If you are still trading on CEX in 2023, were you asleep the entire 2022?

With countless reminders on CT about not your keys, not your funds. Active crypto traders have gradually taken their exploits on-chain to avoid another FTXesque event.

The problem?

There aren’t many user-friendly options that offer a CEX like experience with competitive fees.

The future is onchain and even CZ knows it.

Why do you think he invested heavily on BSC as his escape hatch?

Onchain perp DEXs will capture significant marketshare in the coming years. Let’s talk about how Vertex could lead the way.

Let’s talk about:

- The Elephant In The Room

- Tragic into Magic

- CEX feels so good

- Value In The Revenue

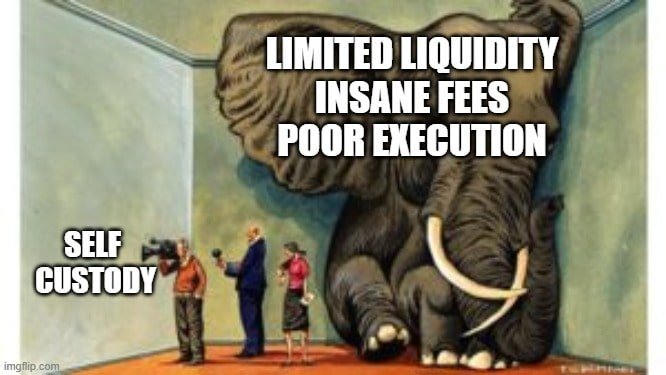

The Elephant In The Room

You have seen how CT larps continuously about self custody of funds after FTX’s collapse. Truth is, the current experience of perp DEXs are terrible. The funds are in your control but in return, you get:

- Limited liquidity

- Insane fees

- Poor order execution

Fair trade? Maybe to some.

Try putting on size on any trade and you will quickly see how the fees will eat into your trading profits. Until the user experience improves and traders stop getting fleeced on fees, the situation is tragic.

Turning Tragic Into Magic

This time it’s different. (Really)

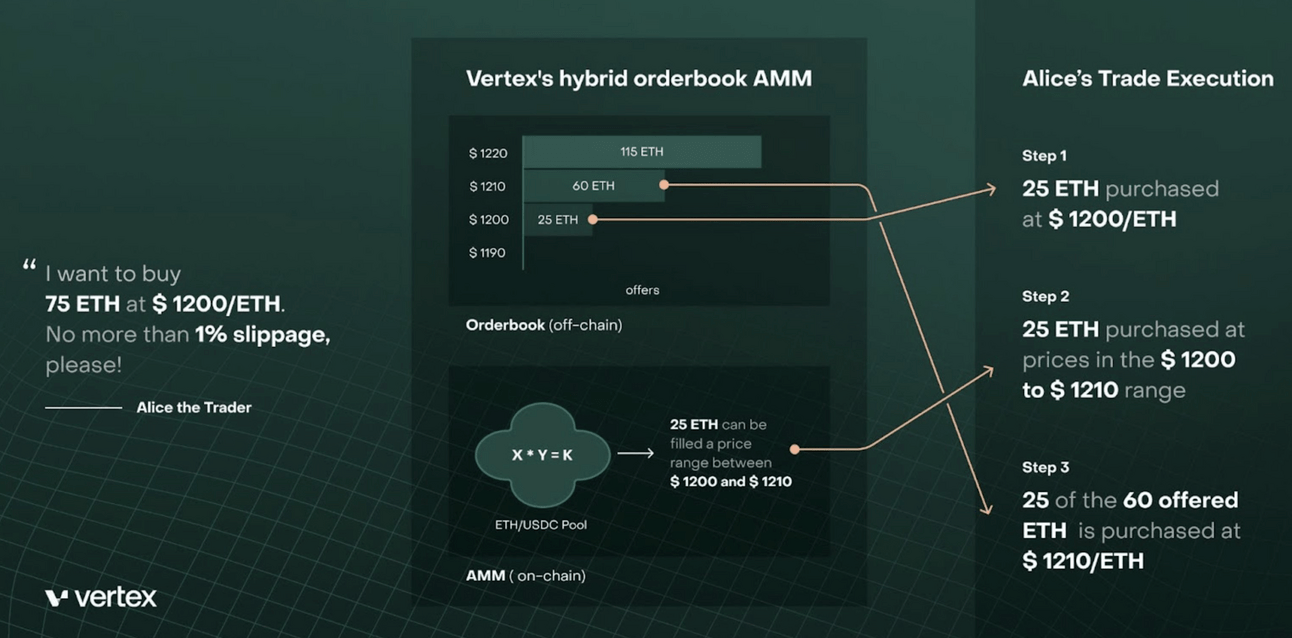

Traditional perp DEXs source liquidity from ambient liquidity using liquidity providers (e.g. GLP for GMX, gDAI for gTrade) while Vertex relies on a hybrid model where liquidity is provided by both market makers and passive liquidity market makers in the AMM through the central limit orderbook (CLOB).

