Liquid staking tokens are all the rage as they constantly print yield for their stakers. Most protocols are solely focused on ETH. But what if I told you there’s a protocol, with liquid staking solutions live on multiple networks. Say hello to Stader Labs which is on a mission to bring 1 billion people into staking and DeFi

In this article, we’ll dive into:

- Stader labs so far

- ETHX

- Liquid restaked token

- Stader partners

- What the future has in store

Growing Across Middle Earth

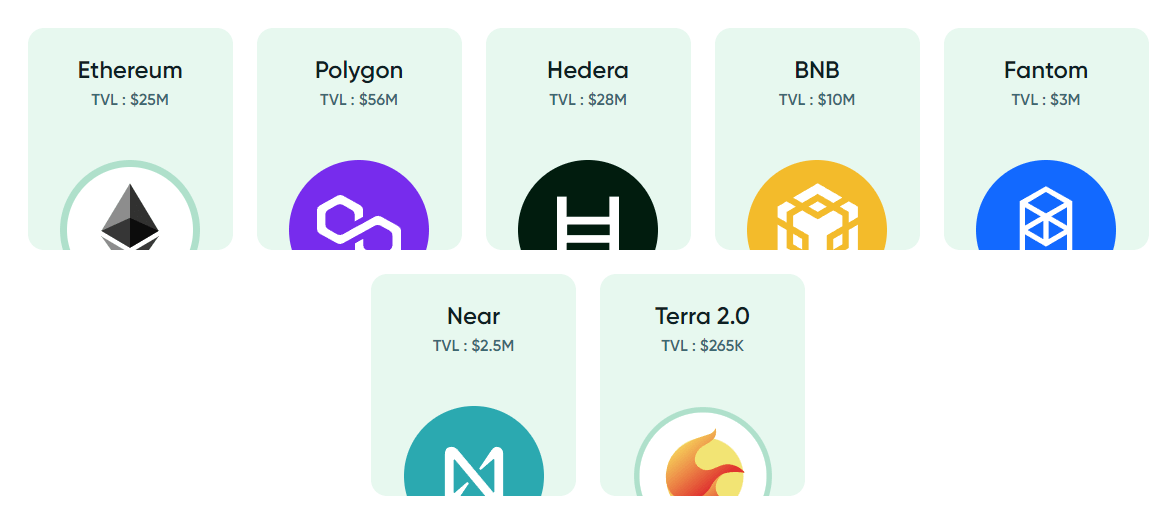

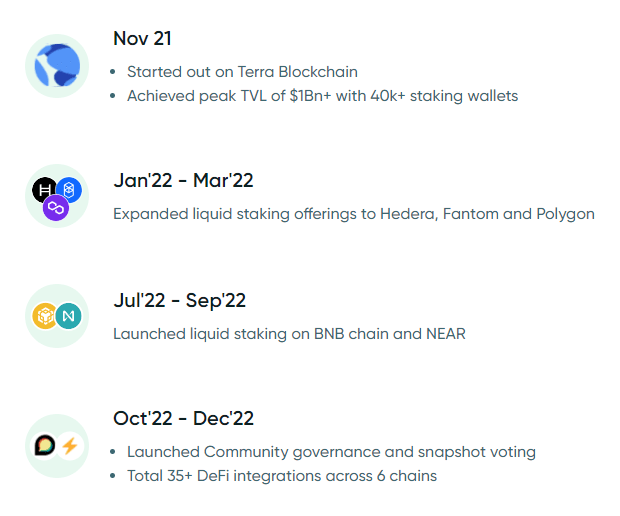

With a combined TVL of $125M, Stader Labs is one of the largest staking protocols out there. Oh, did I mention that it is also the largest liquid staking protocol that exists on multiple chains (6 chains and growing)? Their biggest competitor is Lido, who is live on five chains.

Stader is a non-custodial staking platform, that aggregates staking offers for users. Rather than simply offering staking through external validators like some other protocols, Stader acts as middleware infra, so that different types of validators can all tap into the platform and in turn offer stakers more options.

