A weekly recap of the largest crypto events and narratives, with an extra dose of insight.

Here’s what we have for you:

-

Coinbase Earnings

-

CRV OTV trades

-

Hong Kong retail trading

-

ETH futures ETF

-

Y2K touch vaults

-

EIP 4844

Refer Two Friends – Get Our Exclusive Airdrop Guide

Before we get started, refer your friends!

It’s as simple as that.

If you love our newsletter, then your friends will love it too. Don’t keep the alpha to yourself.

Refer a friend today by opening this newsletter in your email and clicking the refer button.

Note: The referral button is only available in the newsletter and is not available here on the website.

Coinbase Earnings

On Thursday afternoon, Coinbase released its much anticipated earnings. As crypto activity continued to see a decline in Q2 amidst increasing interest rates and continued enforcement action by the SEC, one would have thought that Coinbase’s Q2 earnings would be pretty disastrous.

But it wasn’t all doom and gloom. First of all, Coinbase beat analyst estimates, posting $708M in revenue vs the analyst estimates of $629M. In addition, this revenue is remarkably impressive when compared to Q2 revenue of $808M one year ago. If you had told me that Coinbase revenue would only have decreased by 12.5% after everything that has happened from then till now, including 3AC, FTX, LUNA, and hack after hack, I would not have guessed that.

Coinbase also managed to generate an increasing amount of subscription revenue from services such as staking, custody, and Coinbase One. However, USDC interest has continued to decline despite rising interest rates, largely due to USDC’s declining market cap.

Conversely, Tether, the creator of USDT, has been seeing their market cap continue to increase as their Q2 profits reached a high of $850M and they are now the 11th largest BTC holder in the world.

What’s the future for Coinbase?

Coinbase looks to be in a strong position, with surprisingly sticky transaction revenue, a slew of new products, an international derivatives exchange that is slowly gaining traction, and most importantly, with their L2, Base, going live in two days.

All of these should be positive catalysts for Coinbase. However, there is still the overhang of ongoing legal action by the SEC, but Coinbase is actively fighting that. If they win, expect to see fireworks.

-RektRadar

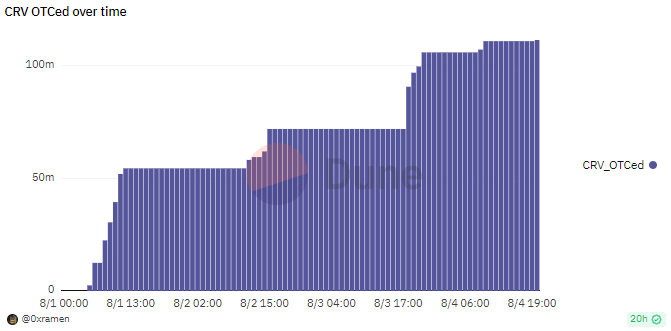

God OTC Trader

It’s not over yet. Curve founder Michael Egorov continues to sell CRV OTC in order to repay his debt. From what we know, he’s selling CRV at $0.40, there’s a six month lockup, but you can sell if CRV goes higher than $0.80. Some of the new buyers include Reserve protocol and Wintermute.

Notable buyers include Yearn, StakeDAO, Sifu, and Justin Sun. Obviously some of these buyers are good and have locked up their CRV in order to direct emissions, however, there are some questionable names too.

All in all, the current OTC deals are helping to decentralise CRV ownership, as previous to this, nearly 50% of the circulating supply was held by Michael himself. In addition, these OTC deals are helping DeFi escape a catastrophic event that will cripple many protocols that are dependent on the Curve ecosystem.

Where do we go from here?

Defi should learn from this lesson and never repeat it. There are a few things we need to do.

- Lending protocols need to manage risk more proactively and understand collateral asset liquidity

- We need to understand how interconnected tokens and ecosystems are, and that sometimes there are trading opportunities that present themselves

Hong Kong Crypto Trading

-

Effectively immediate, retail users can start trading certain cryptocurrencies in Hong Kong. The two exchanges who received licenses are HashKey Exchange and OSL Digital Securities.

-

The list of crypto tokens that retail investors can now access isn’t huge, at ten or so tokens, but it includes BTC and ETH. This could eventually pave the way for larger retail trading volume from more altcoins.

ETH Futures ETF Applications

-

SEI is a general purpose L1 that is specialized for trading. With various technologies such as twin turbo consensus and a order book, anyone will be able to tap into SEI to facilitate their trading infrastructure.

-

This is a project that has gotten a relatively larger amount of hype given all its technological promises. Binance just announced a launchpool for SEI, and the token will list on August 15th. This could be worth participating in.

Y2K Launches New Vaults

-

Crypto depegs are frequent. Y2K has traditionally been a good product for hedging against stablecoin depegs. However, with their new product, you can now bet on token prices.

-

A new “Touch” vault will payout those who bet that a token touches a certain price. In this case, if you bet on a “Touch Down” for CRV with a $0.40 strike price, you get paid out if at any moment of time until expiry, CRV reaches $0.40.

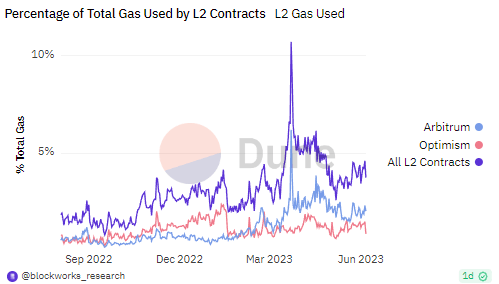

L2s have slowly but surely started to gain more usage across the past year. As Optimism and Arbitrum continue to gain adoption, various other L2s such as Polygon zkEVM, Scroll, and zkSync Era are just launching or growing. This leads to a future where much of the activity within the Ethereum ecosystem takes place on rollups.

Rollups make money by charging transaction fees from users, and then paying some transaction fees to post state roots and transaction call data back to Ethereum. The difference in how much they charge in total and how much they have to pay in total is essentially their profits.

This means that if they are able to charge more from users, or have to pay less to Ethereum, they will make more profits. This is where EIP 4844 comes in. I’m sure you’ve seen this EIP enough on twitter lurking around.

EIP 4844 is an update to Ethereum that cater to a rollup centric scaling roadmap. Specifically, Ethereum blocks will now have a sidecar that accepts blobs. These blobs accept data from rollups, and importantly, make it up to 90% cheaper to submit data to Ethereum.

If rollups don’t change how much they were charging users to submit transactions, but now, their costs have suddenly decreased by 90%, then they stand to keep much more money after everything.

EIP 4844 is expected to go live sometime in the next half a year, and could very well be a big driver for rollup profitability. This would be a strong catalyst to watch if you’re trading tokens such as ARB and OP.