Vertex offers both spot and perp trading along with money markets all vertically integrated on a single platform.

Is the CLOB perp DEX superior to the LP perp DEX?

Projects that solve major pain points will have a natural product market fit.

Let’s compare:

- Liquidity

- Order Execution

Liquidity

Traditonal LP perp DEXs are limited by the liquidity provided by liquidity providers (LPs). For example, if there is $10M of liquidity available, traders will only be able to open trades with a sum of $10M or less in open interest. In addition, traders have to pay borrowing fees for the liquidity.

In a CLOB perp DEX, liquidity is dependent on the market makers and the depth of order books. However, that also means your trades could eat through the bids/asks in the orderbook when trading with size.

Liquidity growth for a CLOB is simple.

- More traders ➔ More trading volume

- More trading volume ➔ Deeper liquidity

- Deeper liquidity ➔ More traders

Execution

When executing a trade on a protocol like GMX, your transaction interacts directly with the GMX smart contracts. But a CLOB perp DEX, is reliant on matching trades across the orderbook.

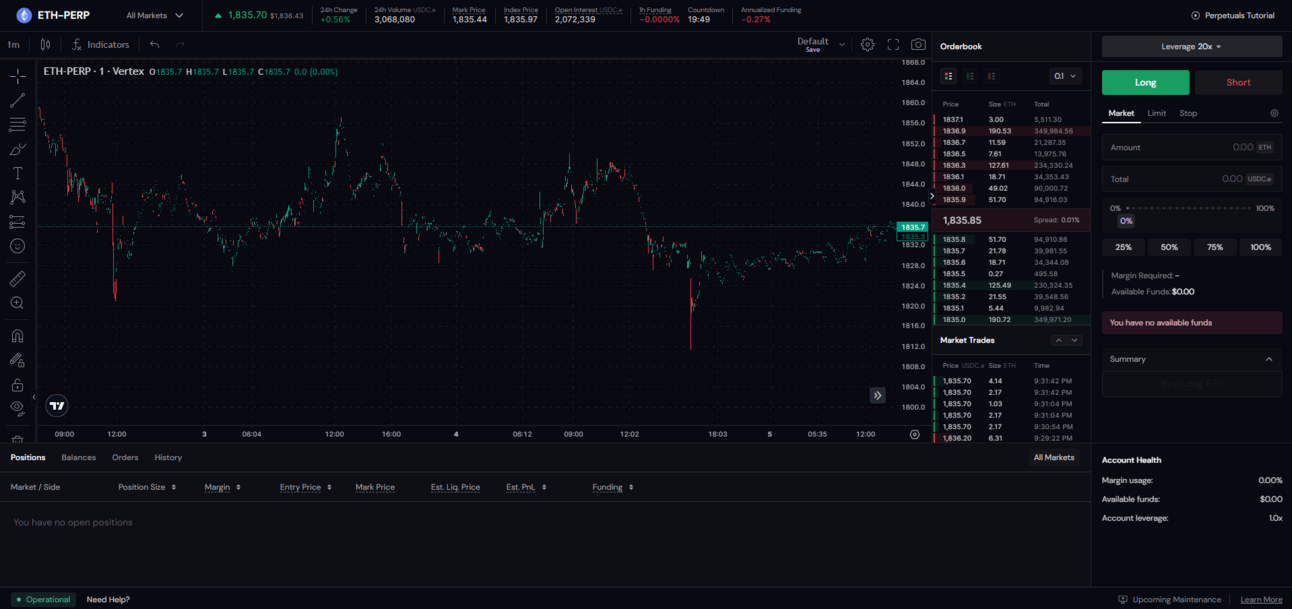

A sequencer matches orders on a first in first out (FIFO) basis across the orderbook. It operates offchain with great efficiency, providing traders with sub-30 millisecond latency, MEV protection, and low gas fees.

