Telegram bots are all the rage right now. With UNIBOT hitting an ATH of $150m marketcap, the telegram bot narrative is in full swing with new competitors and copycats popping up daily.

In this article, we’ll dive into:

- What they are

- Current meta

- Top movers

- Upcoming bots

- RektRadar’s take

What Are Telegram Bots?

With 55m daily active users, Telegram represents an untapped ocean for web3 projects. Telegram bots were developed to enhance the social experience by allowing you to play games, get buy notifications, or even interact directly with the blockchain.

Ever since DefiLlama reported Maestro sniping bot’s huge daily revenue. There has been an arms race to build the best sniping tool.

For the average crypto native, interacting with Uniswap is painful. From slow swap confirmations to getting frontran by MEV bots, the market is screaming for a solution.

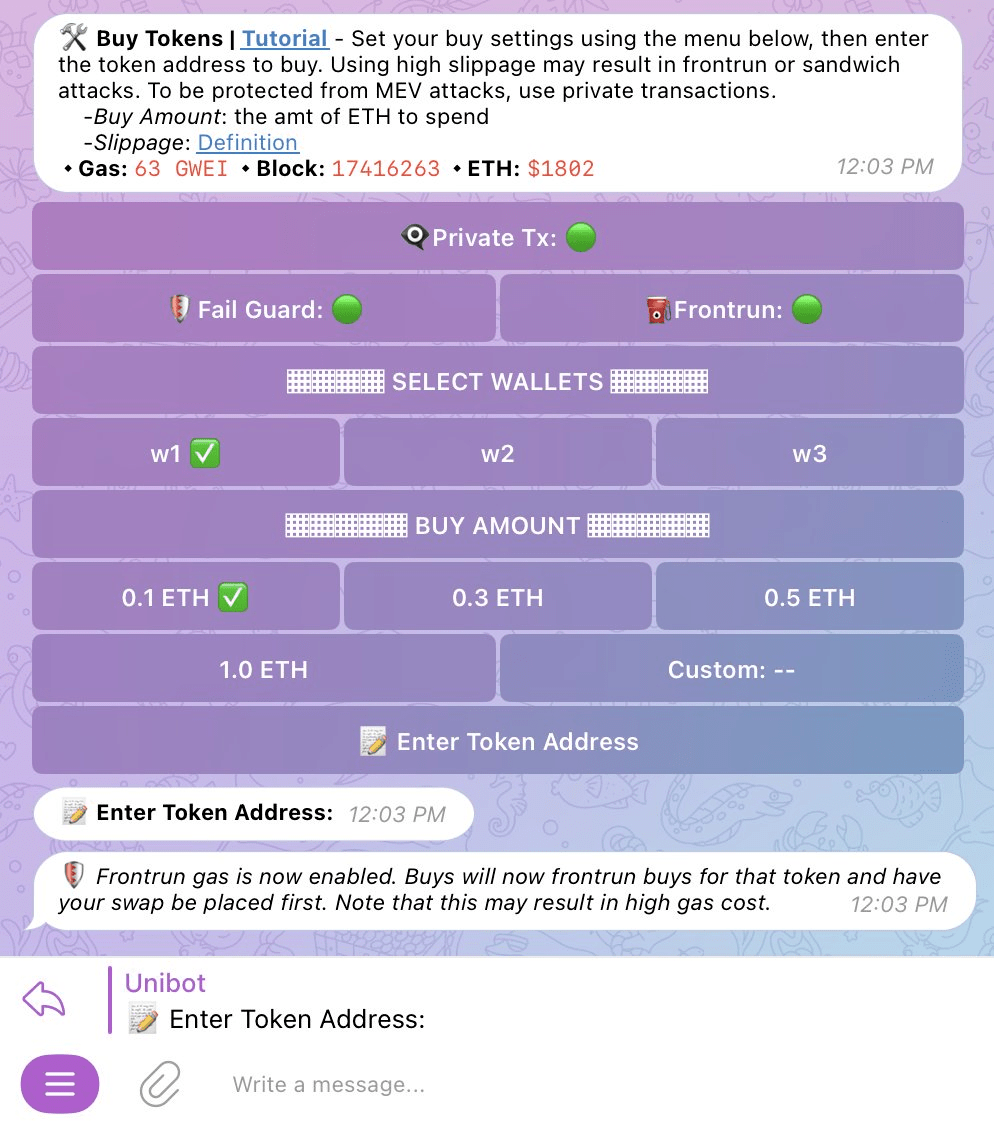

A telegram bot allows users to swap with low slippage at lightning speed without getting sandwiched by bots.

