Does the world need decentralised money? Between the incoming rise of CBDCs, increased government surveillance, and the centralisation of financial institutions, the case for decentralised money has never been stronger. One clear path to that is backing a stablecoin with ETH, one of the most decentralised tokens there is today.

In this article, we’ll dive into:

- The current stablecoin landscape

- How to design a decentralised stablecoin

- The decentralised stablecoin market

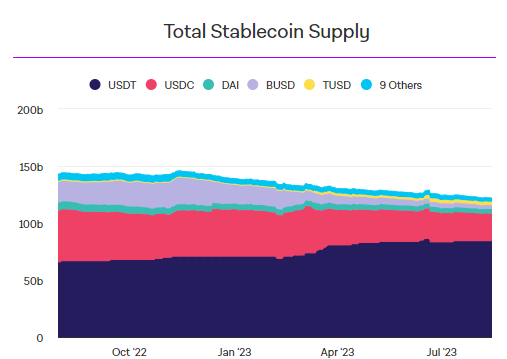

What Is The Current Stablecoin Landscape?

Today, stablecoins are perhaps the only crypto product to have found product market fit. With $120B in total supply, nearly $10T in onchain stablecoin transfer volume, and thousands upon thousands of users, stablecoins are here to stay whether we like it or not.

However, current stablecoins have some design flaws, mainly in that they are centralised. The two largest stablecoins, USDC and USDT, both rely on a centralised issuing party. You depend on them to custody the stablecoin collateral, to accurately mint new stablecoins, and be able to process redemptions on a whim.

Most importantly, these institutions have the ability to blacklist issued stablecoins, meaning that they could easily “freeze” your stablecoins, preventing you from transferring them to anyone else, or even any other smart contract. This is why we need decentralised stablecoins.

How Do We Design A Decentralised Stablecoin?

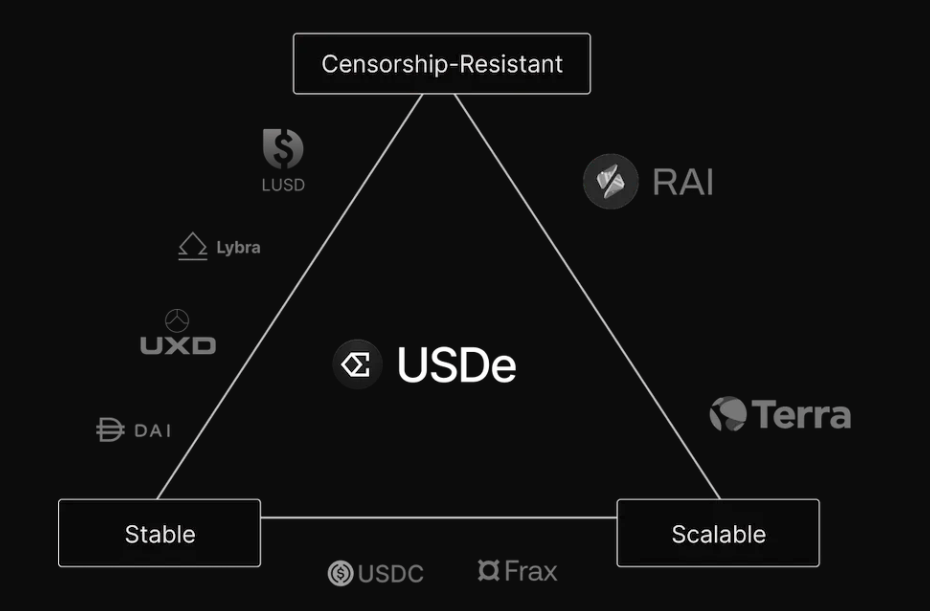

There are a few common ways to design a stablecoin. That is an algorithmic stablecoin, CDP-backed stablecoin, and fiat-backed stablecoin.