Now we mentioned getting a CEX like experience is fundamental to the user experience. Binance’s latency is currently 12-15 milliseconds, with the lowest latency possible being 5 milliseconds, so 30 milliseconds of latency is seriously impressive for a dApp.

CEX Feels So Good. Yes Yes Yes

The goal of Vertex is to provide a CEX like experience, but onchain. There are a few unique ways that Vertex is fulfilling that goal.

Especially for users with limited capital, being able to:

- Leverage their collaterals

- At fractional costs

Will attract a larger audience pool of traders.

Here’s how Vertex tackles these problems.

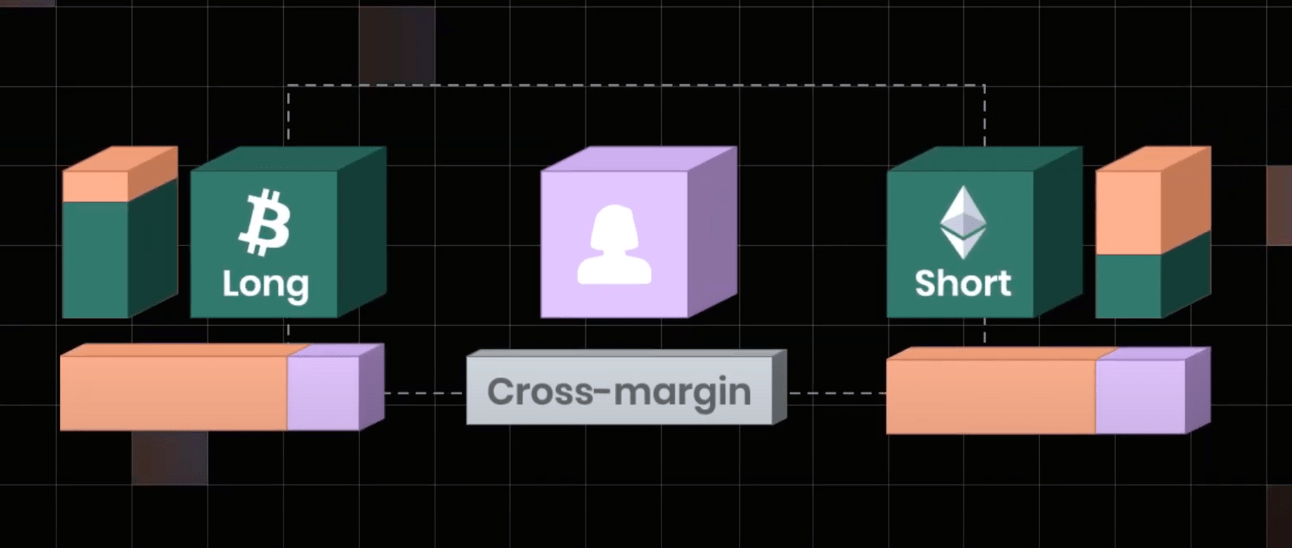

Cross Margin

Crypto DEXs are notorious for their lack of capital efficiency. Not only are you limited by your margin on single trade positions, there are also limited trading pairs.

With over 20+ perp markets, including slightly more obscure ones such as PEPE, SUI, and ARB, Vertex offers more options for traders looking for an edge.

It also utilizes a unique cross-margining system. This means that the user’s

- Account balances

- Open trades

- Outstanding borrows/Lends

All act as collateral for each other. Compare this to other perp DEXs such as GMX and dYdX that use an isolated margining system and it will be easy to see which has superior capital efficiency.

Cross-margining systems are the de facto gold standard on a CEX and open up opportunities for interesting pair trades (e.g. long ARB short OP), and also allow PnL from open trades to be used as margin. For example, users could also capture the funding rate by shorting a perp and longing the underlying spot market, because Vertex also has spot markets.

