Perp DEXs are one of DeFi’s biggest sectors. With the launch of GMX V2, Synthetix V3, and new DEXs such as Vertex, the competition is intensely heating up.

In this article, we’ll dive into:

- Perp DEX landscape

- Protocol upgrades

- New competitors

- What lies ahead

Perp DEXs – Where do we go from here?

Perp DEXs were the star of 2022. With GMX dominating the “real yield” narrative, and what some would say, single-handedly putting Arbitrum in the spotlight of thousands of users, it seemed like perp DEXs were the future of finance. After FTX’s collapse, fuel was added to the fire as everyone thought a large amount of CEX perp trading volume would move onchain into perp DEXs.

Why perp DEXs?

Perp DEXs have a few advantages that are valuable to crypto investors and speculators alike. A centralized entity is replaced by smart contracts, guaranteeing trade settlement and permissionless trader access. Traders enjoy greater privacy and retain custody over their assets. There are significantly fewer barriers to using a perp DEX such as a lack of KYC requirements and in general higher leverage available.

Perp DEXs are often community-focused, which means that users are able to participate more actively in the protocol as liquidity providers or have more exposure to the protocol’s growth and upside through various mechanisms such as token staking.

Where do perp DEXs stand in comparison to CEXs?

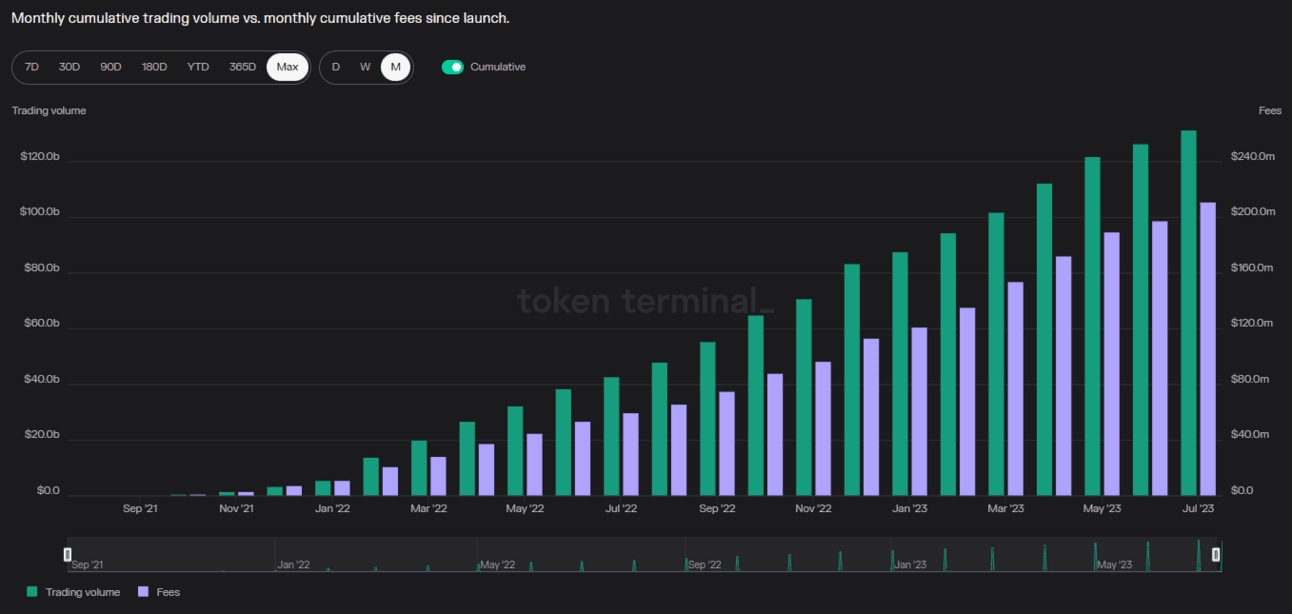

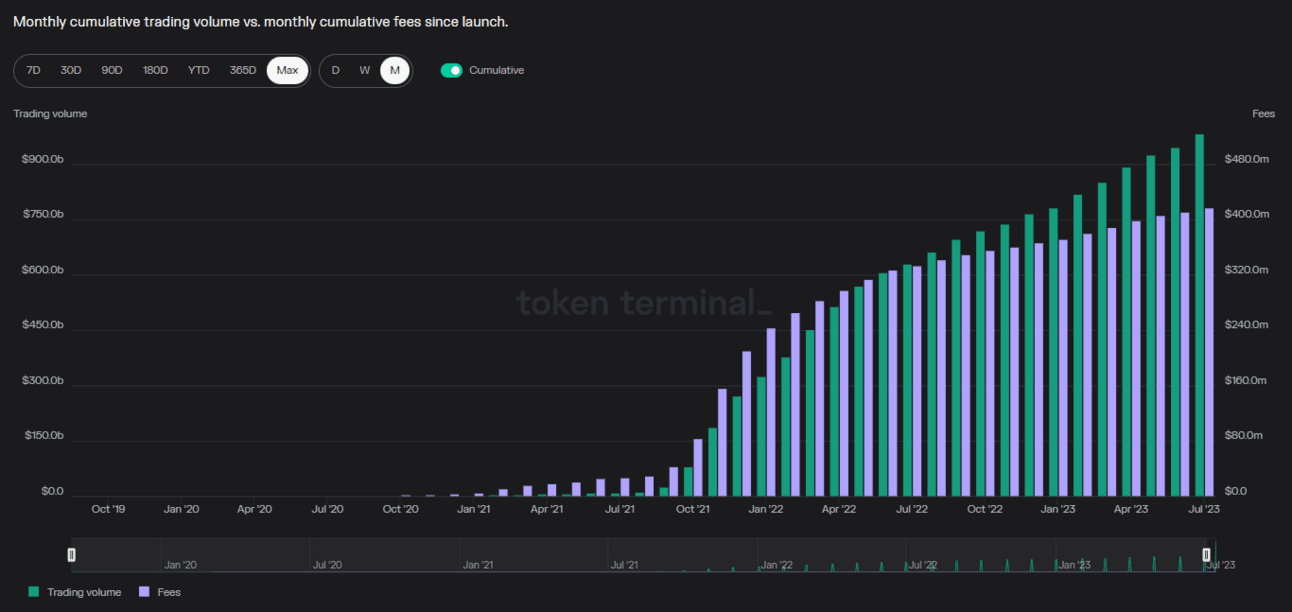

The total volume across major perp DEXs (not including dYdX) since inception is ~$250B. This is still small in comparison to the ~$1T monthly spot volume that CEXs experience and this doesn’t even include perp volume. DEX to CEX futures trade volume % has never been above 2.02%, so there is still a long way to go. Having said that, perp DEXs have shown immense growth in a short time, with total fees generated reaching ~$290M and utilized by nearly 2M unique traders.

Perp DEXs are primed to continue to take market share away from CEXs, the only question is, who will win? Existing incumbents such as GMX, Gains Network, and dYdX? Or new protocols with new innovations such as KTX.finance, Vertex, and Mux?