Fiat backed stablecoins are the ones we all know such as USDC and USDT, that are backed by US dollars. The US dollars are commonly used to buy treasury bills, generating interest revenue for the issuing company.

Alrogithmic stablecoins, as we know all too well, don’t really work. I’m sure we still have some PTSD from LUNA and UST so let’s not repeat that.

Lastly, there are CDP-backed stablecoins. The largest CDP-backed stablecoin is DAI issued by MakerDAO, with a current marketcap of $4.5B. DAI is backed by a mix of assets, including ETH, USDC, and RWAs. However, some of the collateral backing DAI is centralised, meaning that the underlying collateral can be frozen or confiscated, leaving it exposed to external forces.

A truly decentralised stablecoin has decentralised collateral. Which then naturally begs the question, what is the best form of decentralised collateral?

The optimal decentralised collateral has two main properties.

- Censorship resistant: Meaning that no one can freeze the collateral, prevent its transfer, etc.

- Scalable: Ideally, the collateral has a large enough marketcap to support a large stablecoin supply.

The ideal candidate for this is without a doubt, ETH, and more importantly, liquid staked tokens (LST). This is because an LST is a more capital efficient version of ETH that earns yield, so LSTs are fundamentally a better choice.

The Decentralised Stablecoin Market

Liquity

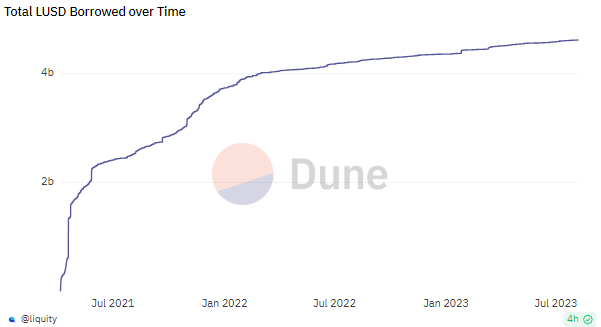

Liquity is a decentralised borrowing protocol that allows you to draw 0% interest loans against ETH as collateral. Rather than charging a constant interest, Liquity charges a small one-time fee to borrow and redeem its stablecoin, LUSD.

Today, Liquity is the largest ETH backed CDP stablecoin protocol, with $741M in TVL and $300M LUSD minted. To date, there has been more than $4B in LUSD borrowed, and the protocol has generated over $31M in revenue.

Liquity has its own governance token, LQTY. The token earns a pro-rata share of the borrowing and redemption fees in LUSD fees. However, Liquidity maintains its stablecoin peg through a stability pool. Users can deposit LUSD into the stability pool, which will be used to repay the debt upon liquidation, with the underlying ETH collateral being transferred to the stability pool.

Liquity is able to support up to a 110% collateral ratio, and in V2, the protocol will accept LSTs, offer a principal protection service, and launch a secondary market for hedging positions.

Lybra Finance

Lybra Finance is an omnichain LST backed stablecoin. It is an interest bearing stablecoin, with the interest being generated by the underlying LST. This makes it a lot more attractive than other stablecoins as it has an in-built interest, compared to, for example, USDC or DAI, which you need to lend out in order to generate interest.

Today, Lybra is the largest LST backed stablecoin, with $360M ETH/LSTs staked, and with $187M of its stablecoin, eUSD, in circulation. The protocol has paid out over $2M in yield to eUSD holders. In addition, unlike Liquity, there is zero mint/loan cost.

-

On Thursday, Coinbase Ventures announced an investment into Rocketpool. They purchased RPL tokens from the Rocket Pool team rather than from the open market.

-

Coinbase will then use ETH from their corporate balance sheet to operate several hundred nodes on the Rocket Pool network. How cool is that?

Lybra has a fairly high collateral ratio at 150%. Any borrower whose loan falls below a 150% collateral ratio will be liquidated, and after liquidation, the borrower’s debt is paid off, and he will only be left with collateral worth 110% of the reduced debt, meaning the liquidator gets 40% of the value of the repaid debt.