Have you ever tried to be the first to buy a memecoin, only to watch it 10x by the time your swap fails on Uniswap? You’re not alone.

Telegram trading bots solve that problem with a few unique features:

- Limit Orders – Execute your trades at price triggers so you never miss dips

- Mirror sniper – Copy-trade and front-run smart money wallets

- Private transactions – Anti-MEV swaps so you don’t lose 5% of your trade to sandwich attacks

- Tx simulation – Predict if transactions will go through before they go onchain

The speed of these snipe tools provides a real edge over any virgin Uniswap user.

Like all things in life, there is a price.

Using a Telegram trading bot means it has access to your private keys, which means you no longer have complete control over your assets. However, for many users, that risk is well worth the edge.

Why Now?

In May 2023, we saw the craziest memecoin trading for the past year. Billions in trading volume across the largest tokens like PEPE, MONG and TURBO.

While degens were fighting for the best entries, they were getting sandwiched relentlessly by MEV bots which squeezed out millions of dollars from daily trading volume.

Here’s how an average user would be trading.

- Open up DEXScreener

- Copy the token address into Uniswap

- Set a high slippage so transaction goes through

- Approve token buy

- Wait for the approval

- Confirm your swap transaction

- Swap transaction is executed

I don’t know about you but that screams idiotic.

What about using snipe bots? Enter the token address. That’s literally it.

Oh you wanted to go to bed after sniping? Set limit sells so sell orders will trigger for you while you sleep.

Can’t find profitable trades? Simply copy-trade a profitable wallet address.

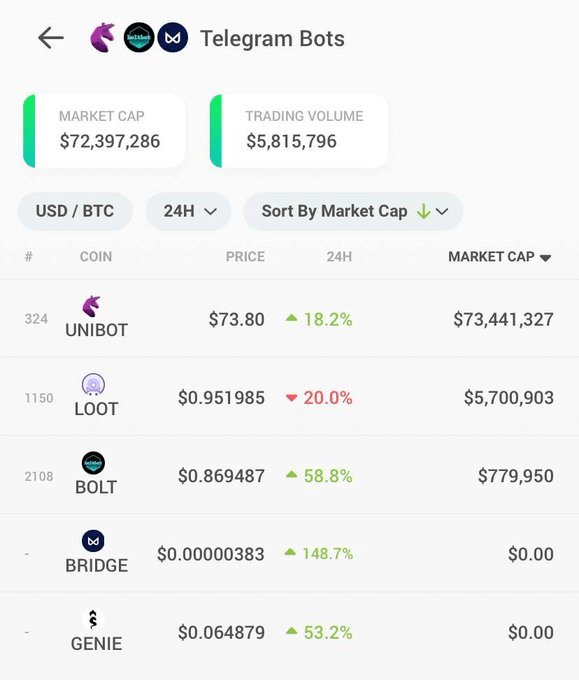

In fact, it’s such a popular category that CoinGecko has made an entire category dedicated to it.

