 wallet. The platform has nearly 200M users, and features everything from food and rides to investments and payments. It’s Uber + Venmo + three other companies combined together on steroids.

-

It just launched its web3 services, including the ability to win blockchain-based rewards, pay with NFTs, and using NFT vouchers at popular restaurants and experiences in Singapore.

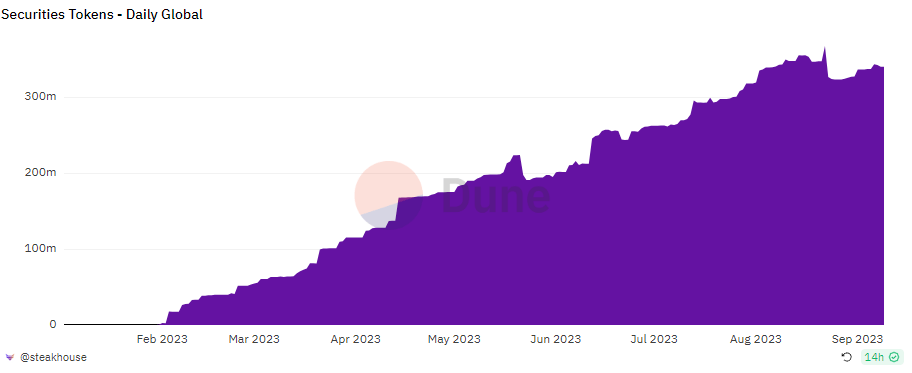

Everything offchain to onchain. That’s the narrative. And will continue to be for the decades to come. To date, MakerDAO has invested roughly $2B in short-term treasury bonds. Right now, they’re doing so by partnering with certain funds that do the investing for them.

However, in a new governance proposal, Steakhouse Finance is proposing to move these offchain treasuries into an onchain structure through its tokenised counterparts.

Since the beginning of the year, tokenised securities have shown immense growth. From $0 at the start of the year to over $300M in market cap today, tokenised securities are here to stay. The largest tokenised security is Ondo’s OUSG, with a $142M market cap.

A few crucial benefits of tokenised securities include higher levels of transparency, simpler accounting, and more easily automated purchasing and redemption processes. All of these lead to significant cost savings, and thus, more profit for its holders.

Continue to pay attention to the tokenisation of assets, as there will surely be some winners within this sector. Think of it as the Lido of tokenised assets, one will emerge.

Why does Visa need the blockchain? Specifically Solana?

Early last week, Visa expanded its stablecoin settlement capabilities to Solana. To answer the question ^, Ethereum is a maximally decentralised blockchain, especially at the core layer. However, Ethereum struggles to break 10 TPS, and before you come and shout at me going, what about rollups, Rollups also only support 10 TPS. And to strengthen my argument, you can’t just launch 100 rollups simultaneously and ask Visa to settle on all of them simultaneously. That would be quite the technical headache.

Meanwhile, Solana manages 300 TPS on a bad day. You can hardly blame Visa for making this decision when I lay out the numbers. In addition, Solana has 0.6 second block times, which is much, much faster than the 12 second block times on Ethereum.

Alright, back to the original question.

Why does Visa need blockchain technology?

Your credit card seems to work fine more often than not. But there’s a term called settlement, which is when the merchant (a business) actually gets the money. For credit card payments, that’s a few days. Which means the merchant only receives your payment a few days after you’ve bought the product or service. Seems pretty bs to me.

By settling payments on Solana, merchants can now receive USDC near-instantly. Importantly, Visa is partnering with Worldpay and Nuvei, two large existing payment service providers. Near instant settlement is one of the strongest value propositions of blockchain vs. traditional financial rails. And this launch should lead to a better payment system and experience for all.

How many more TradFi companies are we going to see adopt blockchain over the years simply because its faster, more transparent, and with better settlement systems? I think it’s going to be more than you think.