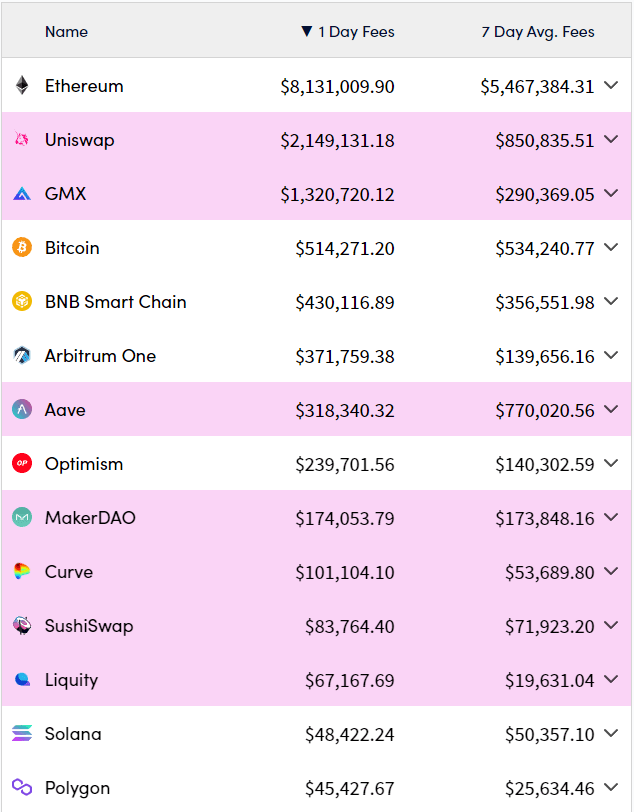

Ethereum is the backbone of defi.

It’s not even a debate.

Just watch the metrics and ETH’s growth potential is obvious in the next 5 years.

It constantly tops the daily fees generated of any onchain application.

But ETH continues to be a volatile asset and when the markets are rocky, where do crypto punters flee to safety?

Stablecoins.

What if you could hold on to your long term ETH bags because you believe in its growth potential?

Plus unlock its liquid value through stablecoins for yield?

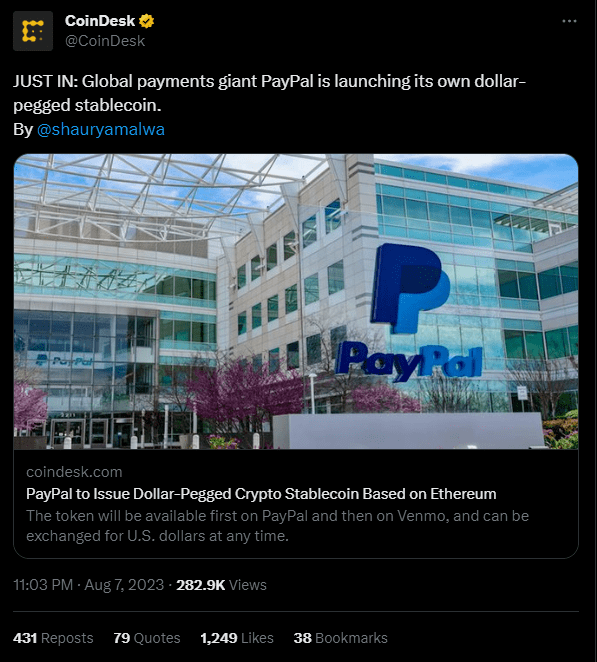

TradFi giants like PayPal see the value of stablecoins and the Ethereum network.

Are you going to fade?

Well then, let’s talk about Ethena, an innovative liquid staking token (LST) project that could unlock the true value of staked ETH.

The $120 Billion Headache

Stablecoins are not without problems.

We have seen current iterations go through their own rollercoasters like when UST and LUNA went bust.

Or when USDC and USDT depeg amid intense fud.

