A weekly recap of the largest crypto events and narratives, with an extra dose of insight.

Here’s what we have for you:

-

Base transactions goes brrr

-

SSV mainnet goes live

-

Arbitrum and Espresso’s shared sequencer partner up

-

Synapse launches its interchain network

-

Points

-

LayerZero, why do they need Google

Remember PYUSD, PayPal’s big stablecoin? Today, it has $45M in outstanding supply, with roughly $3.7M minted in the last thirty days. A few days ago, PayPal announced that PYUSD will now be available on Venmo, one of the most used financial payment apps in the U.S. This may not seem like big news, but to me, it is vital that the next generation of users don’t even know that they are interacting with blockchain technology. The more that is abstracted away, the better.

Nansen had a third-party security breach where 6.8% of users had some form of information leaked. Some users had their login email and password leaked, and a small subset of these users had their blockchain addresses leaked too. Not great. This is an obvious use case of crypto, to use ZK technology so that your personal information never has to be stored on a centralised database, and can be retrieved without revealing the underlying information.

I’m not sure if we have any K-pop fans here, but without exposing myself as an avid K-pop watcher (no one asked but my favourite group right now is G-Idle), South Korea’s Dreamus has debuted NFT tickets for K-pop concerts. Once again, this probably seems gimmicky to you, but these NFTs are integrated directly into SK Planet’s loyalty app, OK Cashbag. Once again, crypto users should not realise they are using crypto.

-RektRadar

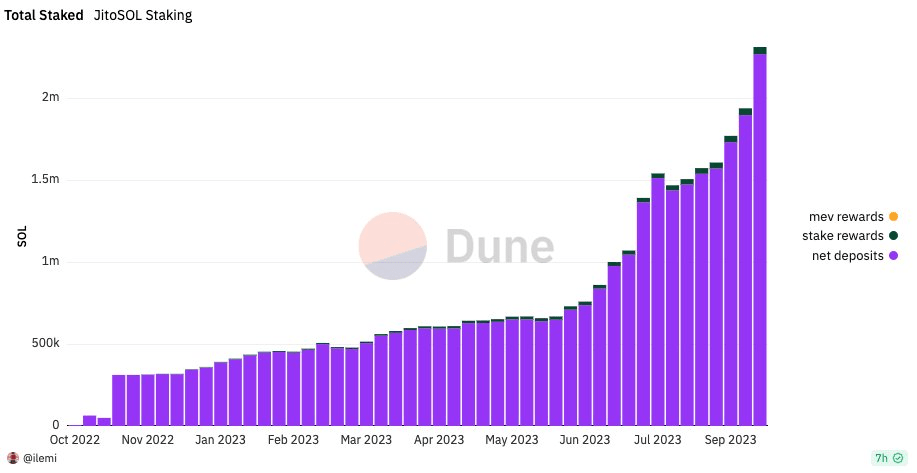

Liquid staking is going parabolic on Solana. JitoSOL is a liquid staking protocol on Solana, where depositors can stake SOL with MEV-optimised Solana validators. That means that stakers receive both SOL issuance and MEV rewards. Jito recently released a points program, so expect to see total SOL staked continue its parabolic increase. Interestingly, much of the SOL staked has come from multi-sig wallets and stake accounts, perhaps signifying that delegated stakers are entering liquid staking.

With the rapid rise, Jito has released a new product, $LST. Yes, the ticker stands for liquid staking tokens. This is a collaboration between MarginFi and Jito, where $LST holders will receive rewards from MarginFi’s validators running Jito’s MEV client. Expect to see more collaborations in crypto as the competition, especially in the liquid staking space, heats up. $LST has a 0% commission, which is rare for a liquid staking token.

I mentioned points programs are the new airdrops; they are evidently working on Solana. Other Ethereum protocols, such as friend.tech and post.tech, with their own points programs that are also doing fantastically.

BASE Token Not Ruled Out Entirely

-

We are so back. Coinbase’s Chief Legal Officer, Paul Grewal, said that a BASE token has not been ruled out entirely. This is in stark contrast to when Base was first announced, and the team vehemently stated that there would never be a token.

-

If a BASE airdrop does occur, I fully expect it to be one of the largest airdrops in history. Coinbase’s stock currently sits at a market cap of $17B, and I think one could expect BASE to be a non-trivial % of the stock’s market cap.

