Real estate. Bonds. T-Bills. Mortgage. Business Loans.

What do they all have in common?

Yield.

Everyone is thirsty for yield in this dry market. From lending in money markets to staking a native token, the quest for yield is never-ending.

Yield is volatile, and many different trades depend on predictable yield, whether that’s an ETH staker, a lender, or a trader. That’s where Pendle, a yield trading protocol shines.

The Problem With Yield

It’s rarely constant.

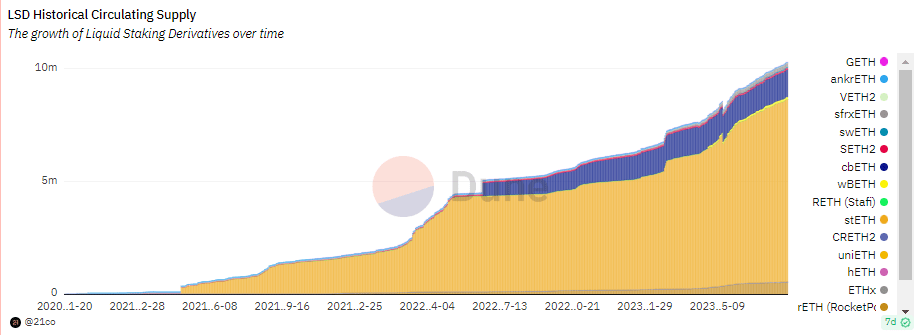

Today, liquid staking and lending are DeFi’s largest sectors. Liquid staking has a combined TVL of $20.3B, while lending has a TVL of $13B. Together, these two sectors make up a whopping 87% of DeFi’s total TVL.

The kicker? This doesn’t include the $43.3B of ETH staked, of which not all is liquid staked.

Every cent of TVL in liquid staking and lending are assets that are earning yield. In liquid staking, you earn yield by providing tokens to help secure a network through validators. In lending, you earn yield by providing tokens so that someone else can borrow them by paying interest.

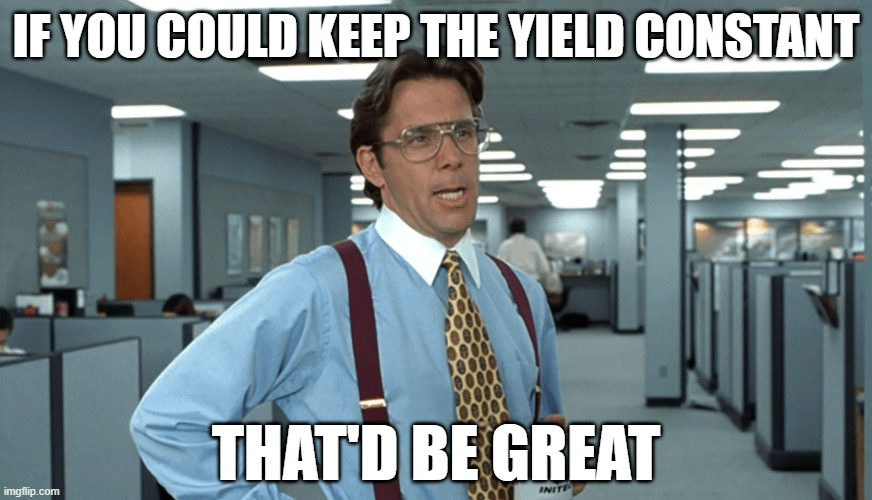

What if you just wanted a stable income generated through constant yield? Imagine having different rent payments every month, or having your mortgage payment differ every year. What a pain that would be.

