A weekly recap of the largest crypto events and narratives, with an extra dose of insight.

Here’s what we have for you:

-

SEC ETF delays

-

The Aerodrome effect

-

Prisma hits caps

-

Lybra launches peUSD

-

Starknet PR disaster

-

MakerDAO considers an appchain

You know how the government always delays when they need to give you money or when they need to fix the local highway? Yeah, the SEC is no different with these spot Bitcoin ETF decisions. On Thursday, the SEC delayed several ETF applications, including BlackRock, Bitwise, and Fidelity.

With this delay, the SEC has 45 days until the next deadline to make a decision. This means that by mid-October, the SEC either has to give us a decision, or they can delay the decision again. In total, they can delay four times, which means that by the latest, a decision has to be made by March 2024 for all the ETF applications.

The market hasn’t been faring so well in response to that decision, and it feels like we are in for some chop for the rest of the year. However, on the macro front, things are looking slightly worse. The unemployment rate jumped from 3.5% to 3.8%, while the labour force participation rate has increased to 62.8%, continuously increasing for the entirety of 2023, which can either be a good or bad thing depending on how you look at it.

Going back to the legal side of things, we have yet another win for crypto. A court sided with Uniswap in an ongoing lawsuit that alleged that Uniswap was responsible for “rampant fraud” on the DEX, or in crypto speak, a lot of people were launching memecoin liquidity pools and rugging. The court said that the protocol was decentralised, and the identities of the scam token issuers were unknown to the protocol. This means that devs are potentially not liable if someone uses their protocol in a malicious manner, especially if the protocol does not have a centralised ownership structure.

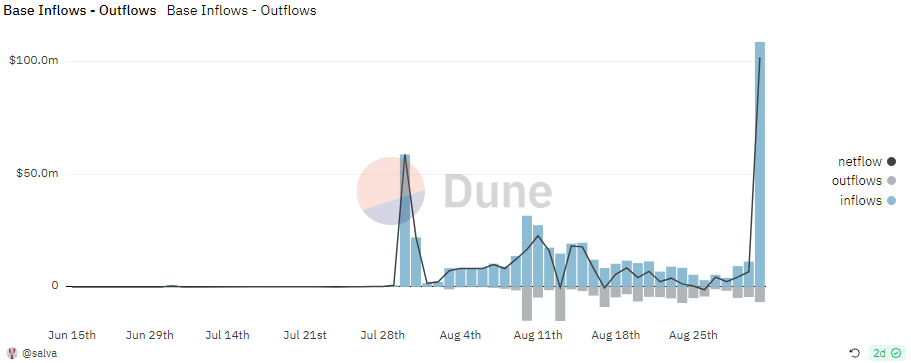

We call this chart, the Aerodrome effect. Base saw more than $100M in native bridge inflows on the day of the Aerodrome launch, and Base as a whole has rapidly reached $387M in TVL. As a point of comparison, Avalanche’s TVL is $515M, Optimism’s is $659M, and Polygon is $768M. To be honest, all of these look attainable by the end of the year if the momentum continues.

On the other hand, Arbitrum has $1.65B in TVL. For now, it seems like that metric could be hard to beat, but as more dApps launch on Base, be it entirely new dApps or existing dApps on other chains, this doesn’t look too impossible. This is especially considering GMX makes up 25% of Arbitrum’s TVL. What if GMX ran the same playbook as Velodrome and Aerodrome and launched another deployment with a new token on Base?

Why has Base fared so well?

If you look at Base’s TVL and net bridge inflows, it far surpasses that of other rollups that have launched this year, including zkSync Era, Linea, Mantle, and opBNB, which begs the question. Why? To date, most exciting L2s have had a killer app that people are willing to bridge over for, and that often kick starts the virtuous cycle. For Arbitrum, that was GMX. For Base, that was friend.tech and Aerodrome was likely V2 of that. Other rollups just haven’t had that juice that is worth the squeeze. Perhaps an airdrop isn’t enough these days.

Prisma Hits Caps

-

When Prisma launched last Friday, it did so with debt caps of $20M. This means that users could deposit as much collateral in the form of wstETH, rETH, cbETH, and sfrxETH as they wanted, but could only mint $20M worth of mkUSD.

-

That debt cap was reached in a shocking 8 hours. In addition, incentives for mkUSD/FRAXbp and mkUSD/crvUSD pools on Convex are now live.

Lybra Launches peUSD

-

On the back of a successful V2 launch, Lybra announced the launch of peUSD on Arbitrum One. peUSD is a omnichain version of the original interest bearing stablecoin, eUSD.

-

peUSD is implemented using LayerZero’s OFT standard. If you have been paying attention for the past few months, it seems like LayerZero is gaining a wide amount of adoption in the multi-chain future, and that could be something to keep in mind.

Starknet Has A PR Disaster

-

Last week, Starknet upgraded to new contracts. This meant that any wallet accounts using the old contracts were deprecated, and any users who did not upgrade their wallets lost access to their funds. As expected, the community was in a complete uproar over this.

-

It seems weird that this is possible on a blockchain, given that we’re all here for public and immutable ledgers. However, Starknet was magically able to restore access to the old accounts which contained a total of $550K.

Oh boy, where do I even start with this one. On Friday, RuneKek, founder of MakerDAO, posted on the Maker forums about a native blockchain for MakerDAO. The purpose of this new blockchain is to make the ecosystem more secure and efficient, and most likely regain more sovereignty over the protocol and DAI.

Here’s where it gets spicy. The proposal cited Solana as the most promising codebase. Yes, the same Solana that has a huge supply overhang due to its FTX investment.

Why Solana?

-

Technical quality of the Solana codebase, specifically the fact that it is highly optimised for the purpose of operating a singular, highly efficient blockchain.

-

The Solana ecosystem has proven its resilience by having gone through the FTX blowup, and the fact that it still has a thriving developer community.

-

There are existing examples of the Solana codebase being forked and adapted to act as appchains.

Of course, Ethereum maxis were in disbelief as to why MakerDAO isn’t choosing an Ethereum rollup. The fact of the matter is that even the most performant rollups today only have a TPS of 20. That is a far cry from the needs of a globally distributed payment system or a stablecoin. There’s a reason dYdX is choosing to launch V4 as a Cosmos appchain.

Will MakerDAO set the trend for dApps who want to retain sovereignty? The Ethereum community shall have to wait with their bated breath.

We all know Lido is a near monopoly at this point. Let’s not pretend that Lido doesn’t have a 70% market share of the liquid staking market. I think it’s pretty apparent that this dominance is here to stay.

Ethereum is great as a base layer for everything because of just how decentralised it is. This is especially true for its validator set and token holder distribution. However, many see Lido’s growing dominance as a threat to Etheruem’s decentralisation.

As a result of this, some liquid staking protocols have committed to self-limit to <22% of Ethereum validators. In a tweet by superphiz, Rocket Pool, Stakewise, Stader Labs, and Diva Staking, were some of the mentioned protocols.

This never really made any sense to me, to be honest. Protocols are companies. Companies act in the interest of shareholders, or in crypto, token holders. This means that a protocol should be maximising profits to return value back to token holders. If a company has the opportunity to be a monopoly within a sector, why would it not do so?

Going back to liquid staking, if Lido has the opportunity to become a monopoly, it will absolutely do so. And if anything, all these smaller protocols agreeing to self-limit have just made that job of becoming a monopoly much easier for Lido. Imagine your competitors telling you, hey, we’re going to limit our market share. Deep down, you’re probably laughing all the way to the bank.