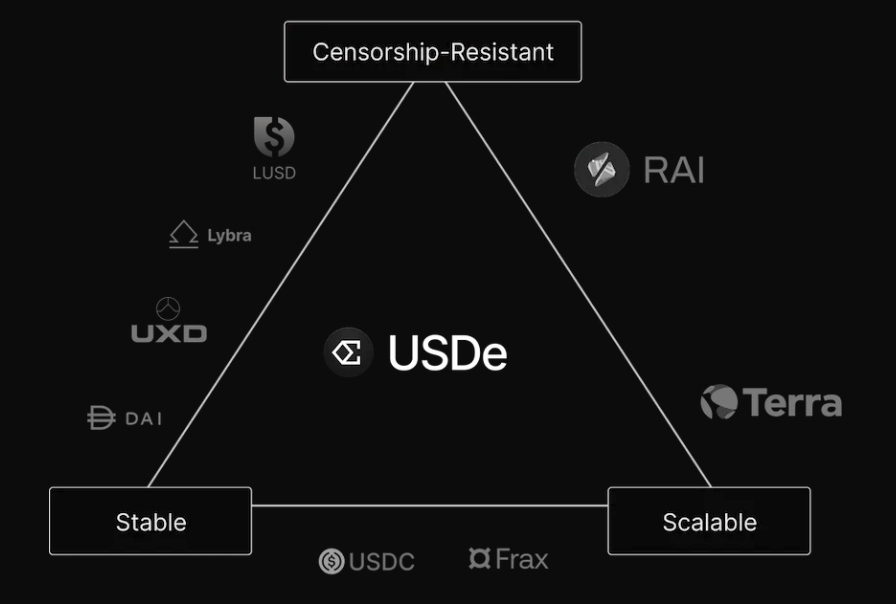

At $120 billion marketcap, stablecoins have to find a delicate balance between:

- Censorship-resistant

- Stability

- Scalability

What are they and why do they matter?

Censorship resistant

The stablecoin and its underlying collateral are free from control by a centralised entity. This means that anyone is always free to buy/sell/hold.

Stability

The stablecoin keeps its peg regardless of market conditions. Most stablecoins are pegged the US dollar. So $1 good. Below $1, no good.

A critical issue with many decentralised stablecoins is that their on-chain liquidity is thin relative to their marketcap.

Just have a look on Curve Finance.

Scalability

The stablecoin must be able to scale in multiple orders of magnitude to support mass adoption.

How do you design a stablecoin that has no tradeoffs between the three? Ethena may have found the optimal answer.

USDe – The Stable In Stablecoins

USDe is Ethena’s next generation stablecoin, designed to be decentralised, stable, and scalable while backed by delta-neutral ETH/LST collateral.

But how RektRadar? You just told me stablecoin issuers have to choose between the three. Well yes, to some extent, but one doesn’t have to sacrifice one for the other, which is what Ethena has achieved with their design.

How does USDe work?