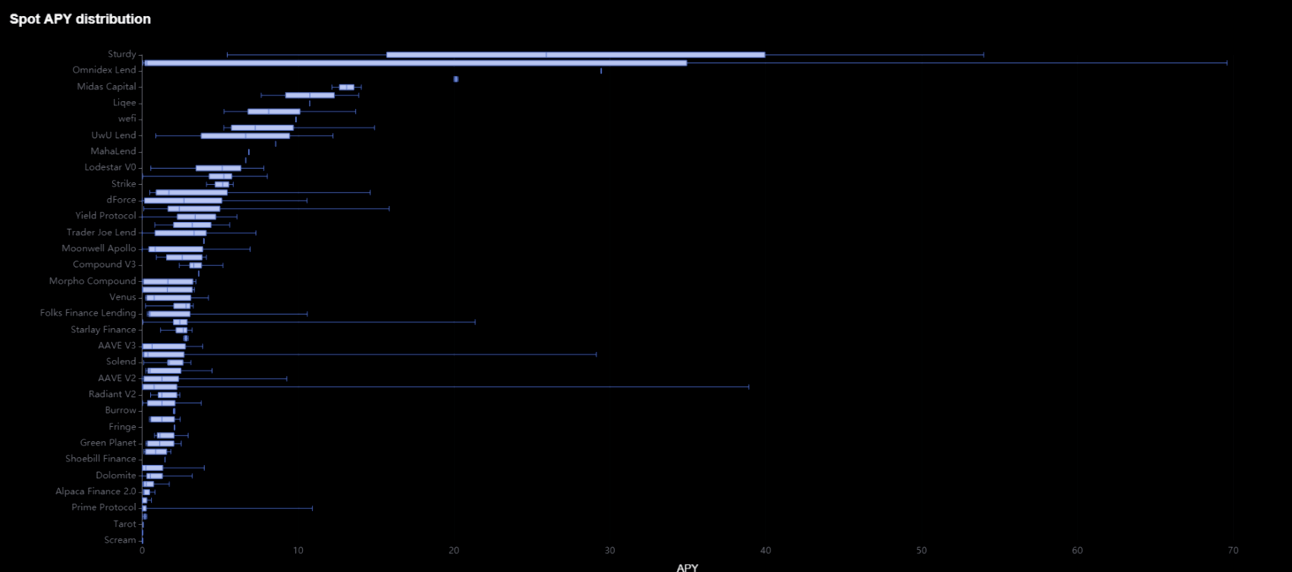

Depending on which protocol you are on, the APY for the largest tokens including WBTC, ETH, USDT, and other large caps, can fluctuate between 0% and 40%. Just look at the APY distribution across various lending protocols above.

Power Is In Your Hands

Pendle gives users control over their yield. Pendle allows users to:

- Fix their yield over a time period.

- Trade yield.

- Provide liquidity.

This opens up a world of options for users. They can now

- Earn a fixed yield on any crypto asset.

- Long yield on leverage because the yield may be underpriced.

- Provide liquidity while holding a yield token so that others can trade yield.

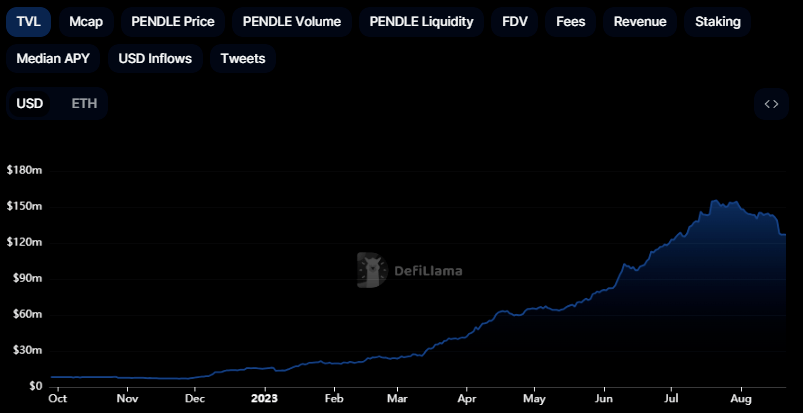

Pendle has shown an immense amount of growth in 2023, with TVL 10x’ing since the start of the year and showing no signs of slowing down. On the LSDFi front, Pendle has the second highest LST TVL at $70M, only behind Lybra.

