A weekly recap of the largest crypto events and narratives, with an extra dose of insight.

Here’s what we have for you:

-

Grayscale decision impacts the markets

-

Aerodrome goes live

-

Zeroliquid launches with no liquidation loans

-

HOLA goes hola at me

-

HMX vs GMX battle, a clear winner

On Tuesday morning, a three judge panel sided with Grayscale against the SEC. This was a result of a year long legal battle where Grayscale claimed that the SEC had approved various Bitcoin futures ETFs but not Grayscale’s proposed products. As a result of this, Grayscale will now have to review Grayscale’s application again.

On the back of that judge decision, BTC ended up 6% on the day, and COIN ended up 15%. The COIN move was likely due to an increased probability of a spot BTC approval, of which Coinbase will act as the qualified custodian for almost all ETF providers.

In the crypto markets, JOE is up almost 30% on the day, while Vega, an innovative derivatives protocol is also up double digits on the week. Notable memecoins such as BITCOIN (Happy PotterObamaSonic10Inu) and XRP (HarryPotterObamaPacMan8Inu) are on the decline, perhaps as capital rotates to farm a few large launches such as Aerodrome.

As far as catalysts go, we do have a few spot Bitcoin ETF approvals that are due for the end of this week, including WisdomTree, Invesco, ARK, and more. However this is the first deadline, and the SEC can easily delay these decisions to future deadlines. However, the entire market is probably trading based on spot Bitcoin ETF approvals right now so I would watch them like a hawk.

-RektRadar

We have liftoff. On August 30th, Aerodrome launched on Base. It quickly became the protocol with the largest TVL on Base. By the end of launch day, it had $27M in TVL. By the time I woke up the next morning, the protocol had garnered $175M in TVL. I don’t think I’ve seen a protocol gain such an astounding amount of TVL in such a short amount of time in the current market conditions.

Just one day after launch, it has generated more than $100K in fees, and attained almost $20M in trading volume. There are currently 31 tokens listed, and the largest liquidity pool is a WETH/USDC pool with $62M in liquidity.

There is a huge amount of incentives being directed to the AERO/USDC pool right now, and with a 2% trading fee, means that liquidity providers are getting a 1,682% APR as of Thursday.

Unibot and UniDEX have all joined the Aerodrome party, and it looks like even before the week has ended, Aerodrome has solidified as THE place to launch your protocol’s liquidity pool. We think the party is just getting started.

HOLA Is Printing

-

HOLA is a seller of crypto marketing services. They help new protocols get market maker packages, listed on CEXs, appear on sites such as CoinMarketCap, and more.

-

It just broke its single day profits record of $14,500, now coming in at $17,250. You may think that isn’t much, but annualised, that is >$6M, with the token $HOLA trading at a $4M mcap.

ZeroLiquid Launches Liquidity Mining Scheme

-

ZeroLiquid is a protocol that offers self repaying, 0% interest, non-liquidation loans for LSDs. One of the drawbacks of LSTFi protocols are the liquidations, so ZeroLiquid is changing the game here by offereing synthetic tokens which are ETH derivatives.

-

They have just launched liquidity mining rewards for zETH (their ETH derivative). The APR is dynamic and currently sitting at >500%. Keep an eye out for additional incentives that may be coming soon!

Prisma Finance Goes Live

-

Prisma Finance, an Ethereum LST-backed stablecoin is live. With a strong focus on liquidity, the protocol has acquired and locked 2M CRV, ensuring that there is deep liquidity for their stablecoin, mkUSD, from day one. In a few short hours, they have already managed to reach $20M in TVL.

-

Liquidity ensures the strength of a peg. The more liquidity there is, the stronger the peg. And from day one Prisma will be working with DeFi heavy hitters such as Curve, Convex, and Frax to drive the most liquidity incentives to their gauges.

-

Go and farm some AERO on Aerodrome, or at least understand what the ecosystem is about

-

Figure out yield trading on Pendle’s new RWA pools

-

Akash mainnet is live. I don’t need to tell you what GPU demand looks like right now for AI.

-

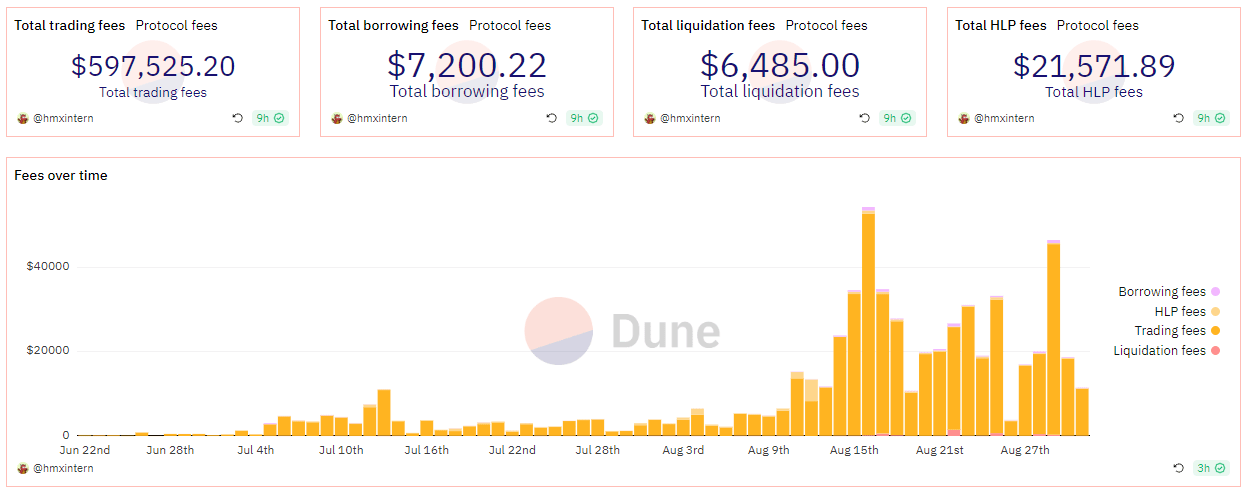

HMX OI consistently increases on the back of increased volume. Some alpha below for you.