Prisma Finance

Prisma Finance is a non-custodial and decentralised LST backed stablecoin. Upon launch, it will support multiple LSTs, including wstETH, cbETH, rETH, sfrxETH, and WBETH. Users will be able to mint a fully collateralised stablecoin, mkUSD, against these LSTs.

Prisma differentiates itself by focusing on stablecoin liquidity. We all know that liquidity is the backbone of any DeFi protocol, especially for a CDP backed stablecoin that needs sufficient liquidity to incentivise stablecoin trading and efficient liquidations.

Prisma is backed by some of the largest players in the Curve war, including Curve itself, Convex, and Frax, who are all some of the largest veCRV holders that exist. This means that they will be able to drive a significant amount of emissions to the stablecoin, and users will be able to receive trading fees, CRV, CVX, and PRISMA on top of their ETH staking rewards.

Similar to Curve, the protocol will have ve-tokenomics, and voters can direct emissions towards minting with a certain collateral, keeping an active borrow with a certain collateral, or incentivise any LP token stakers.

Ethena

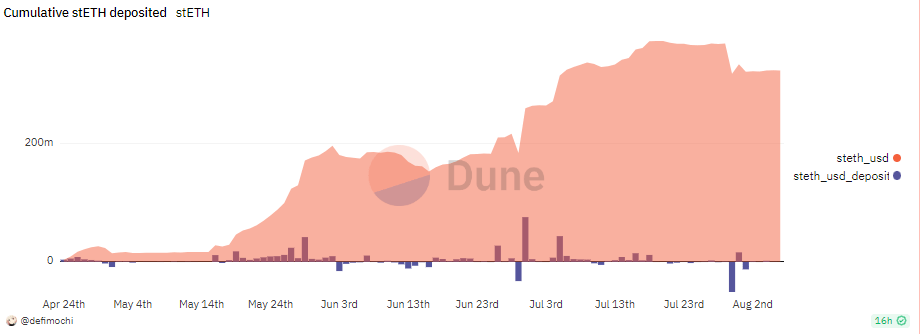

Ethena is a protocol that provides derivative infrastructure to transform ETH into a decentralised yield bearing stablecoin. Users can deposit ETH or LSTs as collateral to create its stablecoin, USDe.

However, unlike other LST stablecoin protcols, Ethena’s stablecoin collateral will be delta-hedged, which means the value of the underlying collateral does not change with market fluctuations in the price of ETH or LSTs.

This is achieved by hedging out the LST with ETH/LST perps. For example, if a user deposits 1 stETH, Ethena will accordingly short the required amount of ETH. They could do this by shorting an ETH perp on an exchange, or for example, they could short the stETH perp on Synthetix so there is no peg risk.

Inherently, this is much more capital efficient than LST CDP stablecoins, as those always have to be overcollateralised. This is in comparison to USDe which can be collateralised 1:1 given the delta-neutral nature of the collateral, and the fact that LST/ETH deposits can be used as collateral to short the ETH perps.

Conclusion

The name of the game in crypto right now is capital efficiency. In the face of high interest rates in tradfi, whoever can provide the highest capital efficiency with the highest amount of yield will be the winner. We see this trend play out across LSTs and restaking.

Decentralised money needs decentralised collateral. And the premier decentalised collateral today are ETH LSTs given the decentralisation of Ethereum the network, ETH the token, and ETH’s relatively large marketcap.

The design space is huge, but there will be a few things decentralised stablecoins will have to focus on. The first is risk management. The collateral risk will have to be managed effectively for a stablecoin to maintain its peg. Secondly, stablecoin is money. Decentralised stablecoin projects will need to increase the network effect of their stablecoin via improving adoption and expanding utility. Lastly, liquidity. A stablecoin or money is useless if I can’t swap it for goods/services/assets. Decentralised stablecoin issuers will have to ensure there is sufficient liquidity for a large amount of daily usage and volume.