Today, Pendle allows users to do all these things on four different chains:

- Ethereum

- Arbitrum

- BNB Chain

- Optimism

Through The Clockwork

Here’s how Pendle does it:

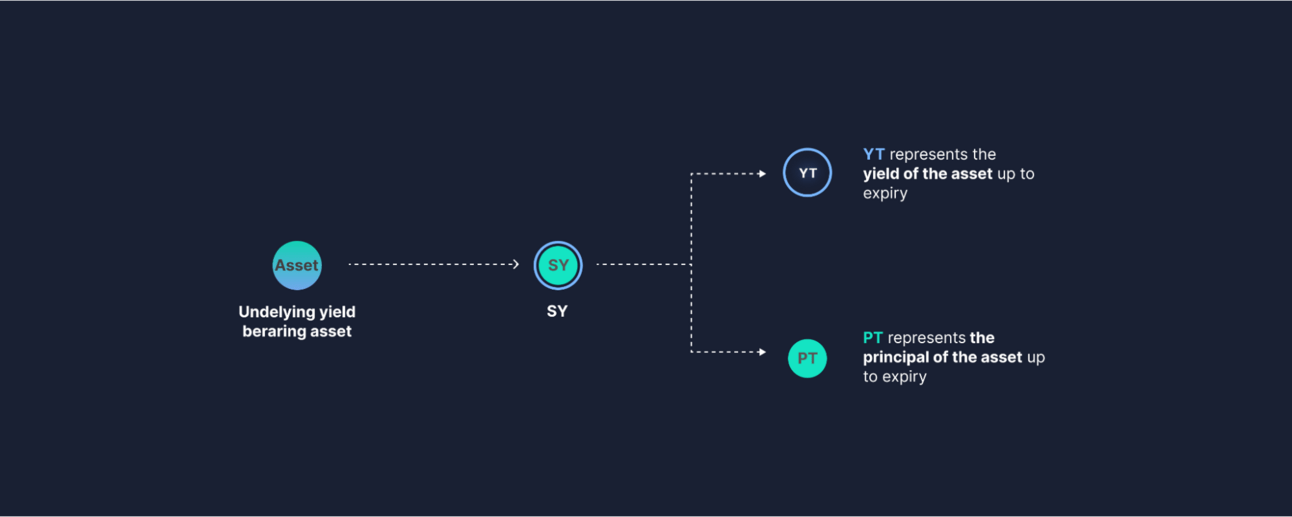

- Pendle splits a yield bearing asset (SY) into two different tokens.

- One principal token (PT) that only represents the underlying asset.

- One yield token (YT) that purely represents the yield generated in the future.

You must be thinking, damn, this three token bingo swap is too complicated. Fret not, Pendle uses an innovative mechanism called flash swaps, so that each asset only has one underlying liquidity pool, SY-PT.

You may have noticed YT is missing, so how do users trade it?