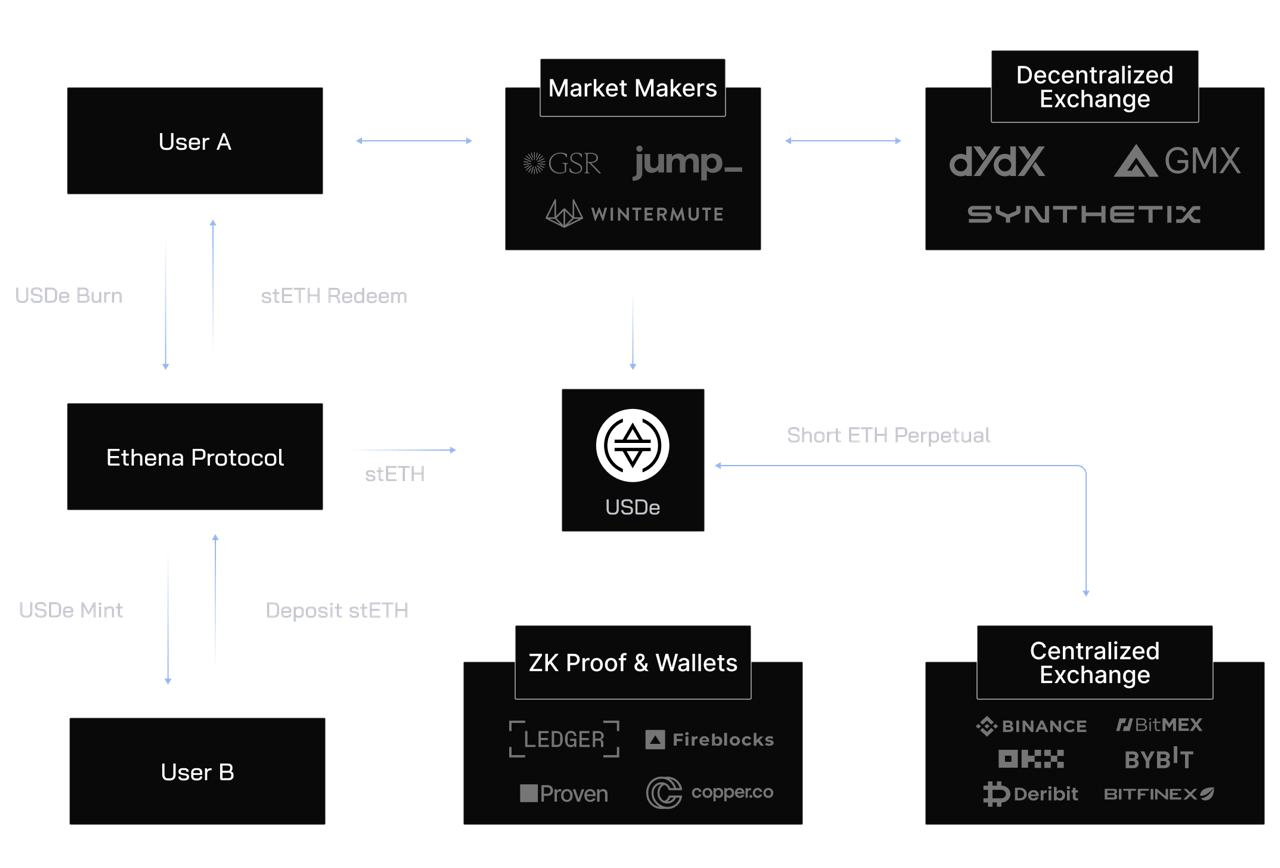

- User deposits ETH, an LST, or USD. The protocol then converts the deposit into an LST.

- The LSTs are then sent to a programmatic custody solution and held in secure MPC wallets.

- Next, market makers and offchain servers will execute an equivalent short of ETH-perp.

- The short will be executed through CEXs such as Binance and OKX or through DEXs such as dYdX and Synthetix.

- The spot ETH/LSTs deposits and the equivalent amount of ETH perp results in a delta neutral collateral (collateral value does not fluctuate with market prices).

- Yield is generated both by the intrinsic staked ETH yield and also by collecting the funding rate from the short ETH perp position (assuming the funding rate is positive for the perp).

Meet Your Liquidatoor

What makes USDe a superior decentralised stablecoin?

Fundamentally, having a delta-neutral collateral means that the protocol has less directional market exposure to a large extent. For example, for existing LST-backed stablecoins, the stablecoin collateral is purely spot LST positions.

This means that if ETH devalues, the stablecoin will be under-collateralised. This means that the protocol has to:

- run a complex liquidation engine

- allow only stablecoin minting

- be vastly overcollaterised with poor capital efficiency

For Ethena, there will be no leverage within the system, so you never have to worry about liquidations!

How does USDe work?

- User deposits ETH, an LST, or USD. The protocol then converts the deposit into an LST.

