A weekly recap of the largest crypto events and narratives, with an extra dose of insight.

Here’s what we have for you:

-

Mantle underperforming

-

EigenLayer caps

-

Coinbase <> Rocketpool

-

Visa account abstraction

-

Telegram’s own wallet

Refer Two Friends – Get Our Exclusive Airdrop Guide

Before we get started, refer your friends!

It’s as simple as that.

If you love our newsletter, then your friends will love it too. Don’t keep the alpha to yourself.

Refer a friend today by opening this newsletter in your email and clicking the refer button.

Note: The referral button is only available in the newsletter and is not available here on the website.

Friend.tech Goes Live

Base this, base that, Base is absolutely based. The Coinbase L2 has rapidly reached $200M in total value bridged, and stunningly crossed the 100K daily active user mark. Compare this to zkSync’s $341M TVL in its zkEVM, Base could rapidly overtake that in the coming weeks. What’s more impressive is that Base the chain itself is basically guaranteed to have no airdrop, whereas zkSync still has not announced its airdrop which is guaranteed.

One explanation for this rise could be the launch of friend.tech, a social app that connects to a user’s twitter account, and allows them to tokenize it and trade “shares” with other users. Once you purchase a share, you can access the user’s content and also message that user.

Since launch, friend.tech has done about 4,400 ETH in trading volume. This could be a trend across Base, especially considering it’s built by Coinbase, a CEX with nearly 110M verified users. Social dApps could be the narrative for the next week as friends.tech is still in invite only beta mode. Forget betting on memecoins, betting on your favourite CT account is the new thing to do.

In a similar vein, another huge project also launched in the social space. DeBank, one of the most popular portfolio tracker, announced DeBank Chain, an asset layer for social built on the OP stack. Mainnet is planned to rollout in 2024, and this could be the start of more tightly knit integrations between social and finance.

-RektRadar

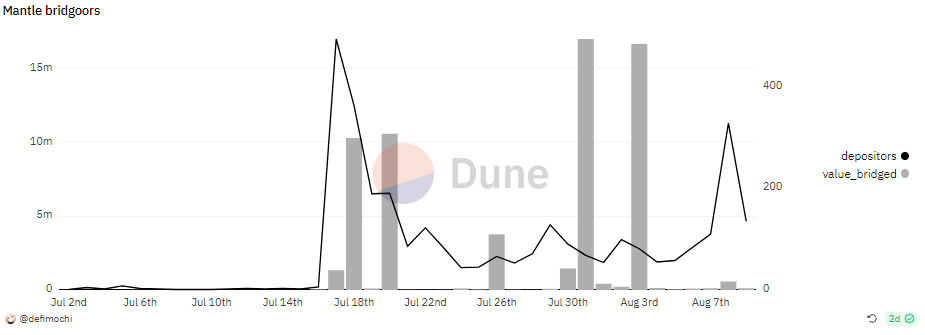

Mantle Not Flying High

Mantle, BitDAO’s new rollup, has shown relatively lackluster performance. Total bridge inflows peaked at ~$15M a day for a few days and has since reverted back to near zero.

Why the lackluster growth?

I think the lackluster growth could be due to a few reasons. First of all, Mantle was never a community chain with a lot of users, especially considering it was spun off by BitDAO, which most users probably have never even heard of. The lack of a significant established brand backing the rollup simply meant that not a lot of people would be interested in it.

Second of all, their launch was timed similarly to the memecoin mania on Base, meaning that Base likely sucked a lot of liquidity that could have potentially bridged to Mantle.

Lastly, there is just not much happening on Mantle. If you go to Mantle’s DeFiLlama page, there are only seventeen different projects, and only four of them have more than $1M in TVL. Given the lack of projects, you can’t expect that users and degens have any reason to bridge over. There’s a caveat here in that if Mantle had one killer project, such as GMX on Arbitrum in the early days, this could be sufficient to drive user activity.

Eigenlayer Raising Deposit Caps

-

What do EigenLayer depositors get right now for depositing? Nothing lol. Not even any yield. But maybe there’s an airdrop along the way. On August 22, the deposit caps will be raised to 100K tokens for any single LST.

-

Today, you can deposit stETH, rETH, or cbETH. There has been notable activity on EigenLayer including some prominent Actively Validated Services (AVS) such as Espresso, a decentralised sequencer, and Lagrange, a ZK cross-chain messaging system.

Coinbase Ventures Invests Into Rocketpool

-

On Thursday, Coinbase Ventures announced an investment into Rocketpool. They purchased RPL tokens from the Rocket Pool team rather than from the open market.

-

Coinbase will then use ETH from their corporate balance sheet to operate several hundred nodes on the Rocket Pool network. How cool is that?

Paying For Gas Using Your Visa Card

-

Account abstraction. The main purpose is to improve the user experience. Visa (yes your credit card visa), has been making big strides in order to propel the crypto user experience forward.

-

With paymasters, Visa has made it possible to pay for onchain gas using your visa card. Imagine never having to top up gas, or never having to worry about running out of gas for a time-sensitive transaction agian.

I’m sure you have seen telegram bots popping up left and right across your Twitter feed. Even we have been talking about it relatively often in this newsletter. But did you know that Telegram has its own blockchain? And their own wallet too?

TON is a blockchain, deeply integrated into Telegram. $TON is the native currency of the network, and using the chain, users can effortlessly buy and trade, and pay each other, all within Telegram. In addition, TON can be used to buy an anonymous eSIM card, buy a domain, buy telegram premium, and even buy NFTs.

That’s not it though. There are DEXs, games, gambling projects, bridges, explorers, staking, social dApps, and more.

Could Telegram be the crypto superapp?

With 800M daily active users, Telegram is poised to gain wide adoption if crypto continues to gain adoption. As crypto goes mainstream, Telegram could represent an easy point of entry for consumers. In addition, a new non-custodial wallet that was recently launched would allow users to easily self-custody their assets through a mobile app.

$TON currently has an FDV of $6.8B, which I would say is relatively fair given that the wallet and network hasn’t gained widespread adoption yet. However, if user adoption and activity ever pick up, I would pay attention given the huge userbase available. As a point of comparison, Unibot, one of the most popular telegram trading bots, only has ~9K cumulative unique users. So user activity still has a long long way to go. But Telegram has the distribution, and that’s often the most important thing.