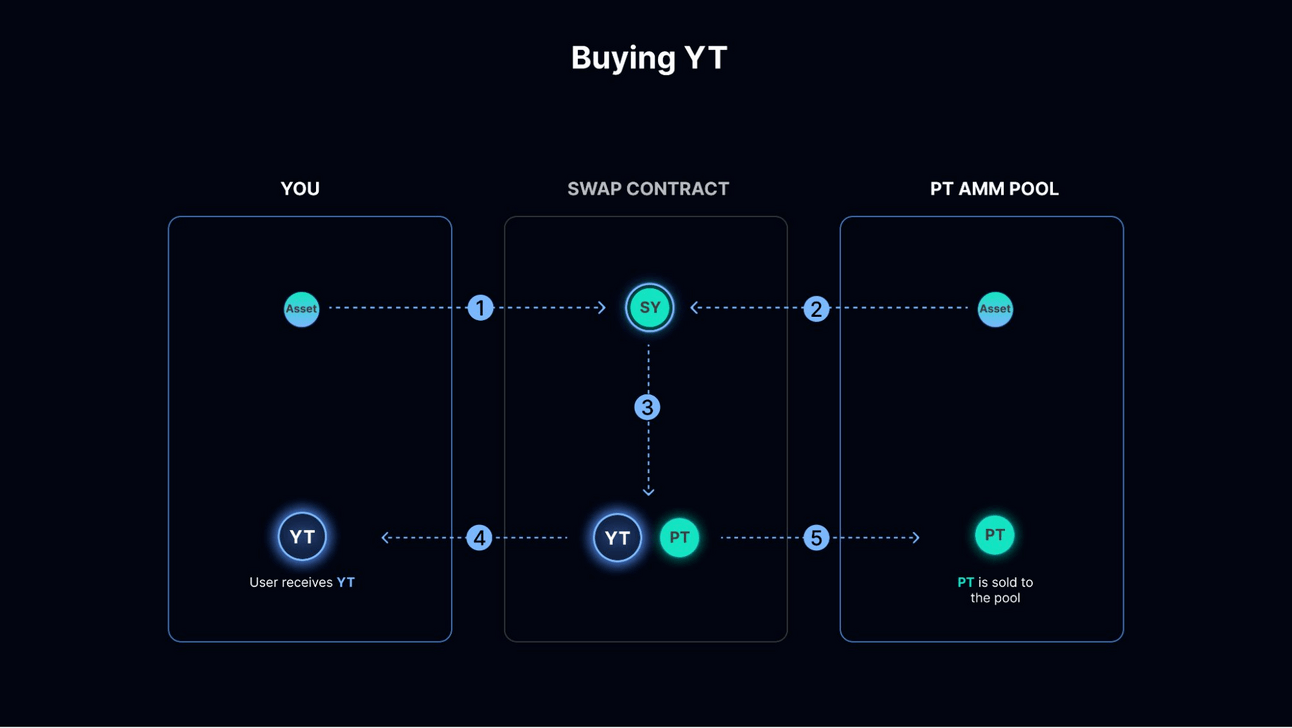

Through a flash swap, when a buyer wants to buy YT:

- The buyer will send SY into the swap contract.

- Next, the contract flash borrows more SY from the pool, and mints PTs and YTs from the underlying SYs.

- Then, the YTs are sent to the buyer while the PTs are sold for SY to return to the pool.

The coolest part? It all occurs within a singular block.

V2 – Yield AMM On Steroids

What’s better than a boring old AMM? A super capital efficient AMM with dynamic curves. Did I just throw out a bunch of buzzwords? Yes. Do they make Pendle a 10x better product? Absolutely.