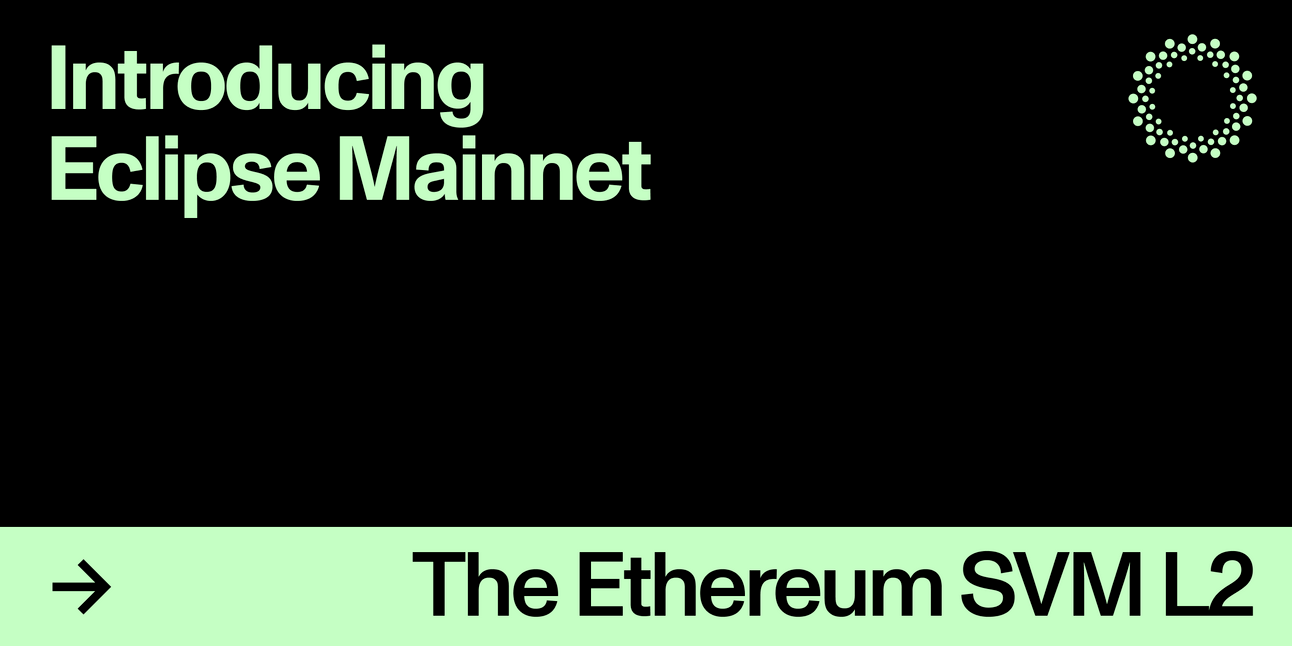

Solana On Ethereum. What.

-

Last week, Eclipse announced its mainnet architecture. The network would use Ethereum for settlement, the Solana virtual machine for execution, and Celestia for data availability.

-

With this modular stack, Eclipse gets the best of multiple worlds. Ethereum for all its liquidity and existing network effects, Solana for its isolated fee markets and parallel execution so you don’t experience ridiculously high gas fees when there’s a popular NFT mint, and Celestia for its super cheap data availability.

KWENTA Staking Goes Live

-

KWENTA staking goes live. Users can migrate their staking positions, but before you do so, don’t forget to claim your final V1 rewards and register your V1 entries and vest your V1 escrow. Anyhow just read the Twitter thread; they do a better job of explaining the process.

-

With V2 staking, users can now transfer v2 escrow entities without vesting, there’s now an unstaking cooldown period, and there’ll also be an early vest distribution along with significantly improved UX.

Who wants incentives? Cue Finding Nemo, me me me me me.

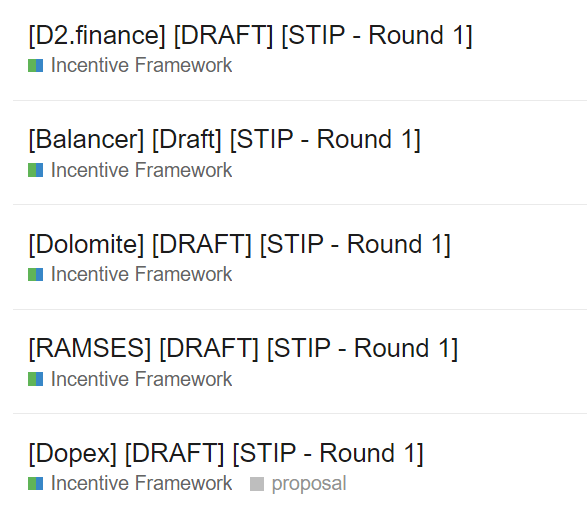

Following the successful DAO vote to distribute ARB as part of short-term liquidity incentives, 50M ARB is now up for grabs. There are four different categories: Beacon grants for up to 200K ARB, Siren grants for up to 750K ARB, Lighthouse grants for up to 2M ARB, and lastly, Pinnacle grants for more than 2M ARB.