Sector Incumbents

Maestro

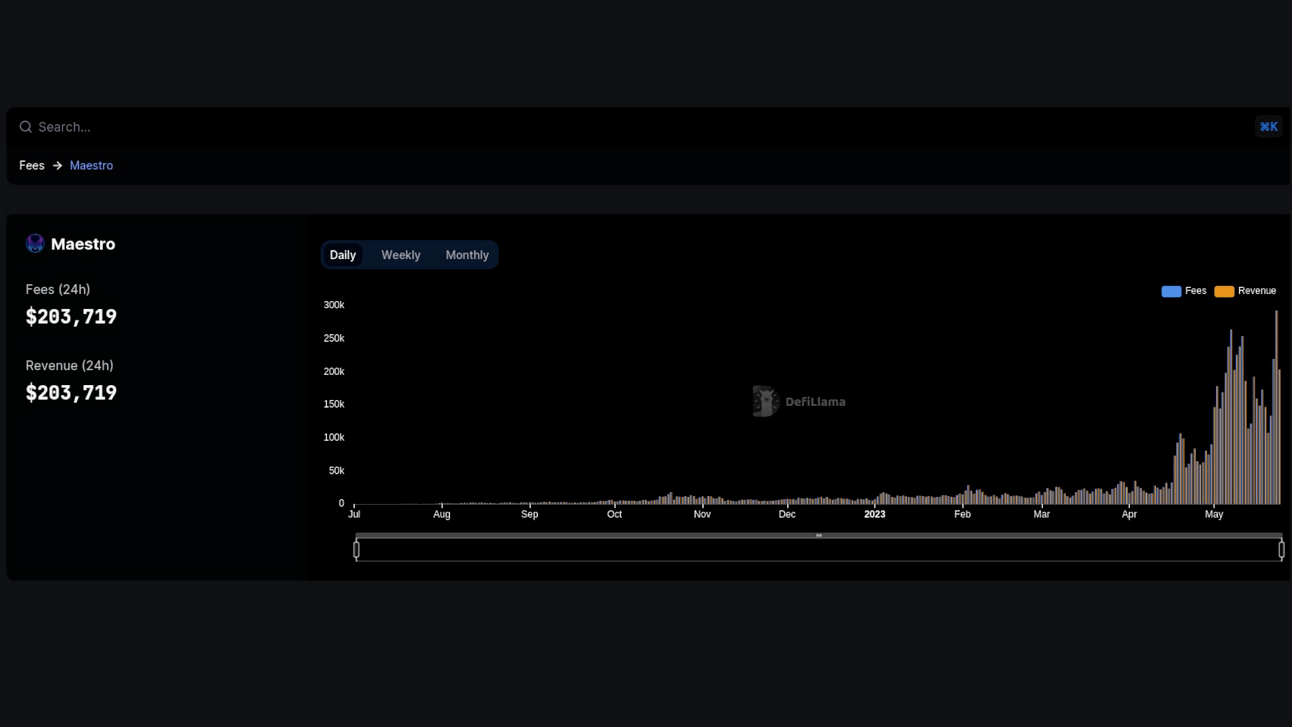

Maestro is one of the earliest telegram bots. Launching in July 2022, it has been live for roughly a year.

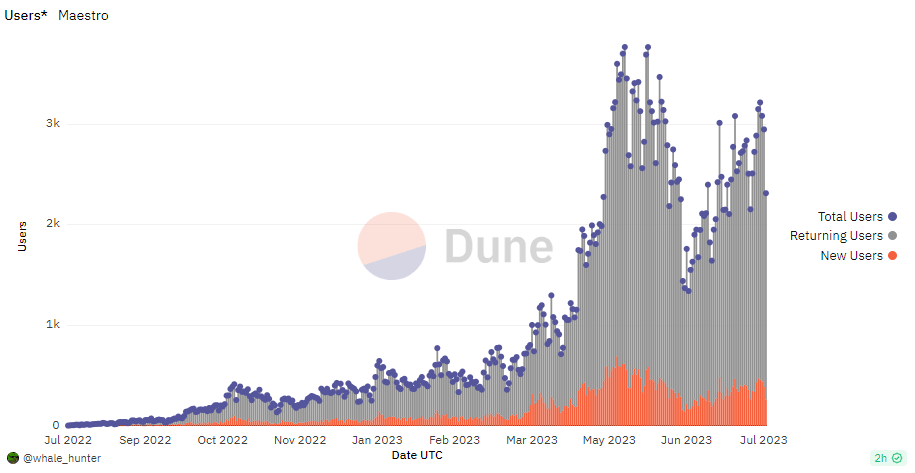

Over that time, it has managed to gain 3,000 daily active users and has cumulatively generated 8,411 ETH and 1,334 BNB in fees. As seen below, growth in Maestro really accelerated in late April/early May of 2023 when PEPE took off.