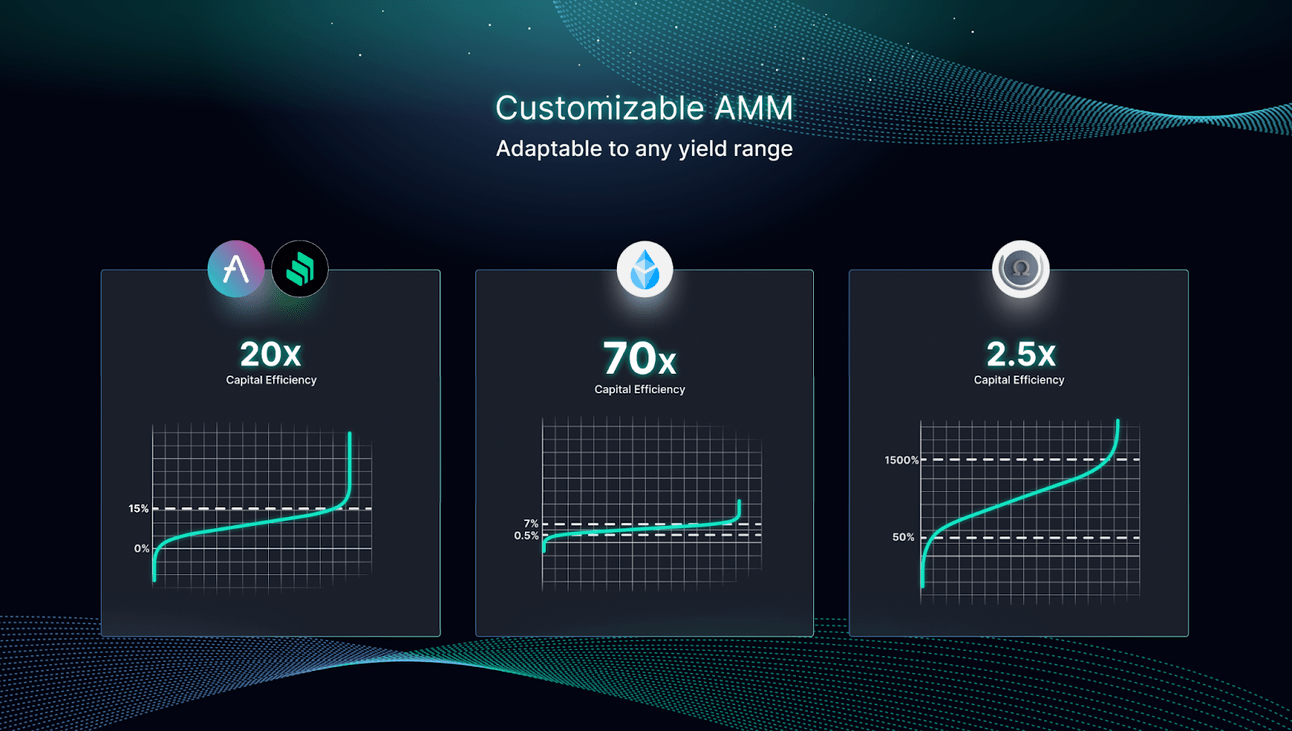

Yields often trade in predictable bands. It’s unlikely that stETH yield ranges from 0% to 100% anytime soon. Similarly, in normal market conditions lending and borrowing rates don’t fluctuate too heavily. Normal AMMs price the assets and provide liquidity from a range of zero to infinity.

Evidently, something would be very broken if staking yields or lending rates were anything close to infinity. As such, Pendle’s new AMM has optimised liquidity within specific ranges, improving capital efficiency by up to 70x for liquid staking tokens.

On another note, Pendle’s liquidity pools have expiry dates, also known as maturities. This means that when liquidity is provided, it is only provided up to a certain date. There are a few interesting quirks with that, including the derivation of a crypto native yield curve.