Stader’s warpath rages on with constant expansion of its liquid staking infrastructure across blockchains. Today, it is one of the largest staking solutions for every network it supports. Their value lies in liquid staking, where users get a derivative of their staked assets, which can then be used across the DeFi ecosystem.

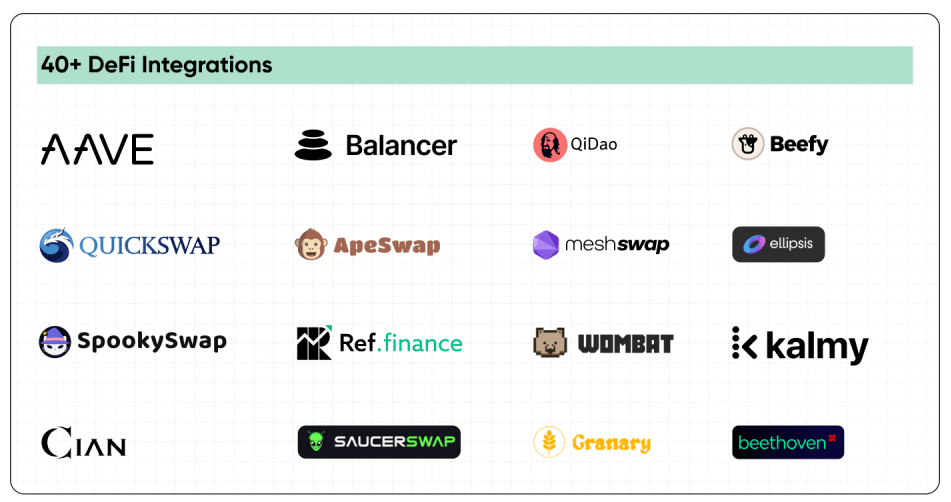

But derivatives have no value if they can’t be used across multiple platforms and chains. That’s where Stader’s biz dev and integrations have truly stood out. Landing many partners across the defi space, Stader has integrated with over 40+ Defi protocols, ranging from lending, CDP stablecoins, leveraged staking vaults, options, DEXs, and more.

The best liquid staking token is the one with the most utility and network effects.

A New Heir Is Born

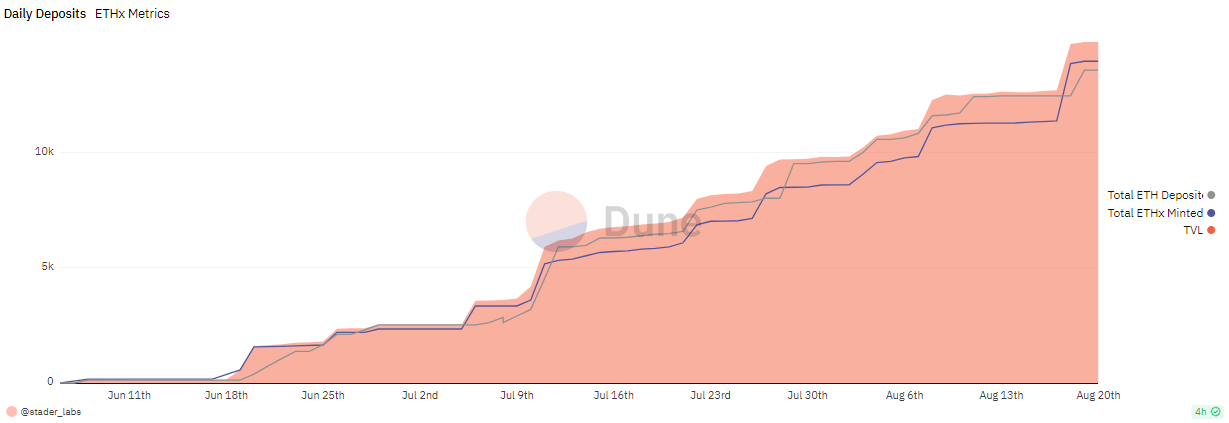

ETHx, a liquid staking token for ETH, is Stader’s newest product. Since going live in June:

- It has rapidly gained $25M in TVL

- Over 500 ETHx holders and more than 300 active stakers.