Maestro has a plethora of features, including:

- Whale bot (receive instant notifications on whale transactions)

- Wallet bot (smooth wallet tracking in with blazing fast price alerts)

- Buy bot (monitor buys, sells, and price changes for tokens)

- Lightning fast sniper bot

Even though Maestro has the largest daily active users (DAU) by a wide margin, it doesn’t have a token.

Unibot

Enter Unibot, which is what Maestro would have looked like with a token.

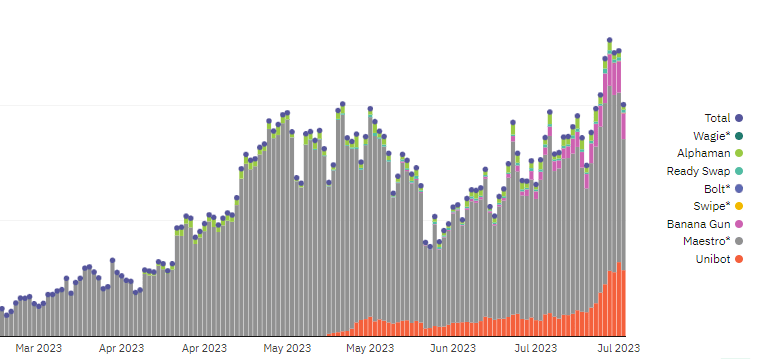

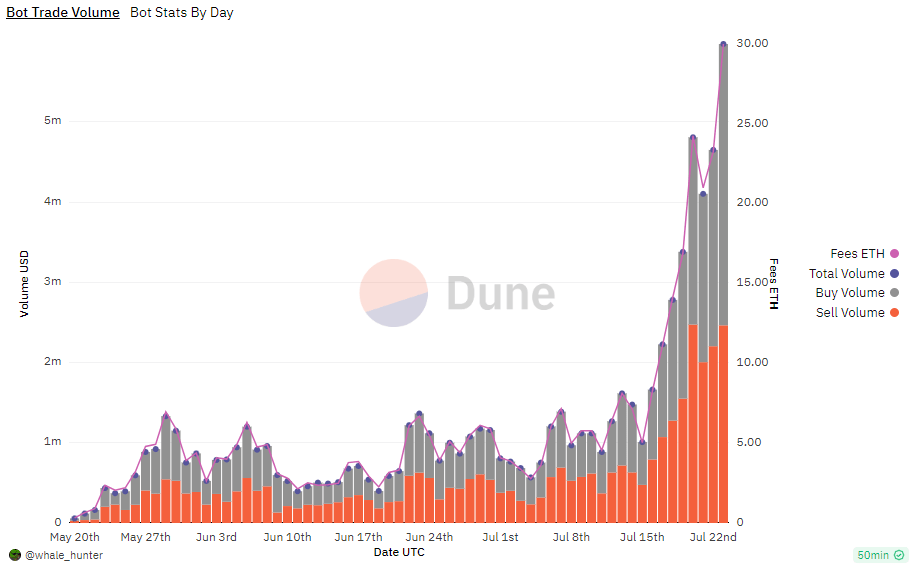

Averaging at 1,200 daily active users, Unibot is still behind Maestro by a margin. However, trade volume on Unibot has gone vertical. The bot now averages $3.3M in daily volume with 17 ETH in fees generated. In total, the bot has 385.1 ETH in fees. (see chart below)

Unibot’s token, UNIBOT, currently has a 5% buy and sell tax. However holding more than 50+ UNIBOT tokens gives you a discount on trading fees, and entitles you to a revenue-sharing agreement. If eligible, Unibot holders will get 40% of all transaction fees and 1% of all trading volume.