Just The Appetizer

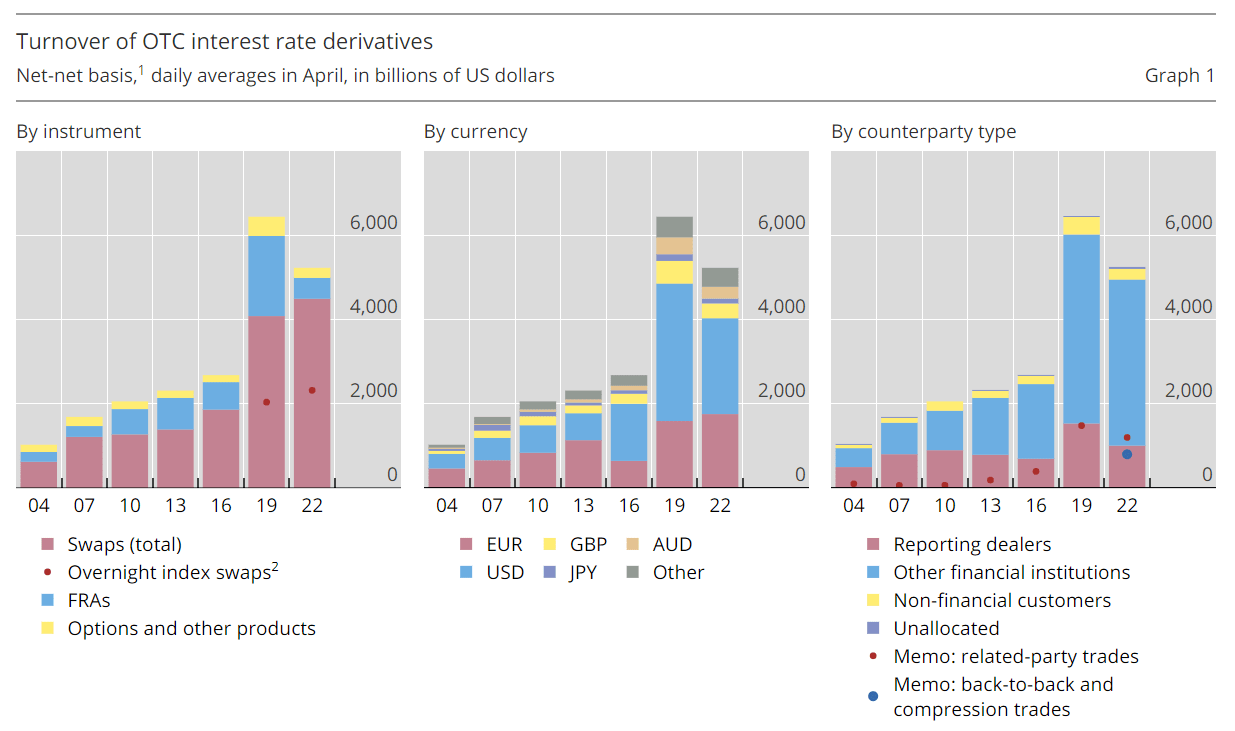

To date, with a current TVL of $126M, Pendle has seen $160M in total trading volume. In TradFi, people trade interest rates on anything from central bank reserve rates to mortgage rates. Interest rates drive a large amount of the economy, as seen in the past year or so as the Federal Reserve rushed to hike rates in response to growing inflation.

In April 2022, the turnover of OTC interest rate derivatives averaged $5.2T per day. Read that again. DAILY. That is a whopping 32,500x of Pendle’s volume so far. Looking at another metric, the total notional amount outstanding of interest rate contracts in tradfi is $490T. I’m not even going to bother finding the multiple for this one compared to crypto.

Let me break it down for you like you are 7. Pendle just had their first taste of sugar and there are still plenty of sweets to try. The interest rate derivative market still has unbelievable room to grow in crypto, and it doesn’t solely lie in crypto assets.

Imagine if Pendle were to tokenise:

- Mortgages

- Treasury bills

- Business loans

It would open them up to the massive opportunity that is lying out there which is multiple orders of magnitude larger than where the sector within crypto is today.

You don’t have to imagine it. Pendle has already front run the narrative. In fact, they are probably THE narrative now. They recently dropped sDAI and fUSDC markets. One represents DAI which receives the DAI savings rate, while the other represents tokenized treasury bills.

Now users will be able to trade and hedge their yield on sDAI and fUSDC on Pendle. Think interest rates are going up later this year? There’s a trade for that. Want to fix your returns? You can do that. Want to yeet whenever Jerome Powell says money printer go brrr? The fUSDC market on Pendle’s got you.

I genuinely believe that this is just the beginning of RWA assets integrations for Pendle. Expect to see more tokenised assets enter DeFi in the coming years and Pendle to integrate more of said assets.

Conclusion

Instant settlement.

Complete transparency.

Innovative liqidity provisions.

Only some of the significant benefits of trading interest rates/yield on the blockchain over TradFi.

Pendle is at the forefront of interest rate derivatives today, and if it maintains its position as the market leader, it could one day conquer a massive piece of the pie when TradFi adoption eventually occurs.

Pendle is currently leagues ahead of its closest competitor. And all the tailwinds are there. Positive catalysts like:

- Growing penetration of liquid staking

- Uptick in leverage through lending/borrowing

- Rapid growth of perp DEXs that use a liquidity token

- Increasing interest in yield trading

Will slowly but surely drive Pendle towards a monopoly of the yield derivatives market in DeFi.