Old School Perp DEX Landscape

GMX

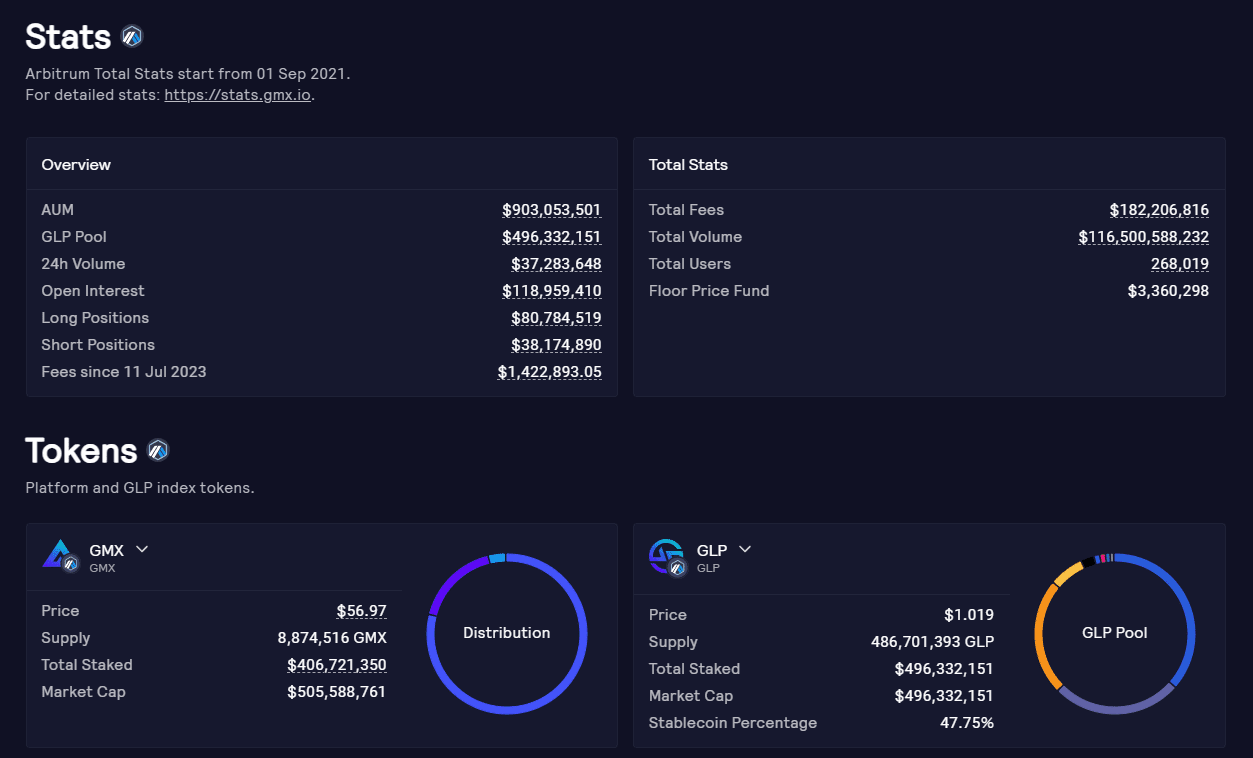

First to town and gain widespread adoption as a perp oracle DEX, GMX took onchain degens by storm. On one hand, traders loved the fact that there was zero price slippage when executing a trade and the minimal fees to open and close positions. On the other hand, liquidity providers also loved the “real yield” that GLP provided, sometimes providing over 50% APR in ETH on a relatively stable basket of crypto assets such as BTC/ETH/USDC as traders kept on losing on their trades.

GMX uses Chainlink oracles and price feeds from large CEXs and allows traders to trade a limited amount of tokens such as BTC/ETH/USDT/USDC/LINK. To date, GMX has achieved $114B in volume while generating $187M in total fees with 115K unique traders.