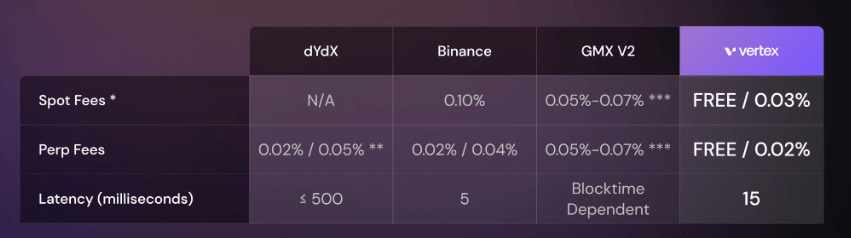

Trading Fees

Vertex has the lowest trading fees of all perp DEXs and CEXs. Yes, you read that right, even better than Binance.

Vertex has no trading fees if you are a maker, both for spot and perps. If you’re taking liquidity, e.g. market order instead of a limit order, your trading fee is still a measly 0.03% for spot and 0.02% for perps.

You want to grab marketshare from competitors?

Fees are the first place to attack. This makes it hyper-competitive with other perp DEXs, but more importantly, with Binance, which handles most of the global trading volume.

Value In The Revenue

Forget the technicals or even the fundamentals.

Can we agree on two things?

- Total marketcap of crypto will exceed its ATH

- DeFi will outpace CEX

Based on this thesis, will a perp DEX like Vertex that offers all the advantages of both CEX and DEX grab significant market share?

I certainly think so.

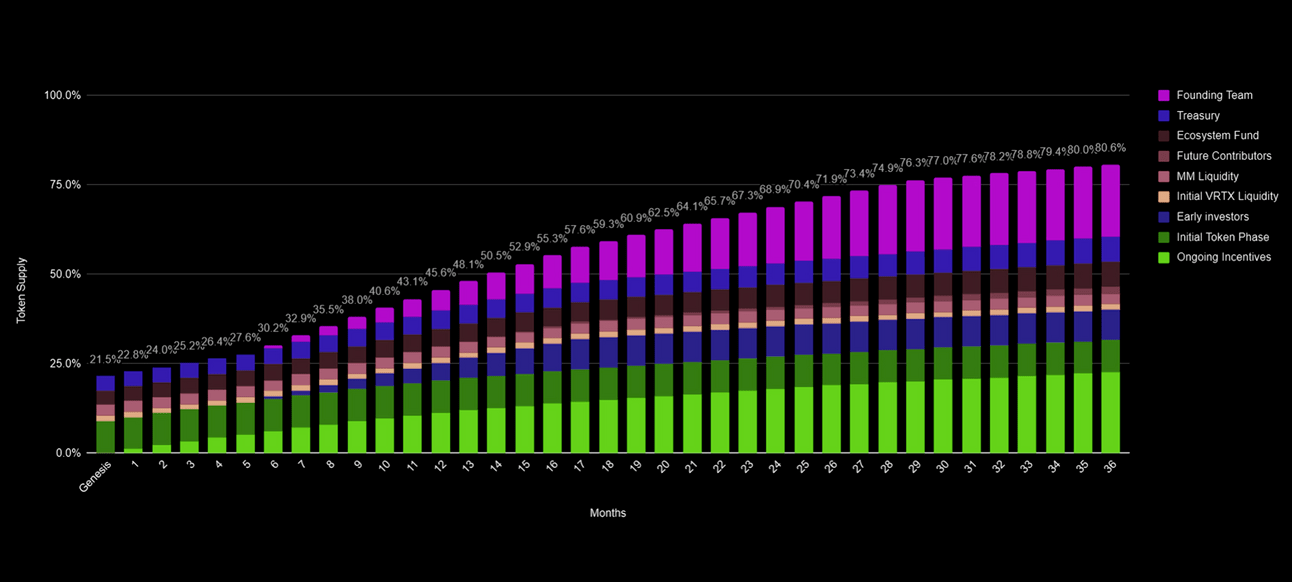

What about tokenomics?

90.08% of the 1 billion VRTX tokens are distributed over a period of five years.

- 33.5% of the total supply is reserved for the founding team, investors, and future contributors

- 37% of the total supply is reserved for ongoing incentives

- 9% reserved for the initial incentive program

- 8% will be directed to the treasury

- 8% directed to an ecosystem fund

Token distribution looks fair, with no significant one-off unlock events. There will be two derivatives of the VRTX token:

- xVRTX

- voVRTX

xVRTX is a staked version of VRTX, and the amount of VRTX one can redeem for each xVRTX increases over time as protocol revenue is generated.

voVRTX is both a governance token and fee token. Ideally, voVRTX will be used to encourage long term staking of VRTX and benefit those who are aligned with the protocol long term.