- The largest staker has a whopping 2,500 ETH staked

This demonstrates confidence in the safety and longevity of the protocol and will only encourage further adoption from new users.

What makes $ETHx better?

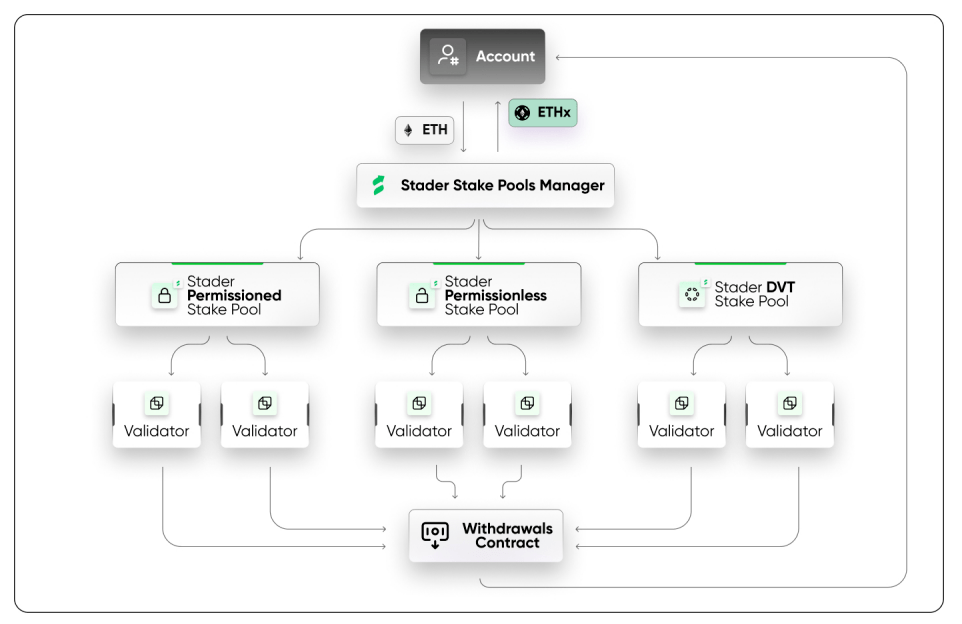

Multipool architecture

Protocols constantly have to find a balance between decentralisation and scalability.

Decentralization usually = low capital + permisionless validator set

Scalability usually = large node operators that operate at scale

Stader has managed to find a middle ground with a multipool architecture.

Stader has a permissionless pool, where anyone can operate a node. With permissionless pools, anyone can come in and be a node operator. One simply needs to provide 4 ETH and 0.4 ETH of their native token, SD, as a bond.

This is the most capital-efficient protocol for solo stakers in terms of bonding requirements. The next most capital-efficient solo staking protocol is Rocketpool, where node operators must put up 8 ETH as a bond. This means Rocketpool is half as capital-efficient as Stader.

Stader runs a permissioned pool that curates validators. To scale and keep up with demand for ETH stakers, Stader also has permissioned node operators which have no bonding requirements and can support an unlimited amount of ETH and continuously spin up nodes. Stader will also be at the forefront of technical developments and will seek to use distributed validator technology as soon as it becomes battle-tested and established.

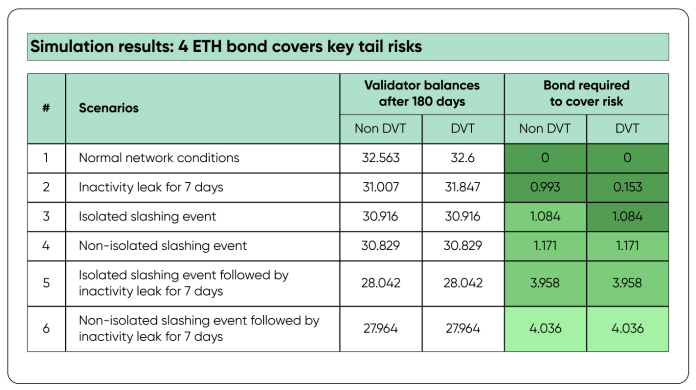

So how is it possible that Stader supports a 4 ETH requirement for a bond while the next best protocol requires double that?