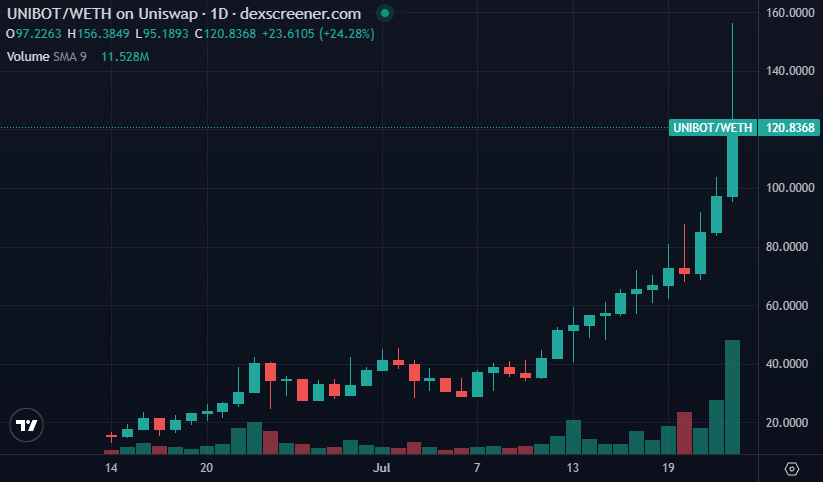

The revenue share incentive along with its successful referral program has taken UNIBOT to new heights as it currently trades at a $120M FDV.

Are You Too Late?

So if Maestro is tokenless and Unibot’s token is already trading at a $120M FDV, are you too late?

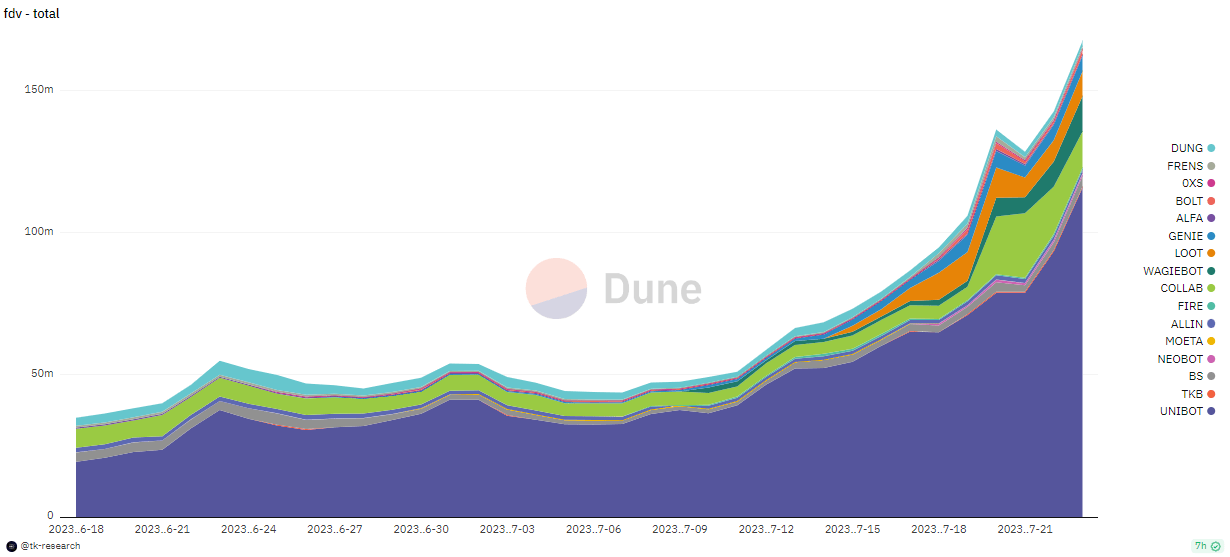

New narratives form regularly in crypto (RLB, PEPE, BITCOIN, UNIBOT, HAMS), the winner pumps the most and has the largest FDV by far. Just look at how UNIBOT’s FDV dominates its competitors.

However, new tokens pop up everyday. These beta plays generally don’t run as hard as the pioneer but telegram bots are actual projects and not just tokens. So they are able to innovate and provide exciting new features as the landscape changes constantly.

Let’s look at a few new projects that may disrupt the existing winners and outperform.

Wagie

WagieBot brings token sniping, tracking, trading, and copy trading direct to messaging apps.

Wagie runs private nodes, which means that they have direct access to the mempool on their supported networks. Direct access to mempool reduces latency and reduces confirmation times for transactions.

They have also released perp trading in the bot. Users can now trade perps directly through Telegram by accessing GMX. Want to 10x long ETH? Just click a button in Telegram!

Lastly, Wagie is working on a Discord version and we know that Twitter, Telegram and Discord are the Big Three for degens.