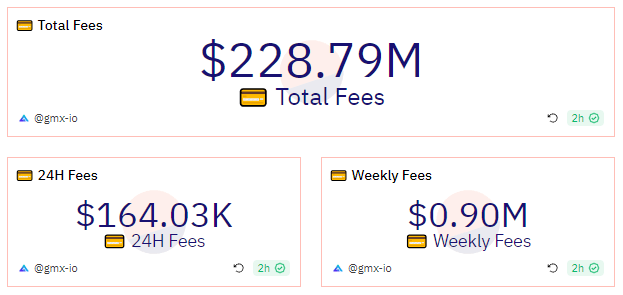

GMX vs HMX, clash of the Arbitrum perp DEXs. How do we evaluate which is the better buy? Data. Always check the data.

HMX is a new perp DEX that launched its public open beta slightly more than 60 days ago. While GMX is the first perp DEX that gained meaningful traction in crypto, and to date, is still one of the largest perp DEXs.

One vital metric for a perp DEX is its fees to market cap ratio. This basically takes the annualised fees for a perp DEX, and divides it by its current market cap. The higher it is, the better, because it means that token holders are receiving the most yield relative to how much the token is worth.

Protocol revenue is data, and data is public. Eventually, the protocol revenue that grows while the protocol grows will be reflected in the token price.

The above picture shows GMX fees. If we take the weekly fees and multiply it by the number of weeks in a year, 52, we get $46.8M in annualised fees. We can then divide that by GMX’s market cap of $340M. With that, we get $46.8/$340 = 0.13x.

We can then do the same exercise for HMX.

Let’s say on average HMX generates $20K in fees per day, which it looks like it already is if you take the average. Then you can multiply that by 365, and we get $7.3M in annualised fees. We can then divide that by HMX’s market cap of $13M. With that, we get $7.3/$13.1 = 0.54x.

Comparing 0.54x to 0.13x, we can see that HMX token holders can expect four times more fees for every dollar of the token they hold. Another way of thinking about this is HMX is four times as undervalued relative to GMX Either way, HMX is vastly undervalued, and when the market eventually realises that, token price will catch up to follow the fundamentals.

Using a single data point, we have determined that HMX is vastly undervalued. Bullish data. Bullish HMX.

HMX stats on the uptrend as the no.1 derivatives platform on Arbitrum

Some fasinating stats about @HMXorg

– No. 1 derivatives platform on Arbitrum

– Did over $1.4b volume in two month

– No. 5 biggest derivatives platfom by 24hrs volume

– Currently $19M in TVL & $673K in fees

– $HMX listed on @stellaxyz_

– Has lowest fees compared to GMX & Gains… pic.twitter.com/ruL8Btoevh— Viktor DeFi 🛡🦇🔊 (@ViktorDefi) August 28, 2023

Supported by resdegen with LPs making money as traders lose

These are 2 bullish charts for $HMX

1) OI consistently trending higher. Currently $35M, close to ATH

2) Traders’ PnL negative: LPs making money

They also just launched their mobile app for everyone and ref links are coming soon, which should give it another push pic.twitter.com/P0WPXaljgc

— Res (@resdegen) August 31, 2023

Lybra V2 goes live

Today marks an incredible milestone for $LBR as it migrates to Lybra V2

– Omnichain compatibility

– Lybra War

– Multiple LST collateral

– DAO governance

– Token BurnThis is just the start of a new beginning for @LybraFinanceLSD https://t.co/wA22b4T12N

— Caff (@ChadCaff) August 31, 2023

Pute_AI . An AI utility hub

🤖https://t.co/J2B3cHVu2L | $PUTE ~ The ultimate AI utility hub-spot, designed for crypto enthusiasts.

Let’s get familiar with the tool-suite that https://t.co/J2B3cHVu2L delivers!

🧵A thread on the currently available AI tools: pic.twitter.com/tEvQKQnys6

— 🤖pute.ai | $PUTE (@Pute_Ai) August 30, 2023

$BAG revenue share is just getting started

#tehBag revenue share is just getting started!

Despite teh market sentiment, and despite the decline in teh number of new launched projects – $BAG‘s revenue keeps going up!

Soon you’ll be able to see teh $ETH APY for your staked $BAG.

Can you imagine what shall happen when… pic.twitter.com/50ixUsaN9Q

— teh Bag – $BAG (@teh_bag) August 30, 2023

Low cap tokens you should be paying attention to

Staying up-to-date with trending tokens is hard😣

That’s why I curated hot tokens for you🔥

Here are 10 low-cap tokens that have high interest from on-chain traders👇 pic.twitter.com/qOSUlGTJiP

— Nikyous (@CryptoNikyous) August 31, 2023

WINR catalysts coming soon

100% agree with @thewolfofdefi about @WINRProtocol $WINR catalysts ⬇️

Some of them are closer than many think👀

Truly decentralised casino with new popular games coming soon, 1000x leverage and own chain at slightly higher 4M MC 🔥

Hmm…how undervalued is that? 10x? 100x?🤔 https://t.co/hNqNYNZRiO pic.twitter.com/UdARgGU6qP

— Crypto Andrew ✍️🧠 (@Crypt0_Andrew) August 31, 2023