A weekly recap of the largest crypto events and narratives, with an extra dose of insight.

Here’s what we have for you:

-

Base transactions goes brrr

-

SSV mainnet goes live

-

Arbitrum and Espresso’s shared sequencer partner up

-

Synapse launches its interchain network

-

Points

-

LayerZero, why do they need Google

Binance staff are dropping like flies. Recently, it was Binance.US’s legal executive and chief risk officer leaving the exchange. This comes days after its CEO left the firm, along with a third of the staff laid off. If you’ve been watching the news, it feels like Binance gets kicked out of a European or African country every other week. It’s not looking so good for them, and it’s entirely possible that next cycle with a new wave of participants, another CEX will take over.

friend.tech has been taking over all the headlines as TVL has rapidly climbed to above $30M. As the new social app continues to take Base by storm, it has gotten another large integration, Unibot. Now, fellow degens can trade keys through a telegram chat. If being able to trade shares of a human being through a telegram chat doesn’t feel slightly dystopian to you, idk what to say. But this is probably the future.

Circle (the issuer of USDC) announced a partnership with Grab, Southeast Asia’s superapp. Through the partnership, every Grab user now has a web3 wallet within the app, and may now earn rewards and collectibles, use digital vouchers, and more! Expect to see more wallet integrations for big tech apps in the coming years as everyone jumps on the bandwagon. On a similar front, PayPal introduced on and off ramps for web3 payments. Now any wallet, dApp, or NFT marketplace can utilise Paypal’s on and off ramp services that are tightly integrated with its seamless payment experience.

-RektRadar

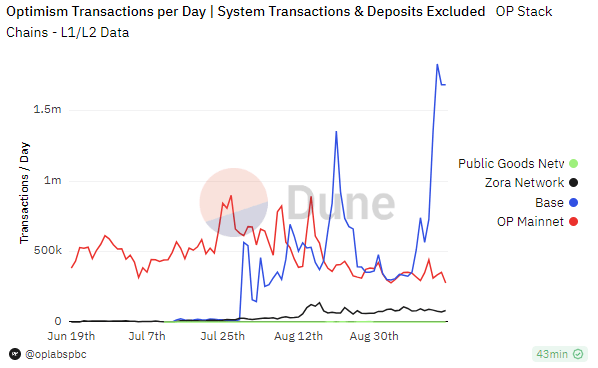

We call this the friend.tech effect. After a few weeks of mania, and then a subsequent two weeks of a cool-down period, friend.tech is so back. If you look at the graph above that shows the number of transactions for various OP stack rollups, you will see that there is a clear winner. It is obvious that this outperformance is being driven solely by friend.tech.

Is it good for an ecosystem if its activity and user metrics rely solely on one app?

I’m not sure. On one hand, that’s likely what a lot of ecosystems will look like in the future. It will have one thriving app and a bunch of other smaller apps. On the other hand, you don’t want ecosystem dependency on a single app. I would argue that these user metrics don’t really matter for any network today. All it takes is one single consumer app to come along and gain normie adoption, and it will blow every existing user metric out of the water.

However, all of this comes at a cost to the network. For example, this MEV bot for friend.tech has spammed the chain with over 20,000 transactions. Perhaps without these MEV bots, activity may not be as high as it seems. But then again, I could say the same for Ethereum where DEX volumes are dominated by MEV bots extracting CEX <> DEX arbitrage.

SSV Mainnet

-

Previously, the SSV network was only allowed to use verified operators to run the protocol’s validators. Starting last week, external validators can now be onboarded using DVT.

-

A single validator can now be secured by a diverse set of clients, geographical diversity, and results in a most resilient and decentralised Ethereum.

Arbitrum <> Espresso

-

Espresso has partnered with Offchain Labs (Arbitrum) for its shared sequencer technology. That makes Polygon’s zkEVM, Optimism, and Arbitrum all partners of the shared sequencer.

-

A shared sequencer is a sequencer that multiple rollups simultaneously utilise, and this guarantees interoperability between various rollup ecosystems, something that will likely be key in a rollup dominated future.

Synapse Launches Its Interchain Network

-

I’m disappointed. Given how much Synapse was hyping its own interchain network and that was pretty much the only thing propping up the token, an L2 built using the OP stack is as lame as it gets.

-

Modularised L2 bridging, native interchain communication, and permissionless interoperability aren’t anything impressive, especially considering it is something that existing solutions provide for already.

Jito, an MEV optimised liquid staking solution on Solana, has launched its point program. One can earn points by holding jitoSOL, using jitoSOL in various dApps, and having others use your referral link.

Why points?

Points have been taking over crypto. Another example of a points a program is friend.tech. Using points, a protocol can achieve the effects of an airdrop without actually having an airdrop.

Importantly, it gives users something concrete to work towards. Often, when someone is farming an airdrop, you don’t know what you need to do in order to maximise the airdrop received. However, with points programs, a user will know exactly what he needs to do to maximise his airdrop.

However, there is nothing guaranteeing a points program leads to an airdrop. It’s entirely possible that a protocol launches a points program and then never does an airdrop, all while generating a large amount of free user activity.

I’m splint on points, to be honest. On one hand, developers can optimise their points programs to the exact metrics they want to grow. On the other hand, it seems like a sillier version of airdrops that will be gamed and sybilled even more than a conventional airdrop.

I would expect points programs to be a big thing during the next cycle, so while the market is boring, take some time to play with a few protocols with points programs so you can get a feel for how they will perform during the bull.

Why Do We Need Google?

Last week, LayerZero announced a partnership with Google Cloud.

What does the partnership entail?

Google Cloud will now run the default oracle for LayerZero. As a refresher, LayerZero’s security depends on two different things: an oracle and a relayer. These two things are meant to be separate, and that is what gives LayerZero its security.

The oracle transmits data from one chain to the other. Specifically, the oracle will pull the block header from the source chain and then send that to the endpoint on the destination chain. As a result of this design, the oracle is undoubtedly the more important entity between the oracle and relayer.

Previously, the default oracle was run by Chainlink. Now, the default oracle is being run by Google Cloud. At this point, you’re probably thinking Google Cloud isn’t very decentralized. And you are correct. It absolutely isn’t. Not even close.

Why Google Cloud?

The first possibility is that LayerZero wants a big tech company as a partner. Many protocols have announced similar partnerships with big tech companies, hopefully in the hopes of a boost to their token price. For example, Aptos recently announced an AI partnership with Microsoft, which doesn’t really mean anything, to be honest.

The second possibility is that this represents a paradigm shift. Previously, we’ve relied on the crypto economic security of slashable stake behind a network. However, deep down, we all know it’s always been about social consensus. For example, if something went drastically wrong with Ethereum, such as USDC being exploited, Ethereum validators would all vote to hard fork the chain.

With this Google Cloud partnership, the security model is basically Google Cloud going “Hey, we are a big tech company; we promise not to rug you.” That seems pretty against crypto’s whole moral of a decentralised future. And I would bet if Google Cloud rugged LayerZero, no asset manager out there is going, I’m going to sell Google stock, and you would still use Google search and Google Maps every day. This is a weird one that I think will have ramifications for the industry as a whole.