Gains

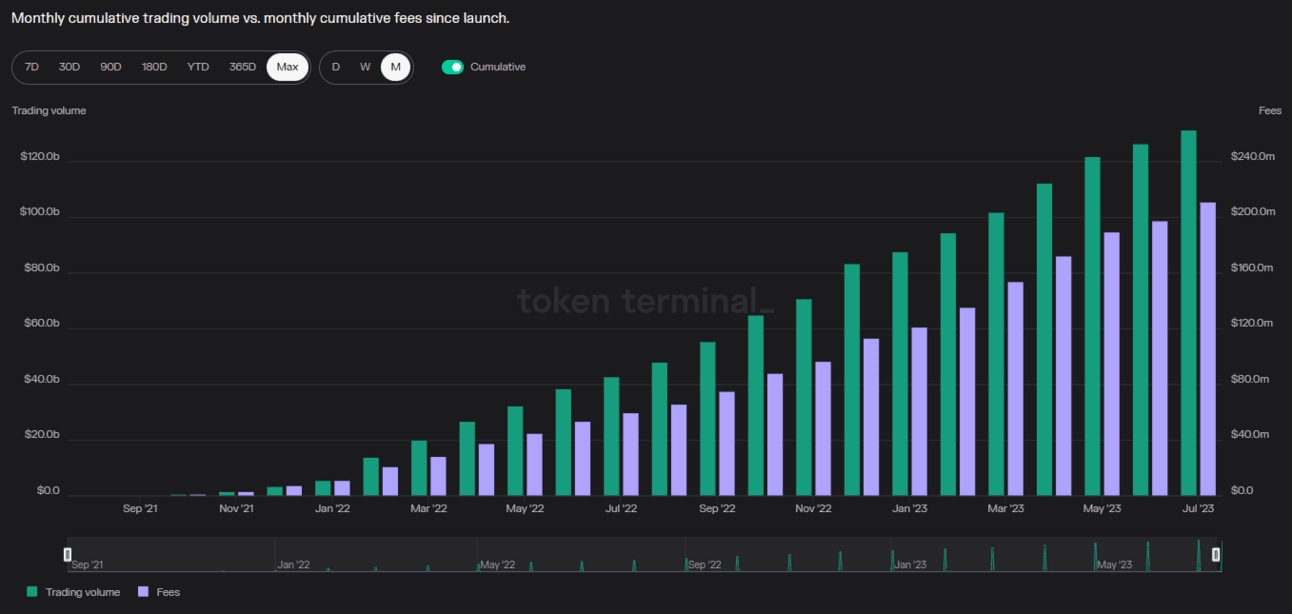

Gains is another perp oracle DEX that has shown quick growth, especially after launching on Arbitrum at the end of December 2022. Originally launched on Polygon, Gains is a perp oracle DEX that allows for trading crypto, forex, and also equities in the past at high leverages (over 100x).

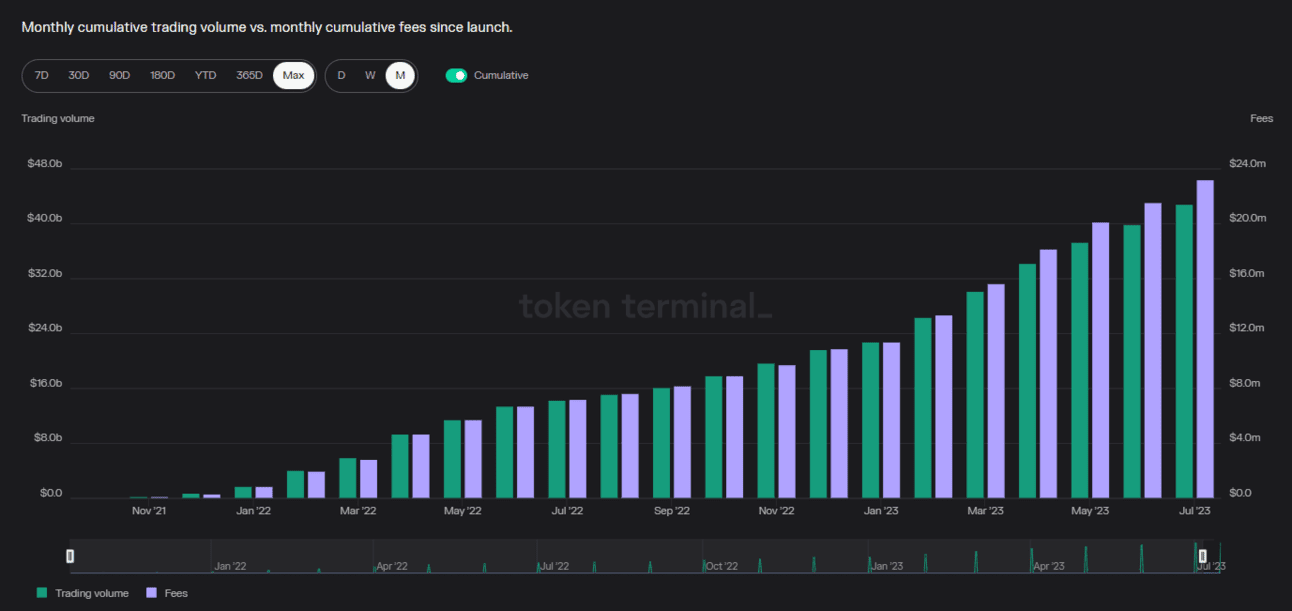

Gains uses a gDAI vault, where liquidity providers can deposit DAI, to act as a counterparty to trades. One point of differentiation for Gains and its liquidity model is that the gDAI vault supports the ability to mint gDAI at a discount during periods of stress. Liquidity providers can lock liquidity anywhere between 2 weeks to 1 year when the vault’s collateralization ratio falls below 150%. To date, Gains has achieved $38B in volume while generating $32M in fees with 15.5K unique traders.

dYdX V3 is a decentralized perps exchange. Unlike other perp exchanges, dYdX does not use an oracle. Instead, dYdX has its own price discovery through a central limit order book, like most CEXs that exist today. Traders can deposit USDC collateral and trade a large variety of perps with up to 20x leverage.