Ape Or Not

I know you rekt degens like to ignore the finer details.

So here are two ways to play it:

- Participate in the VRTX Incentives Program

- Betting on VRTX and stake for real yield

VRTX Incentives Program

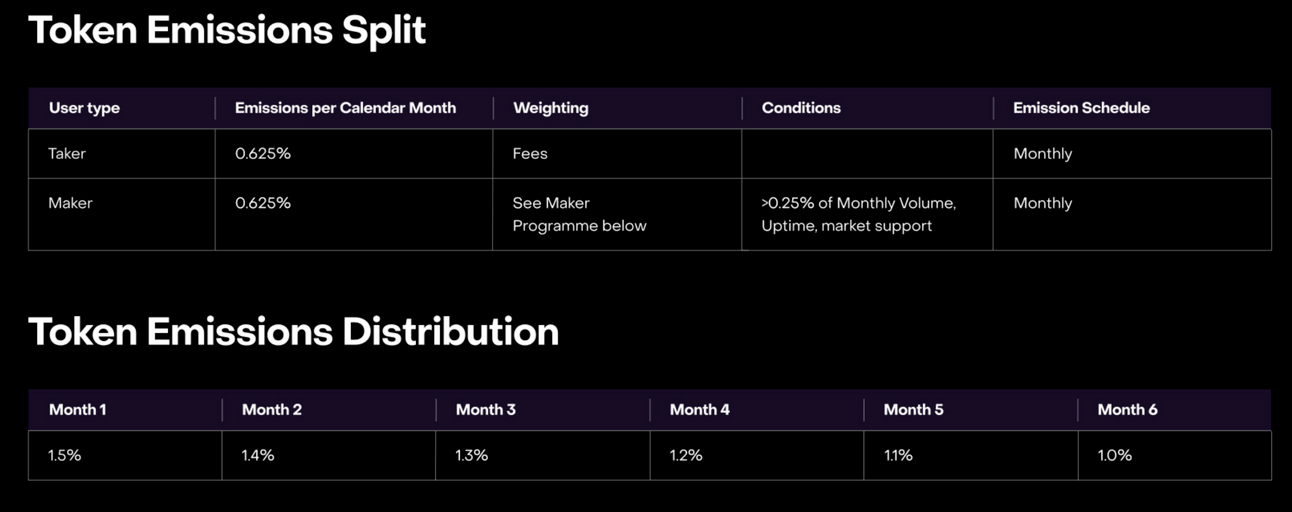

To incentivise early users, Vertex is distributing 9% of its token supply over 6 epochs, with each epoch lasting for 28 days.

Half of the 9% is reserved for market makers who provide liquidity in the orderbook, with minimum depth and maximum spread parameters to ensure they are providing good liquidity and not just spoofing the orderbook.

The other half is reserved for takers, or more commonly known as degens apeing market orders. The more fees a trader pays, the more tokens they will get. It’s that simple.

Having an easily understandable airdrop farming program could potentially spur a large amount of activity. We have seen how VELA’s beta program brought in millions of trading volume and that has continued after official launch.

Vertex is truly a superior trading experience, both in terms of the user experience and the low fees along with deep liquidity available.

Betting on VRTX

By focusing intensely on the user experience, Vertex could dominate the perp DEX landscape and even take on the big CEXs.

The low trading fees, low latency, cross-margining capability, and spot/perp markets make it competitive with a CEX offering. If there is one perp DEX that can attract volume from CEXs, Vertex is our best shot in a while.

Of course there are execution risks. Vertex will have to ensure that its risk engine executes liquidations effectively in black swan events. It will also need to generate a large amount of volume to sustain its tokenomics, given that its trading fees are so low compared to other perp DEXs.

The bullcase for Vertex would be:

Crypto total marketcap growth ➔ DeFi growth

DeFi growth ➔ More traders onchain

More traders onchain ➔ Bigger trading volume

Bigger trading volume ➔ Deeper liquidity & more fees

Deeper liquidity & more fees ➔ More traders + VRTX growth

There is a gap in the perp markets onchain right now.

Can Vertex fill this gap and possibly even take on the big boys?

If you want to help Vertex take on Binance, while farming some of that sweet airdrop during the initial token phase, be sure to use our referral link https://app.vertexprotocol.com?referral=OLuyVv8S9R for an extra 10% rewards boost.