Stader has conducted an extensive study and analyzed the various network conditions such as inactivity leaks and slashing events on the consensus layer to simulate key tail risks. In the table above, 4 ETH is a sufficient buffer to cover any potential risks. Similarly, when considering MEV loss where a node operator does not share MEV rewards, a 4 ETH bond does not represent a significant difference from a 8 ETH bond when it comes to % yield lost.

Liquid Restaked Token

We know liquid staking is one of the fastest growing sectors in crypto and another sector that has shown exponential growth is restaking, primarily led by EigenLayer.

Restaking is a process where users can stake their ETH or LSTs and help validators provide security for other actively validated services, which is a fancy term for anything that needs a validator set. By providing your staked ETH, other networks will use that staked ETH as security for their validator set.

This brings a whole host of new opportunities, including enhanced yield from consensus rewards or flexibility for other protocols. But restaking suffers the same capital efficiency issues as when Ethereum first migrated to a PoS network.

This is where Stader’s liquid staking tokens come in as an innovative solution. Stader has recently announced a liquid restaked token (LRTs). An easy to use product, where restakers can mint LRTs to be used across the DeFi ecosystem and swap it back to ETH through an AMM assuming there is sufficient liquidity.

Allies Of Expansion

A liquid staking platform’s efficiency and utility is determined by its partnerships and integrations, especially for a middleware platform. This allows Stader to onboard native users of the partner platforms with little friction and rapidly increase its user base.

Stader has a host of partners, including various CEXs, DeFi protocols, and blockchains. Notably, CEX investors include Coinbase Ventures and Blockchain.com while crypto heavyweight Jump was also an early investor.

Ecosystem partners include DeFi powerhouses Aave and Balancer, but also hardware wallets such as Ledger. Imagine if Ledger’s default staking solution in their app integrated with Stader?

Crafting The Fut

Stader dreams of bigger future other than staking middleware platform. Here are a few things they have for the road ahead:

- Stripe for crypto rewardsStader plans to build a reward API so that CEXs and institutions can power staking programs in a secure and decentralised manner. With this, there is no counterparty risk, e.g. if someone stakes on Binance, they can rest easy knowing that Binance doesn’t have custody over their entire stack of staked ETH. Here’s where all those partnerships above come into play.

- Blockchain expansion

The night is young, and blockchains are aplenty. As more PoS blockchains launch and gain traction, Stader will slowly expand and cement itself as the premier multi-chain staking middleware. - Vaults

Users crave yield, and as yield dries up, users and protocols must look elsewhere for yield. Stader is getting a head start with their vaults. With vaults, Stader can automate various yield generating strategies to further enhance yield for end users.

Ascension To The Throne

There are multiple catalysts that will cement liquid staking as one of crypto’s largest sector:

- Value of crypto assets will continue to grow

- More PoS networks will go online

- Liquid staking penetration will increase

The cash flows are constant, the opportunity is immense, and the protocols are profitable. Stader is slowly but surely cementing itself as a core player within the space by staying at the forefront of technical innovations.

Whether that is embracing distributed validator technology, or pushing the limits of capital efficiency with a 4 ETH bond requirement, or adopting restaking as a narrative, Stader is making all the right moves.

Stader is not only a simple liquid staking protocol, importantly it is a middleware platform. This means that it doesn’t necessarily have to win as a liquid staking platform to dominate the sector. Its many distribution methods for its different products, with various target audiences, set it up to be a dominant infrastructure play in the world of staking and solidifying its right as the king of liquid staking.