An index price is calculated using price data from various exchanges, and funding rates are calculated based on these index prices and execution prices. This means that, unlike other perp oracle DEXs which do not have price discovery, dYdX is a venue for price discovery. To date, dYdX has achieved over $1T in volume while generating $420M in total fees.

Upgrade The Old

Existing perp DEXs were built in the bull market. Many of them didn’t have battle-tested risk management systems, liquidation engines, and optimal liquidity provision mechanisms.

For example, a common argument that you heard against GMX’s GLP model is that what happens in a bull market when everybody is long and GLP holders get rekt? Or for example, how scalable are perp DEXs, how decentralised are they truly, or does it even make sense that traders get zero price impact upon execution?

To answer many of these valid concerns, old perp DEXs have been upgrading intensively.

GMX 2

GMX V2 brings a slew of upgrades to the protocol in terms of user experience, protocol risk management, and liquidity providers.

First of all, GMX is attempting to balance the trader experience with liquidity provider exposure. Open/close fees have been halved from 0.1% to 0.05%. However, funding fees have been introduced to balance open interest, to the benefit of liquidity providers, and there is now a price impact for large trades.

In addition, GMX V2 will introduce a new liquidity provision mechanism. ETH will be used for long liquidity and USDC will be used for short liquidity. Importantly, this means that the number of assets traded can be increased as ETH/USDC can be used as liquidity for longing or shorting any token. GMX will also use new low-latency oracles from Chainlink that will make front-running harder and provide a better trading experience.

Synthetix V3

Synthetix V3 is poised to elevate Synthetix from a liquidity platform for perps, to an entirely permissionless derivatives liquidity platform. With V3, Synthetix is aiming to power the next generation of onchain financial products and becomes a liquidity layer anyone can build on top of.

Synthetix V3 aims to introduce its own new front-end utilising its own liquidity, Infinex. In addition, Synthetix is aiming to introduce multi-collateral staking, where stakers should be able to use ETH or other LSTs to provide liquidity, rather than the SNX token. There will be multiple debt pools that other protocols can tap into, and Synthetix will essentially be offering liquidity as a service. Synthetix will also be going cross-chain and will be able to deploy on any EVM-compatible chain.

New Competitors

Vertex

Vertex is a new perp DEX on Arbitrum that aims to create a CEX-like experience onchain. Unlike other perp DEXs, Vertex uses a central limit order book (CLOB). This means that Vertex can scale much more than other perp DEXs, as professional market makers can come in and provide liquidity. However, Vertex also caters to less sophisticated users who would still like to provide liquidity for their spot trading through simple AMM liquidity pools.

Vertex uses a fully on-chain trading venue and risk engine, with an off-chain sequencer that matches orders. This is what allows Vertex to provide a CEX-like experience, providing extremely low latency for traders. However, unlike existing perp DEXs, by trading on a CLOB, a user’s trade will have a price impact as you are eating through the liquidity in the order book.

One innovative feature of Vertex is its universal cross-margin system. A user’s different positions will offset each other and the protocol will calculate the portfolio’s overall risk. This results in a much higher capital efficiency for your collateral, especially in scenarios where you are running delta-neutral trading strategies.

GMX V2 brings a slew of upgrades to the protocol in terms of user experience, protocol risk management, and liquidity providers.

First of all, GMX is attempting to balance the trader experience with liquidity provider exposure. Open/close fees have been halved from 0.1% to 0.05%. However, funding fees have been introduced to balance open interest, to the benefit of liquidity providers, and there is now a price impact for large trades.

In addition, GMX V2 will introduce a new liquidity provision mechanism. ETH will be used for long liquidity and USDC will be used for short liquidity. Importantly, this means that the number of assets traded can be increased as ETH/USDC can be used as liquidity for longing or shorting any token. GMX will also use new low-latency oracles from Chainlink that will make front-running harder and provide a better trading experience.