These grant categories have different requirements, such as having a certain amount of TVL or volume. For example, the Pinnacle grant category requires a TVL of $30M or a thirty-day cumulative volume of $200M for the past twelve months. So, getting these grants is certainly no easy feat.

As one can see from the image above, a huge number of Arbitrum protocols have already put their foot forward, including Thales, Frax, Wormhole, SpartaDEX, Magpie, Gamma, Dopex, and Dolomite. The list goes on.

From a trading perspective, I think protocols receiving 2M or more ARB could have some potential token upside. I would look out for protocols with solid plans on how to use the incentives and a low market cap relative to the amount of ARB they receive. For example, Aura Finance currently has $23.5M of TVL on Arbitrum, while their token only has a market cap of $28M. They would currently be eligible for a grant of up to 2M ARB, which would be worth ~$1.64M at current prices.

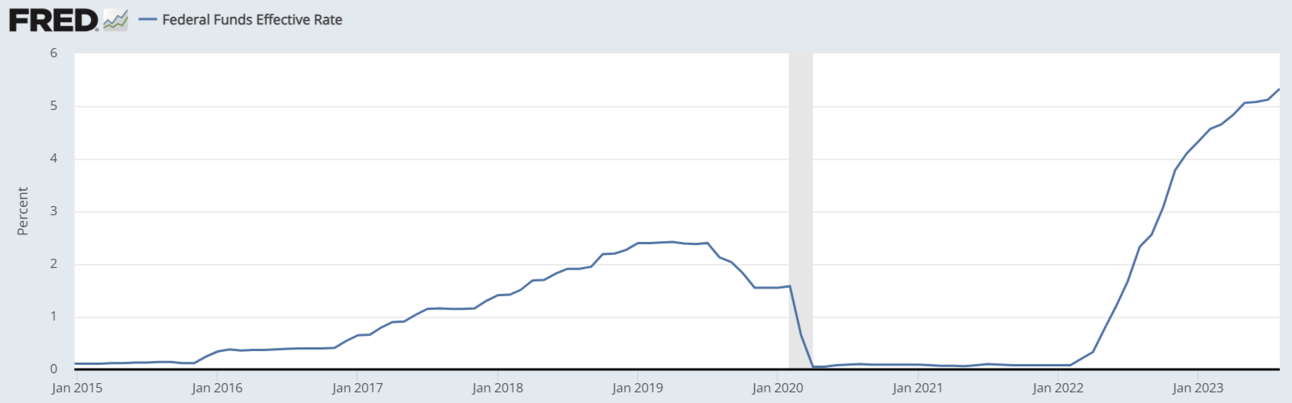

Jerome Powell Please

Last week, the Fed decided to leave the reserve rate unchanged at 5.25-5.50%. If you listened to the ensuing Q&A, Jerome stated that the Fed will continue to proceed carefully multiple times, which is good. You definitely don’t want the Fed overreacting like your ex did.

According to the CPI, August’s inflation rate came in at 3.7%. However, that is still way above the Fed’s inflation target of 2%. It seems like interest rates will stay higher for longer.

What does that mean for crypto?

A high-interest rate is bad for crypto. It means that the cost of borrowing is higher, and, most likely, that investors are not deploying capital into risk assets, of which crypto is the riskiest. With higher interest rates, investors require higher returns on their investments, as they can now receive nearly 5.50% on US treasuries.

On the other hand, a high-interest rate environment is great for protocols that are integrated with RWAs. For example, onchain tokenised treasuries have been doing fantastic since the start of the year, as people much prefer the 5.50% on a tokenised treasury product over the 2-3% you get by depositing a stablecoin on AAVE.

I’m sure we would all love to see Jerome Powell nuke interest rates to zero, and we get on with the bull market. However, that would also mean that whatever bullshit price increases you saw in the supermarket/grocery store would worsen as inflation would likely make a comeback.

Unfortunately, we all still have to pay attention to the macro picture.