- The LSTs are then sent to a programmatic custody solution and held in secure MPC wallets.

- Next, market makers and offchain servers will execute an equivalent short of ETH-perp.

- The short will be executed through CEXs such as Binance and OKX or through DEXs such as dYdX and Synthetix.

- The spot ETH/LSTs deposits and the equivalent amount of ETH perp results in a delta neutral collateral (collateral value does not fluctuate with market prices).

- Yield is generated both by the intrinsic staked ETH yield and also by collecting the funding rate from the short ETH perp position (assuming the funding rate is positive for the perp).

Next, there’s an opportunity cost to holding money and any investment opportunity has to be worth it relative to that opportunity cost. In TradFi, this is known as the risk-free rate, which currently stands at ~4.15% if you use the 10 year treasury yield.

Crypto has historically skewed towards a positive perp funding rate due to a demand for leverage on the upside.

Average OI weighted ETH funding rate

- In 2021, it was 16%

- In 2022, it was -0.3%

- In 2023, it is 8.3% to date

Comparatively when using ETH as a collateral, stETH staking APR stands at ~3.8% today.

What does this mean?

Rather than generating 3.8% on your ETH, USDe would generate higher intrinsic stablecoin yield thanks to its delta-neutral perp position generating 8.3% yield from funding rates (based on historical averages).

This makes it inherently more valuable compared to other decentralised stablecoins.

Solving DeFi Problems With TradFi Solutions

Ethena’s motto isn’t “Enabling the internet bond” for no reason.

Other than building the premier decentralised stablecoin of the future, Ethena will be launching other 3 other products:

- Internet BondsInstead of using a perpetual swap to hedge the ETH exposure, Ethena could also hedge it out using dated futures. These would create bond-like products with fixed returns instead of a variable return.

- Repo FinanceWhen the cost of borrowing is lower than the potential yield generated on what you are borrowing, there is an opportunity for an investor to use leverage to enhance their returns. Similar to how you use a mortgage to borrow, become a landlord, and hope your rent from tenants pays off your mortgage. Ethena could utilise the same mechanics to provide investors leveraged returns on their US dollars and LSTs.

Digital Golden Age Generations In The Making

After decades of capital growth in real estate and stocks, fueled largely by low interest rates and quantitative easing. The US M2 money supply (a commonly used measure of the total money supply) has ballooned to $20.89T. Trillion with a T. Given that the current stablecoin marketcap is only $120B, the total stablecoin market could grow by more than a hundred times before it hits the upper limit.

Is that going to happen? Obviously not. But it does show the potential growth of the market and the opportunity ahead. Ethena estimates the immediate stablecoin opportunity to be roughly $10B.

In addition, the US treasury market stands at $25.1T today, while the global bond market totals $133T. The opportunity is immense, and if Ethena is able to capture even a fraction of this, it could potentially be one of the most profitable crypto applications to exist.

Today, ETH’s marketcap is $222B, a farcry from the total US dollar money supply of $21T. As ETH is the second largest crypto asset by marketcap, and likely the most decentralised. Overtime, as crypto grows and institutional adoption increases, one can expect the marketcap of ETH to exponentially increase, and for Ethena to potentially integrate other forms of decentralised collateral.

A Rising Tide Lifts All Boats

Alright, let us all stop daydreaming for a second.

Let’s talk about facts based on history.

Because history repeats, right?

Would BTC ETF bring forth a wave of liquidity for crypto?

And if BTC marketcap grows, it would be safe to assume ETH will follow. It could probably outperform BTC in altseason because decentralised money needs decentralised collateral.

The opportunity and mission is clear. A decentralised financial system doesn’t work without decentralised money, and Ethena is possibly a good bet to achieve the goal of stable, scalable, and censorship-resistant money.

Now I mentioned stablecoins were a $120 billion headache at the start.

But it really is a $120 billion opportunity.