KTX Finance

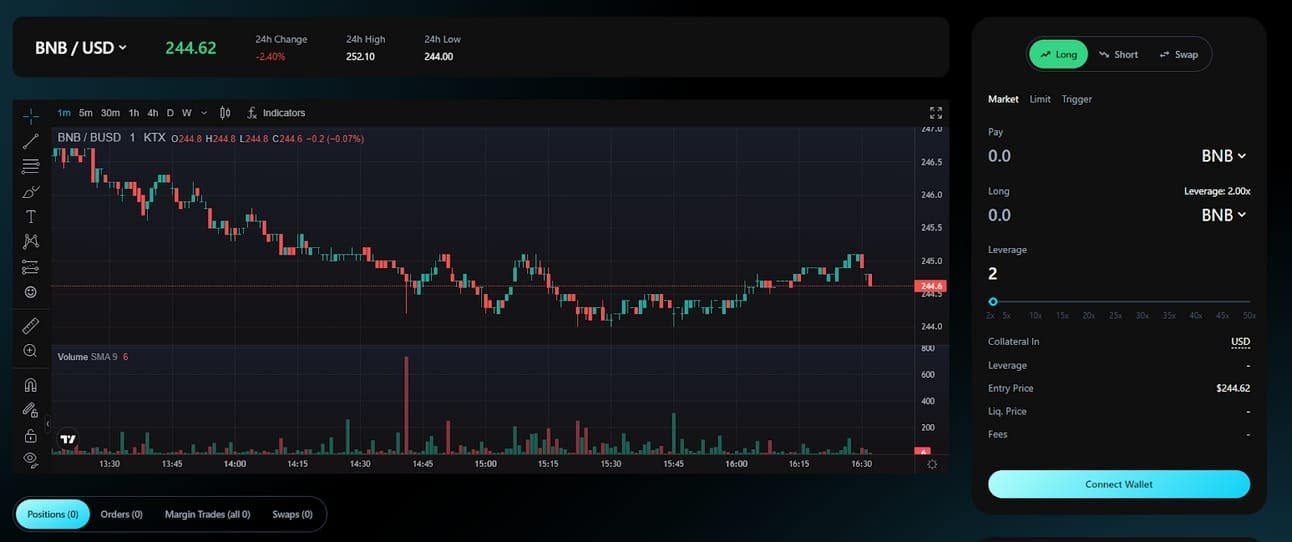

KTX is a new kid on the block. It is a capital-efficient decentralised spot and perp DEX on BNB chain. Capital efficiency, low fees, and a great UI/UX is the name of the game. BNB chain still does not have a dominant perp DEX, so the playing field is wide open.

KTX doesn’t just want to stop at perps, they want to establish themselves as the derivatives exchange on BNB chain. Not only that, the team is planning on combining the best of both worlds by incorporating social features such as copy trading into the protocol.

Simple perp DEXs don’t cut it for you anymore? KTX is planning on building out delta-neutral vaults, collateralised debt positions, options, and even multi-asset swaps, with cross-chain compatibility in the near future.

The protocol uses a similar tokenomics structure to GMX, with 70% of fees paid out in BNB to liquidity providers (KLP holders) and the other 30% paid to KTC, the governance token holders. You’ll have to stake KTC in order to vest esKTC, which is locked for one year. Having a balanced liquidity pool asset list is important, so KTX will also be utilising a single liquidity pool which comprises of 50% stablecoins and 50% blue-chip assets.

Each blockchain will likely have a dominant DEX and any one protocol that generates network effects for themselves could be poised to capture a huge market. And one thing in crypto that has become apparent is that there is always innovation out there.

Conclusion

Perp DEXs are still an ever-growing space. Volume has to 50x before we catch up to CEX perp volumes. And even then, compared to TradFi and other asset classes, there is still a huge opportunity for perpetual futures and derivatives to grow.

As we experience different market conditions throughout the years and protocols have to cater to liquidity providers with different risk profiles, and traders with varying levels of sophistication, innovation and thoughtful mechanism design will be the key to building a safe and scalable perp DEX.

Where does that leave us?

Legacy perp DEXs have the benefit of an existing user base and battle-tested mechanisms whereas newer perp DEXs have the benefits of being able to start from a clean slate without incurring much technical debt. It remains to be seen which perpetual DEX will eventually dominate the playing field, but one thing is for sure, if onchain perps ever surpass CEX perps, and crypto as an asset class continues to grow, the rewards will be huge.

Refer Two Friends – Get Our Exclusive Airdrop Guide

Before we get started, refer your friends!

It’s as simple as that.

If you love our newsletter, then your friends will love it too. Don’t keep the alpha to yourself.

Refer a friend today by opening this newsletter in your email and clicking the refer button.

Note: The referral button is only available in the newsletter and is not available here on the website.