WagieBot currently charges 0.80% as a base fee, 20bps lower than Unibot’s default 1%. However, their overall revenue only stands at 3.32 ETH as of today. If you include the token’s 4% buy and sell tax, the project has generated 375 ETH in lifetime revenue. WAGIE currently trades at a $14M FDV.

LootBot

What’s the best risk reward play in all of crypto? Farming airdrops!

LootBot helps you farm airdrops. You deposit funds into a wallet, and the bot has a large number of airdrops that you can farm from the get-go, including zkSync, LayerZero, Linea, Scroll, and Base.

Select which project you want to farm and the bot can help you automatically completely daily transactions to qualify for airdrops. There are unique features such as anti sybil-detection, where the bot attempts to conceal onchain movements by using mixers. Premium users also have the option to automate mixing funds through CEXs to guarantee a legitimate wallet transaction history.

The protocol generates revenue in two ways. A subscription model with $30 per wallet/month is available for users, or there is also a free-to-use model where users pay 20% of the airdrop value.

$LOOT has a 5% buy and sell tax, and token holders are currently eligible for a 25% revenue share. If you burn your LOOT, you become eligible for a 50% revenue share. The token currently trades at a $11M FDV.

GenieBot

GenieBot is a AI telegram bot that helps projects manage users looking for information and with customer support. It’s like having a community moderator work 24/7 to help with FAQs.

Geniebot solves that problem by using AI and LLM technology to help answer in-depth questions at any time. The bot taps into official documentation such as blog posts, docs, and whitepapers to provide answers.

GenieBot reminds me of ZenDesk in Web2. The business model is sustainable as projects that want to onboard Geniebot are charged 0.15 ETH for 7 days, 0.5 ETH for 30 days, and 1.2 ETH for 90 days. 40% of this revenue is then returned to those who stake a sufficient amount of $GENIE. The token currently trades at a $5.5M FDV.

NeoBot

NeoBot is a suite of tools built to support crypto traders.

It gives you information on the earliest buyers of a requested token, top 20 holders of a token and can help scan tokens for their security using AI.

In addition, users can conduct a token scan which includes information on the token itself, the deployer address, ability to be rugged, and on trade volume.

Users have to hold 10,000-25,000 $NEOBOT in order to use the tools and revenue is generated through a 7% buy and sell tax. The token currently trades at a $1.6M FDV.

Final Thoughts

The Telegram bots narrative has existed for a few weeks. The bulk of returns generated in this narrative will have come from traders who had a position in UNIBOT early and that will likely continue.

However, this does not mean that there is no opportunity left. If you think UNIBOT is expensive at a $141M FDV, there are much smaller tokens that you can buy, depending on whether you want to bet on feature differentiation, focus on a different niche, or alignment with another narrative.

Hopefully, you found this piece helpful in how we think about narratives and chasing returns. If you liked this piece, get your friends to subscribe to RektRadar today.

RektRadar’s Insight

UNIBOT has probably been dominating your newsfeed for the past month as FDV continues to soar. DAUs are actively increasing and we foresee further growth in both DAUs and valuation.

However, there is opportunity in bots that serve other defi niches.

We have seen how WagieBot bringing perps trading to telegram has brought significant boost to its valuation. Perps trading is a huge sector of DeFi, e.g. GMX, Gains, Vertex and the first mover to bring it onto Telegram should dominate the niche.

However, anything sweet attracts ants. Profits and demand naturally attracts competitors. The success of the bots mentioned above will attract fresh competition hoping innovate on:

1. Existing features

2. Solving problems in different niches

Don’t forget that projects can outperform existing leaders by attaching themselves to some other narrative. Even though AI is not the leading narrative, it’s obvious it will be more prevalent in the future. It is likely AI will be a prolonged narrative with its own mini-cycles as the next innovation or new business model is discovered. In this case, a telegram bot like Genie is well positioned to “attach” itself to this other narrative.

Refer Two Friends – Get Our Exclusive Airdrop Guide

It’s as simple as that.

If you love our newsletter, then your friends will love it too. Don’t keep the alpha to yourself.

Refer a friend today by opening this newsletter in your email and clicking the refer button.

Note: The referral button is only available in the newsletter and is not available here on the website.